- Ethereum price rallied by over 85% in 2023 – a similar increase in 2024 places the target above $4,000.

- Spot Bitcoin ETF approval will be a key catalyst for a price rally and also set a precedent for ETH ETF approvals in Q2 and Q3 2024.

- Ethereum mainnet is expected to undergo the sharding upgrades, starting with Dencun, which will introduce proto-danksharding.

- Investors and traders alike are anticipating ETH price to rise in order to book profits before Q2 2024.

Ethereum price increased considerably in 2023, recovering about a third of the crash from December 2021 to May 2022. However, the remaining two-thirds of this crash is expected to be recovered in 2024 owing to multiple factors.

ETH investors have a lot to look forward to throughout the year as events such as spot Bitcoin ETF approval, Dencun (sharding) update, and spot Ethereum ETF decision will be taking place, which are expected to be bullish catalysts. However, the lack of institutional investors' interest might act as a barrier to this growth and keep ETH from reaching $4,000.

2024 Fundamental outlook: Ethereum price to witness growth from spot Bitcoin ETF approval

2024 is expected to kick off the bull run that the crypto market has been waiting for since June 2022. Ethereum price, along with the rest of the market, is set to witness bullishness owing to one single factor – the approval of spot Bitcoin exchange-traded funds (ETFs).

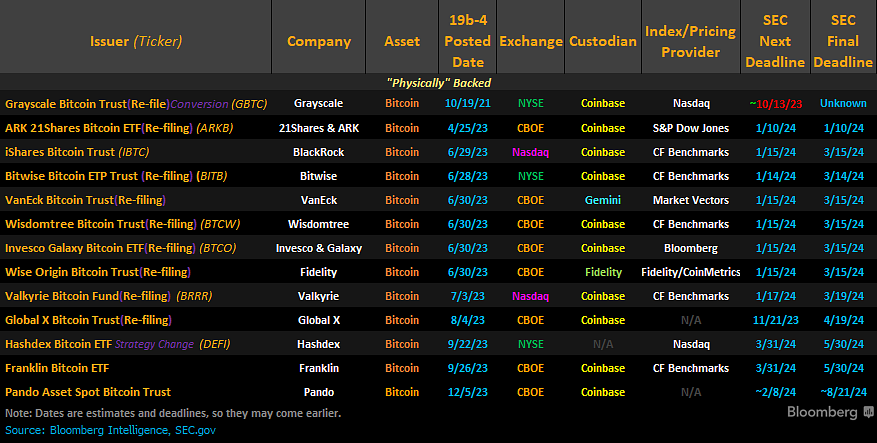

Over a dozen investment fund managers, including the likes of BlackRock, ARK Invest, and Fidelity, have applied for ETFs. The initial outcome was not positive as the Securities and Exchange Commission (SEC) exhibited skepticism, but following Grayscale's win, sentiment changed.

The court ruled in favor of the asset manager in the lawsuit filed against the SEC for rejecting the request to turn the Grayscale Bitcoin Trust (GBTC) into an ETF. This imbued confidence in the market, and the deadline for the final decision is expected to arrive by January 10, 2024.

Bitcoin spot ETF update

As Bitcoin price rallies, Ethereum will fulfill its role as the "Silver to BTC's Gold" and likely push other altcoins to rally as well.

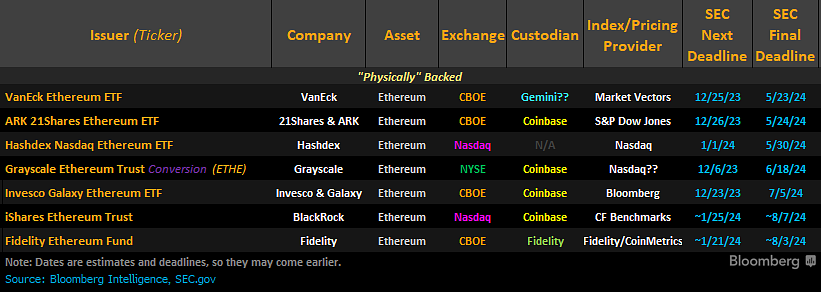

Furthermore, this approval will also set a precedent for Ethereum spot ETFs, which asset managers are already eyeing. VanEck, ARK Invest, and BlackRock, among three others, have already applied for a spot ETH ETF. Grayscale, too, filed to convert its Ethereum Trust (ETHE) into a spot ETF.

