- Ethereum price consolidates on the weekly chart inside an ascending triangle.

- A successful breakout from this setup forecasts a 43% upswing to $2,943.

- But ETH could rally ahead and tag the MRI’s resistance level of $3,186.

Ethereum (ETH) price shows a tightening of the multi-month consolidation. A breakout from this sideways movement could trigger a volatile move to the upside.

Also read: Ethereum is a commodity, but SEC will not admit it, expert says amid ongoing ETF race

Ethereum price edges closer to breakout

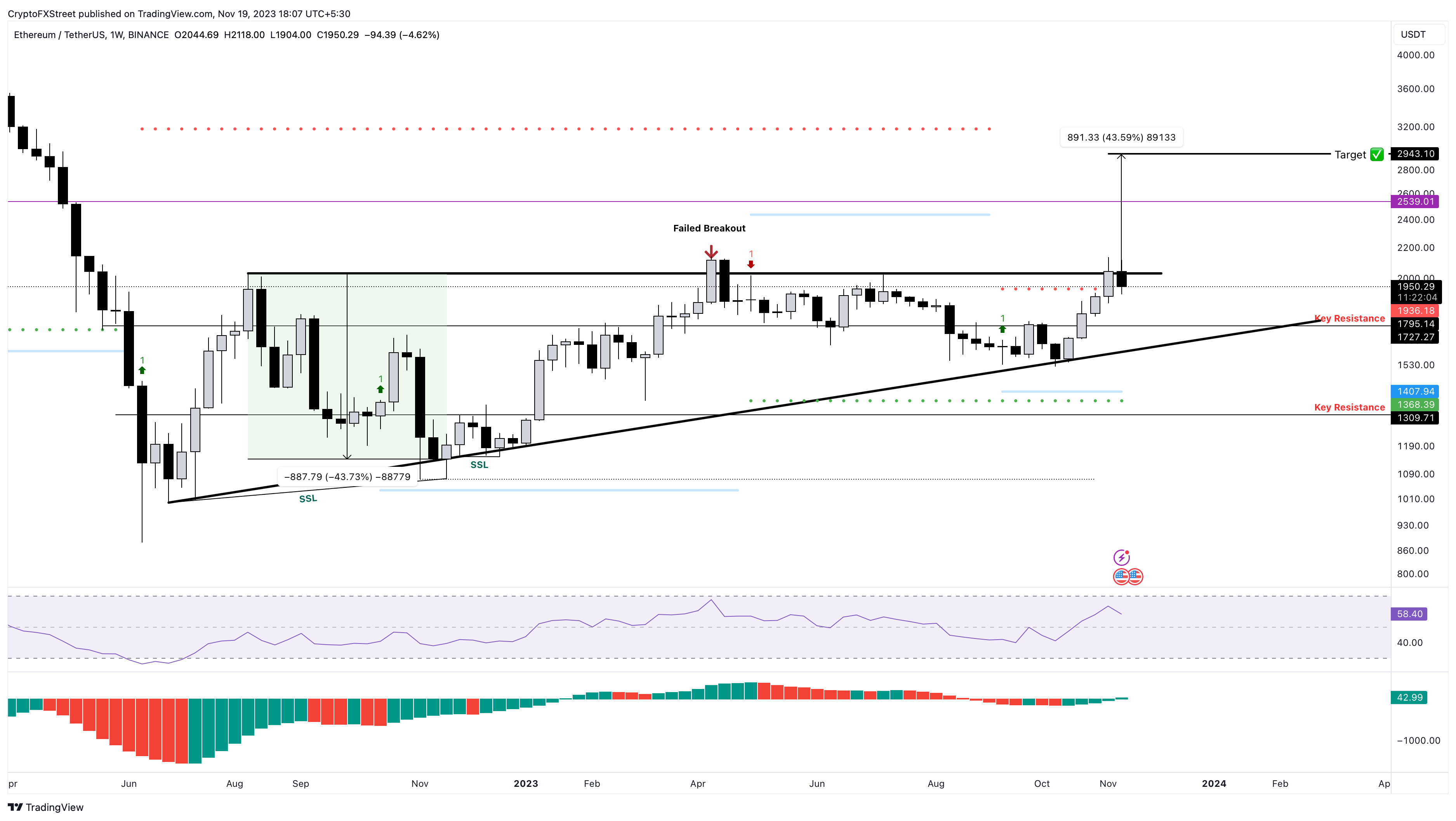

Ethereum price has set up three higher lows and three roughly equal highs since June 2022. Connecting these swing points using trend lines, reveals an ascending triangle setup. A decisive weekly candlestick close above the triangle’s horizontal resistance level at $2,000 will signal a breakout.

In such a case, this technical formation forecasts a 43% rally to $2,943, obtained by measuring the distance between the first swing high and swing low to the breakout point of $2,000.

Currently, Ethereum price sits above the Momentum Reversal Indicator’s (MRI) resistance level of $1,936 and below the ascending triangle’s horizontal resistance level. From the looks of it, ETH seems to have flipped the $1,936 hurdle into a support floor.

If Bitcoin price does not crash wildly in the upcoming weeks, Ethereum price is set to break out and kickstart an upswing to $2,943. But this move is likely to face resistance around the $2,539 hurdle, which served as a critical support level in March 2022.

While $2,943 is the theoretical target, ETH could rise higher and tag the next MRI resistance level of $3,186. This move would constitute a 60% gain.

ETH/USDT 1-week chart

On the other hand, if Ethereum price fails to stay above the $1,936 support level, it could trigger a correction down to the $1,795 support floor, where buyers could give the breakout another go.

But if this attempt fails and Ethereum price produces a weekly candlestick close below $1,547, it will create a lower low and invalidate the bullish thesis. In such a case, ETH could slide as low as $1,309.

Also read: BlackRock’s spot Ethereum ETF filing fails to catalyze ETH price sustained rally

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Chainlink active addresses drop as whale selling spikes, could LINK crash below $10?

Chainlink active addresses slide dramatically to 3,200 from February’s peak of 9,400. The downtrend in network activity coincides with increasing selling activity among whales with between 10 million and 100 million LINK.

Bitcoin stabilizes around $83,000 as China opens trade talks with President Trump’s administration

Bitcoin is stabilizing around $83,500 at the time of writing on Wednesday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. A breakout of this strong level would indicate a bullish trend ahead.

Binance Chain completes $914M BNB token burn, hinting at a potential rally

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.