Ethereum price eyes $3,600 despite facing stiff resistance

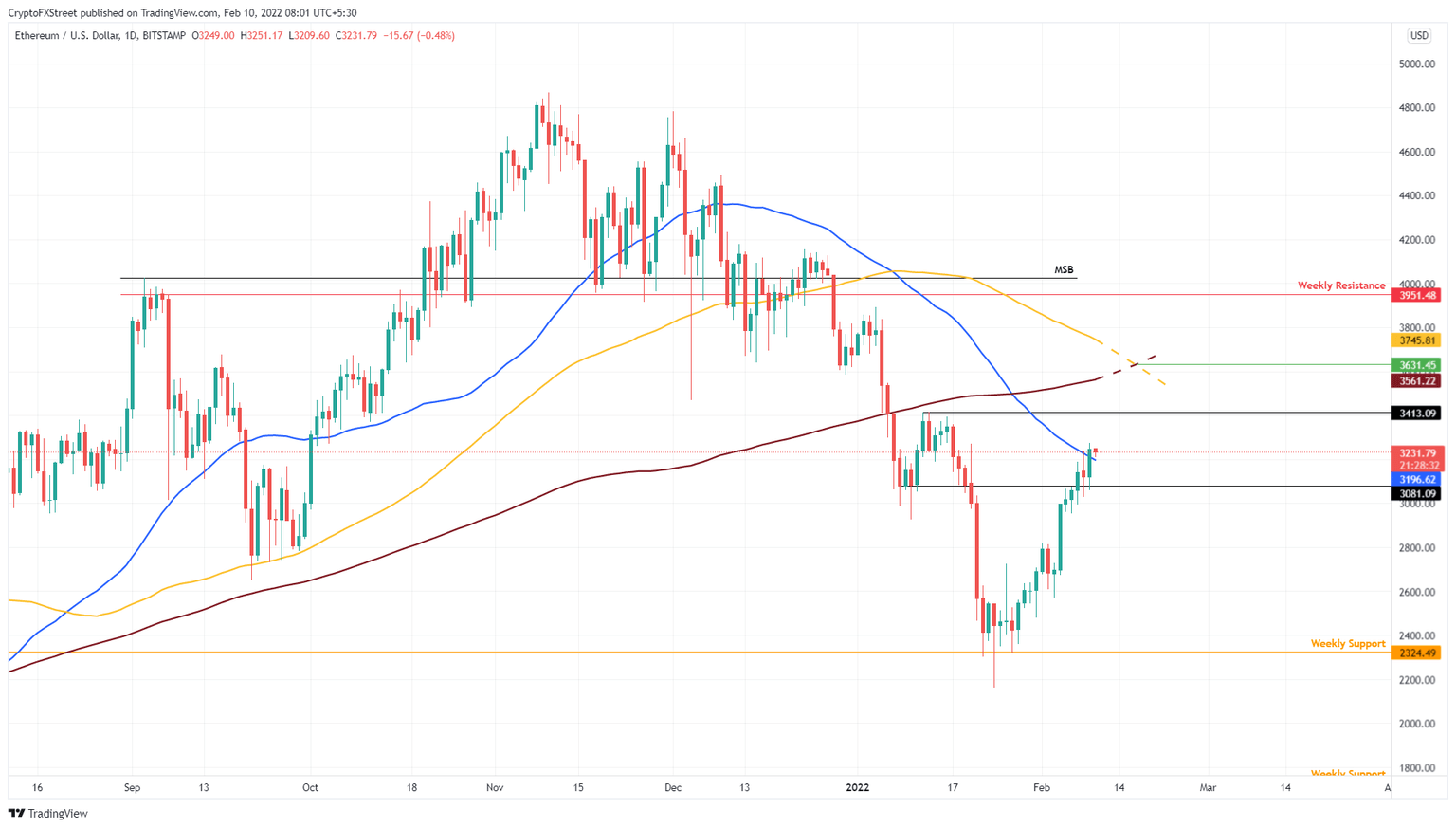

- Ethereum price has sliced through the 50-day SMA at $3,196, indicating a bullish outlook.

- ETH eyes a 14% upswing despite facing a stiff resistance barrier at $3,413.

- A breakdown of the $3,081 support level could trigger a 9% retracement to $2,792.

Ethereum price has flipped a crucial barrier, suggesting an increase in buying pressure. This move comes after ETH experienced a massive uptrend over the past week. Going forward, investors can expect more gains from the smart contract token.

Ethereum price to define the macro outlook

Ethereum price rallied 41% in nearly two weeks, starting from January 27. This exponential ascent pushed ETH to produce a daily candlestick close above the 50-day Simple Moving Average (SMA) at $3,196. This development sets a bullish tone, implying that further gains are plausible.

A potential spike in buying pressure is likely to push Ethereum price to retest the $3,413 hurdle. If buyers manage to flip this blockade into a support floor, it will set the stage for an ascent to $3,631, where the 100 and 200-day SMAs are likely to crossover.

Therefore, market participants can expect the upside for Ethereum price to be limited at $3,631 or a 13% gain from $3,196.

ETH/USDT 1-day chart

While this outlook is plausible, it relies heavily on the resurgence of buying pressure. A failure to do so could result in a retracement to the immediate support levels at $3,081 and $2,792. Ethereum price could consolidate around these areas and attempt an uptrend.

However, a breakdown of the $2,792 barrier could trigger a potential descent to the $2,324 barrier. A daily candlestick close below this foothold will create a lower low and invalidate the bullish thesis for Ethereum price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.