According to Bloomberg ETF analyst Eric Balchunas, these applications have strong odds of approval, too, since they would be similar in design and structure to spot Bitcoin ETFs. However, their final deadline is between May and August 2024, giving investors time before they can get their hands on the investment products.

Ethereum spot ETF filings

That said, following the spot BTC ETF approval, ETH ETFs will see much less friction in acquiring a green light from the SEC. This will be the driving factor for the continuation of the Ethereum price rise in Q2 2024.

The Surge after the Merge

During a recent Ethereum Community Conference in Paris, Ethereum founder Vitalik Buterin discussed the future of the blockchain. Referencing the Merge, Buterin stated that the chain is only 55% complete and has a long way to go.

The next four stages, as noted by Buterin, will be The Surge, the Verge, the Purge, and the Splurge. The first of these four – The Surge – will introduce sharding on Ethereum.

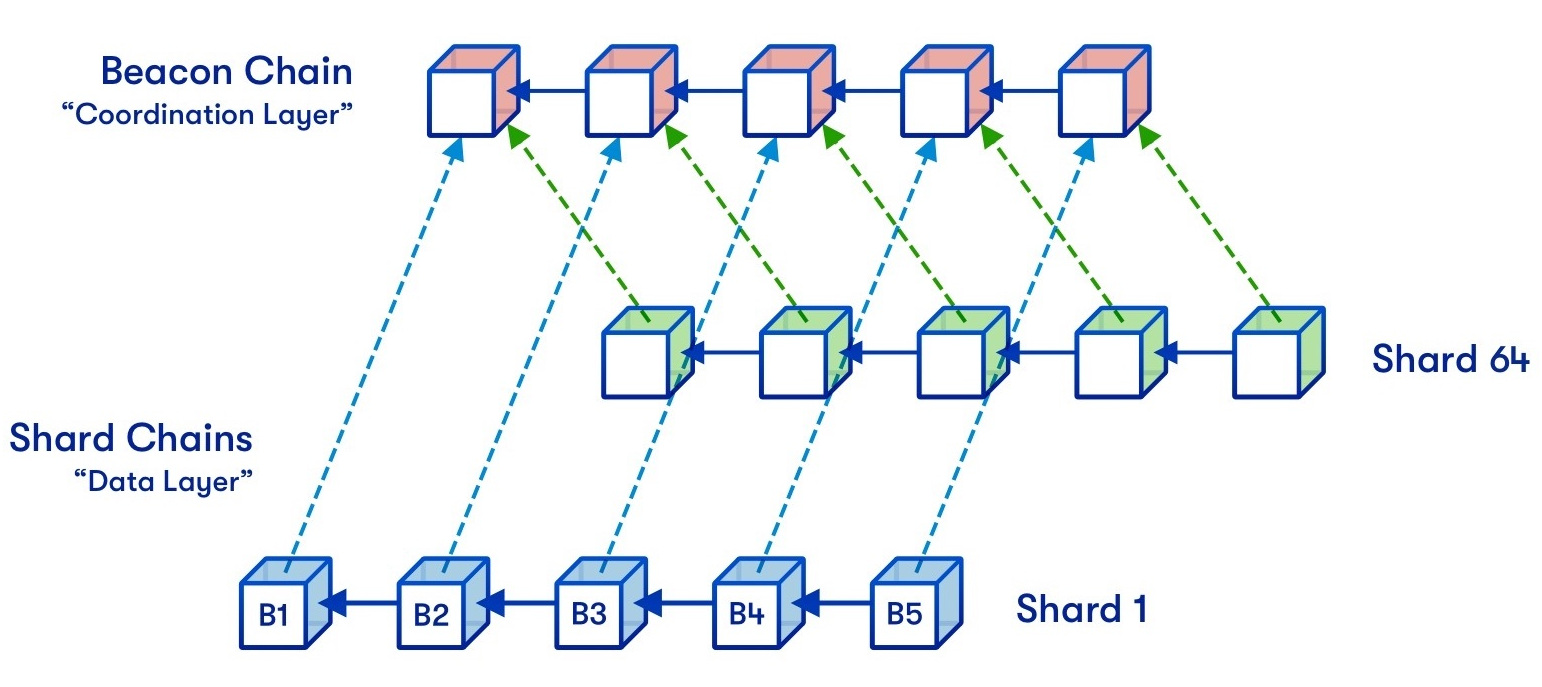

Sharding is a key scalability solution for Ethereum that aims to improve the network's capacity to process transactions and execute smart contracts. This is done by splitting the network into smaller, more manageable chains called shards.

Ethereum Sharding structure

These shards are individual components of the Ethereum network itself. Each shard operates as an independent blockchain with its own set of smart contracts. These chains can process transactions and execute smart contracts independently, reducing congestion on the Ethereum mainnet.

The main goals of Ethereum developers with the sharding update are as follows:

- Scalability: As the Ethereum network continues to grow, it faces significant limitations in transaction throughput and processing capacity. Sharding introduces a parallel processing approach, allowing multiple transactions and smart contracts to be processed simultaneously across different shards.

