Ethereum derivatives data highlights the lack of short-term strength as ETH price lags Bitcoin’s recovery to the $40,000 range.

While speaking at the Virtual Fintech Forum in Hong Kong on May 27, Ethereum co-founder Vitalik Buterin commented on obstacles related to the Ethereum 2.0 rollout. Buterin said that there had been several internal team conflicts in the past five years and as a result, he confirmed that Ethereum 2.0 launch is unlikely to occur before late 2022.

In a May 22 report from Goldman Sachs, analysts said that Ether has a "high chance of overtaking Bitcoin as a dominant store of value." Furthermore, the report noted the growth of the decentralized finance (DeFi) sector and the nonfungible token (NFT) ecosystems being built on Ethereum. Coincidentally, on the very next day, Ether's price bottomed at $1,750.

On June 14, CoinShares released its weekly fund flows report and Ether investment products had the largest outflows, totaling $12.7 million.

However, the upcoming $1.5 billion options expiry on June 25 could be a turning point for Ether, according to Cointelegraph. This figure is 30% larger than the March 26 expiry, which took place as Ether's price plunged 17% in five days and bottomed near $1,550.

Despite flirting with $2,600 after a 12% rally over the past week, top Ether traders seem unable to change their neutral-to-bearish positioning according to derivatives data.

The 3-month futures premium is neutral-to-bearish

Normally, Tte 3-month futures will usually trade at a premium to regular spot exchanges. In addition to the exchange liquidity risk, the seller is postponing settlement and usually charges more.

The 6% to 17% annualized return on stablecoin lending indicates bullishness whenever the 3-month premium trades above that range. On the other hand, when futures are trading below the stablecoin lending rate, it is a signal of short-term bearish sentiment.

Huobi ETH Sept. futures premium vs. spot market. Source: TradingView

As shown above, the 8% premium — 26% annualized — vanished on May 13, indicating extreme optimism. Since then, it has been ranging near 2.8%, which is equivalent to 10% annualized. Thus, top traders are neutral-to-bearish according to this indicator as it nears the lower level of the expected range.

The options skew shows moderate signs of fear

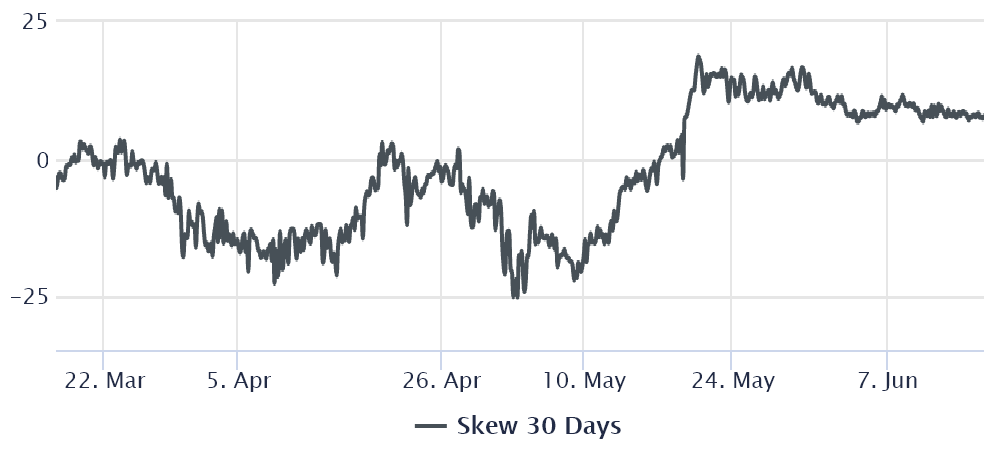

The 25% delta skew compares similar call (buy) and put (sell) options and will turn positive when the protective put options premium is trading higher. Whenever this metric surpasses 10%, it is considered a "fear" indicator.

The opposite holds when market makers are bullish and this causes the 25% delta skew indicator to enter the negative range

Deribit Ethereum options 25% delta skew. Source: laevitas.ch

From May 20 to June 8, the indicator stood near 10%, indicating a higher protective put premium, which is usually a ‘fear’ indicator. However, over the last week, it has slightly improved to 7%, within the "neutral" range, but still close to bearish sentiment.

There is no evidence of bullish growth in top traders' confidence as Ether tests the $2,600 resistance. So until those indicators flip to neutral-to-bullish, traders should act with extreme care before concluding that a bull run is in place.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.