- Ethereum price trend creates significant opportunities for patient speculators.

- Berlin hard fork changes aim to bring gas fees in line with computation costs.

- Momentum indicators are not overbought, projecting higher prices.

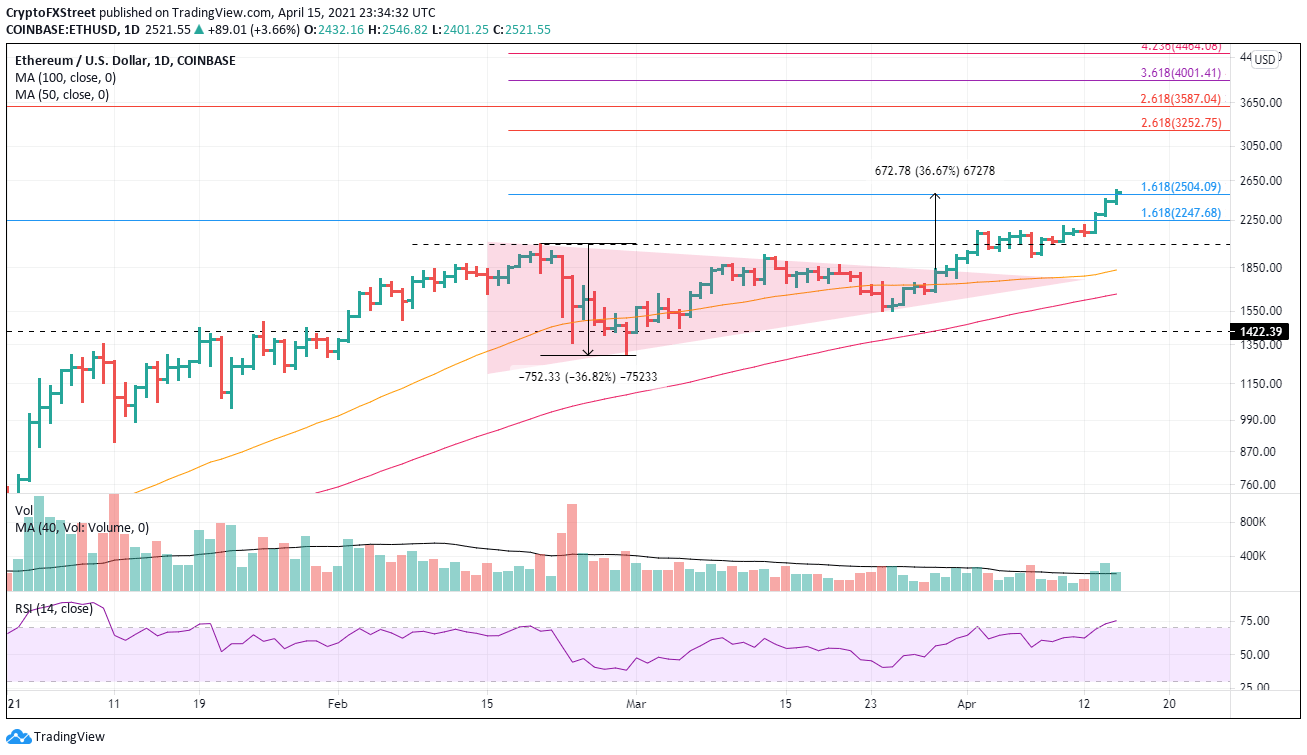

Ethereum price over the last two days has shaken free of Bitcoin’s price stumbles and continued to rally to the first target of the 161.8% extension of the February decline at $2,504. This could potentially be followed by the symmetrical triangle measured move target of $2,507. Conditions remain in place for a continuation of the rally to the next levels of resistance, beginning at $3,250 and beyond.