- Crosslinking: Shards communicate with each other through crosslinks, which are references to the state of one shard included in another shard's block. Crosslinking helps maintain consistency and integrity across the entire Ethereum network.

- Increased opportunities for validators: Validators participate in the consensus process by proposing and validating blocks on individual shards. Validators are chosen to propose blocks based on the amount of cryptocurrency they lock up as collateral in the Ethereum 2.0 Proof-of-Stake system.

In the sharding update, the beacon chain will play a crucial role as well. The beacon chain was the first Ethereum 2.0 upgrade, which acts as a separate blockchain that coordinates the overall network and manages the consensus algorithm (Proof-of-Stake). This chain will be used to coordinate communication between the shards.

The process of implementing sharding will begin with the Dencun upgrade. Set to be executed in Q1 2024, the upgrade will bring proto-danksharding to the network. Proto-danksharding will act as the scaffolding for future scalability upgrades, including danksharding, which is a crucial part of the Surge.

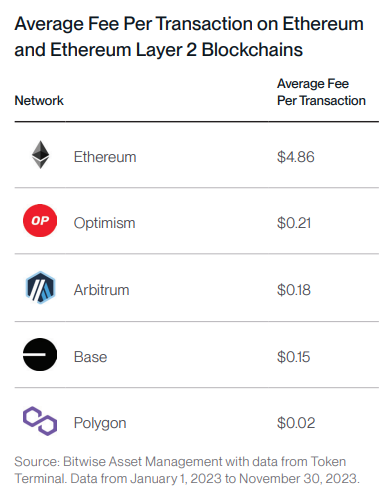

Dencun upgrade will also optimize the Ethereum gas fees, which has been a prevailing issue for users. Throughout 2023, Ethereum layer-2 chain’s fee per transaction has averaged $0.02 to $0.21, whereas Ethereum mainnet transaction fees have averaged $4.86.

Ethereum and layer-2 chains’ gas fees

As these updates are set to arrive in Q1 and Q2, with many of them expected to be deployed by May-June, they will likely act as the bullish catalyst of the second half of 2024.

2024 Technical Outlook: Ethereum price could see $4,000

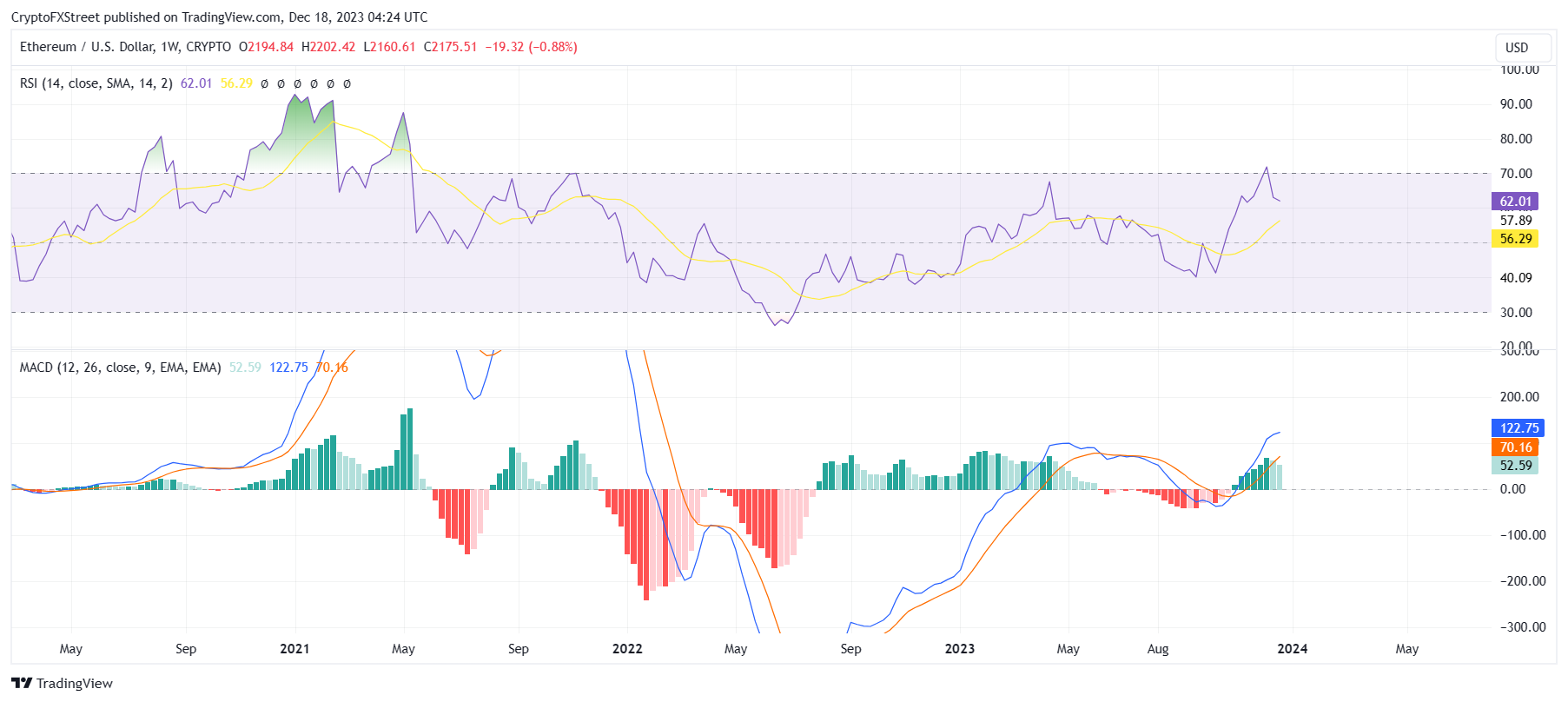

Ethereum price over the past year had a good run, rising by more than 85%. While Q1 proved to be a good quarter for the altcoin, the growth halted, and ETH largely consolidated throughout Q2 and Q3, struggling to breach the $2,000 mark.