Ethereum hard fork flaw leads Coinbase to disable ETH withdrawals temporarily

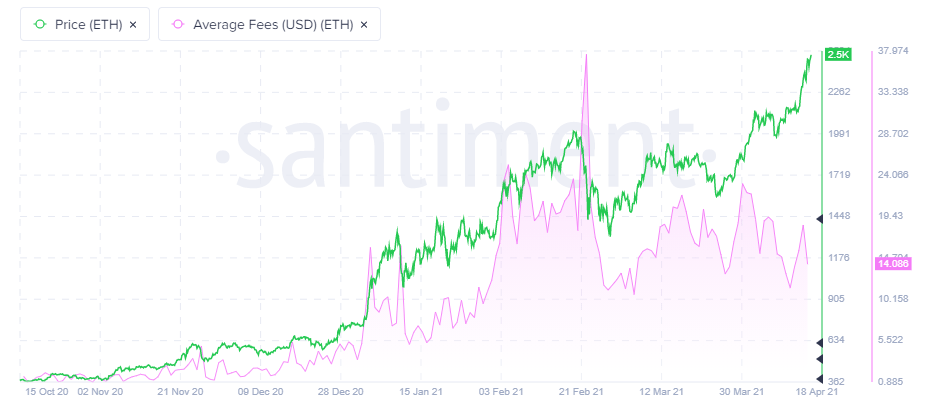

The second-largest cryptocurrency introduced a hard fork that seeks to solve a significant issue for the network, high gas fees. In a year, gas fees that users pay to use transactions have climbed from below 10 cents to a high of $40 in February. Currently, the average fee is close to $19, but in comparison to the minimal fees charged by Cardano and Algorand, the Ethereum costs are astronomical. Moreover, lesser-known networks such as Polygon and Celer Network have grown as they strive to combat the high gas fees by aggregating transactions.

Ethereum’s goal focuses on this hard fork changing the algorithm that calculates gas fees, with the hopes of appreciably reducing costs that may eventually stifle the amount of utility and transactions users ideally want to make. A chart of the gas fees since October 2020 is displayed below.

Source: Santiment

The hard fork is one of many improvements along the way to creating ETH 2.0, Ethereum’s transition from proof-of-work to proof-of-stake.

Ethereum price supported by more prominent investors gradually accepting the risk profile

The noteworthy advance since the late-March lows has not pushed the daily or weekly Relative Strength Indexes (RSI) into overbought conditions. There is no sign of a bearish momentum divergence, restoring confidence that strong tailwinds still support ETH.

In an FXStreet article on April 11, it was projected that ETH would challenge the 161.8% extension level of the February decline at $2,504 and reach the symmetrical triangle measured move target of $2,507 within a short time and that has been the case.

Due to the strength of the ETH rally and the recent decoupling from Bitcoin’s price stumbles, attention turns to higher price targets, including the 261.8% extension at $3,253. Patient speculators can hold out for the 261.8% extension of the 2018 bear market at $3,587.

ETH/USD daily chart

A reversal of fortunes is always a possibility in investing, and ETH speculators should mark the early April highs as the first level of support if heavy selling emerges. The following support level is at the February high of $2,041. A failure there cancels the bullish outlook and puts price on course to test the 50-day simple moving average (SMA) at $1,835.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin bulls defend lifeline support as risk-off sentiment continues

Dogecoin price stays below three major daily moving averages after Elon Musk severed perceived ties to D.O.G.E., the agency. Uncertainty in global markets over Trump’s tariff war heightens risk-off sentiment.

Bitcoin recovers as dominance increases, signaling a shift amid market stress

Bitcoin price recovers slightly, trading above $84,000 on Tuesday after falling 4.29% the previous week. Crypto Finance reports that Bitcoin’s dominance rose to 61.4%, reflecting a shift toward BTC as a resilient asset amid market stress.

Solana Policy Institute launch to shape policies for decentralized networks

Solana Policy Institute aims to educate policymakers on decentralized networks like Solana. SPI plans to unite Solana's ecosystem voices to demonstrate the technology's economic and social benefits amid debates over its decentralization and reliability.

Tether adds to Bitcoin reserves with over $735 million withdrawals from the Bitfinex hot wallet

Arkham intelligence data shows that Tether added 8,888 BTC worth $735 million from the Bitfinex hot wallet. The address currently holds 92,000 BTC, worth $7.65 billion, and is also the sixth-ranked BTC wallet address.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.