However, in Q4, Ethereum price began rallying again, mostly owing to expectations surrounding the spot Bitcoin ETF approval, which also led to many investment funds filing for spot ETH ETFs. During this duration, ETH shot up by 51% to end the year at around $2,200, which is the present trading price.

Thus, if throughout 2023 ETH rose by over 85% despite the bearish market conditions, a similar rally or even a larger one can be expected out of a bullish year in which ETF approvals are expected, network developments are implemented, and Bitcoin halving will take place.

ETH/USD 1-week chart

If ETH repeats 2023’s performance in 2024, the target for next year will be at over $4,000. The price indicators also suggest a bullish outcome despite the slight correction in the past few weeks. The Relative Strength Index (RSI) has just exited overbought, coinciding with the pullback witnessed over the last week, whilst the Moving Average Convergence Divergence (MACD) is rising above the zero line, showing the uptrend is accompanied by strong bullish momentum.

Although the receding green bars do suggest that the bullishness is waning at the moment, some pullback before bullish momentum regains strength is common in longer timeframes, and this can be observed during the past bull runs as well.

Furthermore, ETH has observed the 50, 100 and 200-day Exponential Moving Averages (EMAs) as support, which is a bullish indication since the last time this happened was in July 2020. At that time, ETH ended up scoring a 1,577% rally from $288 to $3,928, a feat that will not be replicated in 2024.

Nevertheless, despite the bullish indications, one should remember that the recent rally has caused the Ethereum price to be overbought on RSI, and investors might attempt to book profits in the first half of 2024 again. This falls in line with historical movement where ETH lived in the overbought zone (RSI above 70.0) for about six months before initiating short-term corrections in June 2021.

Ethereum RSI and MACD

The prospect of investors selling their holdings to realize profits is also evident from the on-chain metrics, which suggest investors may book profits if the Ethereum price shoots up. Nevertheless, ETH would still be expected to remain above the $2,500 mark until Q2, after the corrections, the ETF hype subsides, and the market moves on to the Ethereum network upgrades.

Profit-taking will bring corrections, but traders remain bullish

On-chain metrics can be used to analyze investors' behavior and make predictions about future price activity. One of the most important on-chain metrics is the Market Value to Realized Value (MVRV) ratio. This metric is an indicator used to assess the average profit/loss of investors who purchase an asset. It can provide clues as to when investors might begin taking profits and selling their holdings, leading to pullbacks in price.

The quarterly and yearly MVRV ratios are the most useful for long-term analysis. The 90-day MVRV ratio measures the average profit/loss of investors who purchased an asset in the past three months, and the 365-day MVRV ratio measures the same over the last year.

For Ethereum, the 90-day MVRV sits at 15.25%, which indicates that investors who purchased ETH in Q4 2023 are sitting at 15.25% profit. Similarly, the 365-day MVRV ratio is presently at 24.18%, suggesting that those who purchased throughout 2023 are, on average, witnessing 24.18% profits.

Interestingly, considering both the timeframes, it is evident that these investors are likely to be tempted to sell their holdings soon to realize profits. This could most certainly trigger a sell-off. As seen in the chart, when MVRV hits 9% to 34% on the yearly time frame and 7.8% to 31% on the quarterly time frame, ETH has undergone considerable corrections. Hence, this area is termed a danger zone.

Ethereum MVRV ratio

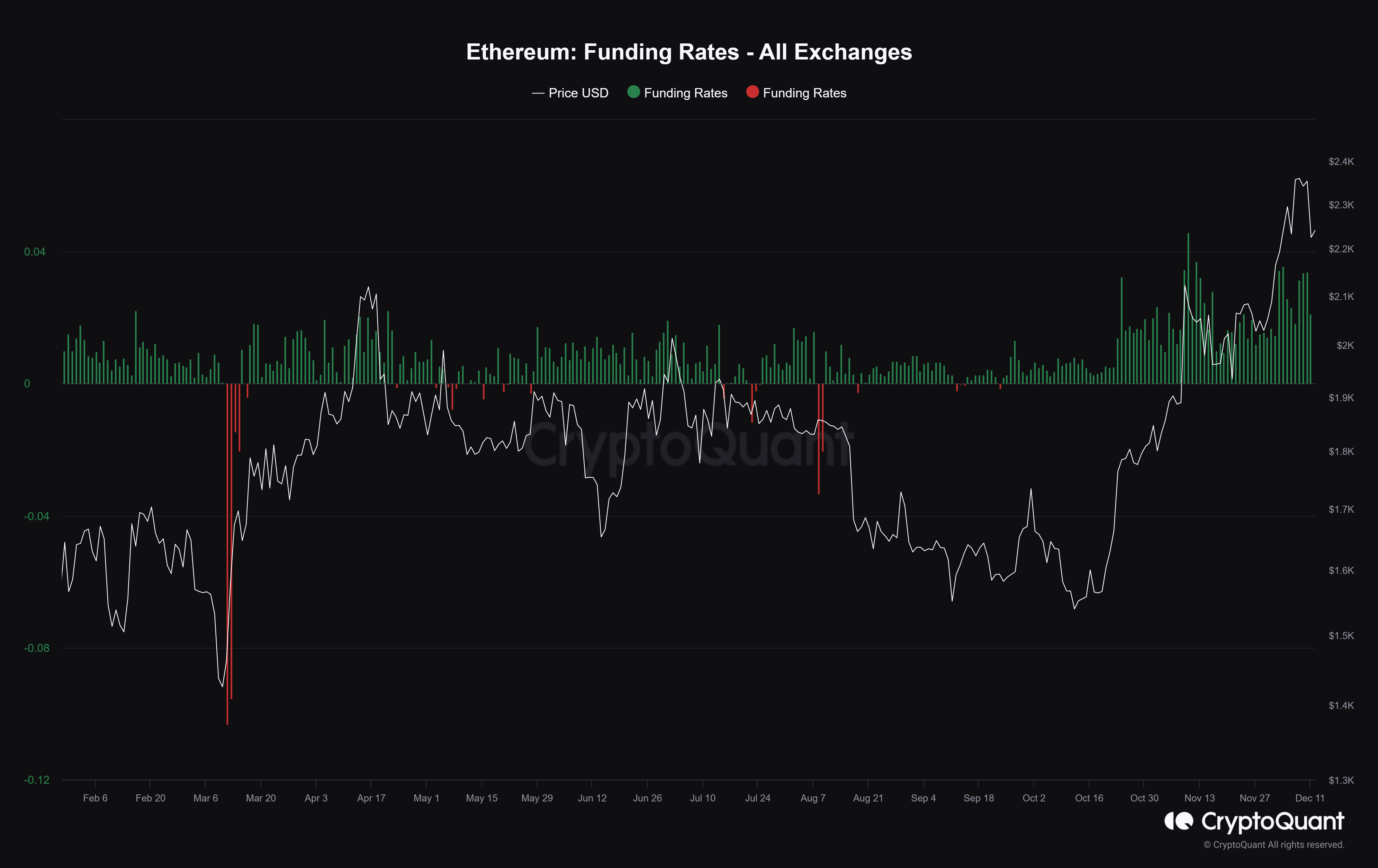

Apart from investors, the traders are also seemingly bullish. This inference is derived from the funding rates, which show an increasing trend. Such a trend suggests that long positions are gaining dominance, indicating a prevailing bullish market sentiment.

As can be observed on the chart below, the last time funding rates plunged into negative, i.e., short traders gained dominance, was back in March 2023. Since then, the rates have largely been positive, which means people are betting on a rise. This is solely being done with the intention of selling for profits.

Ethereum funding rate

So, considering these conditions, the bull run that starts due to spot Bitcoin ETF hype, followed by the sharding update, will likely urge investors to sell and realize profits. However, long-term holders will refrain and wait until the bull run flips and ETH begins witnessing a downtrend.

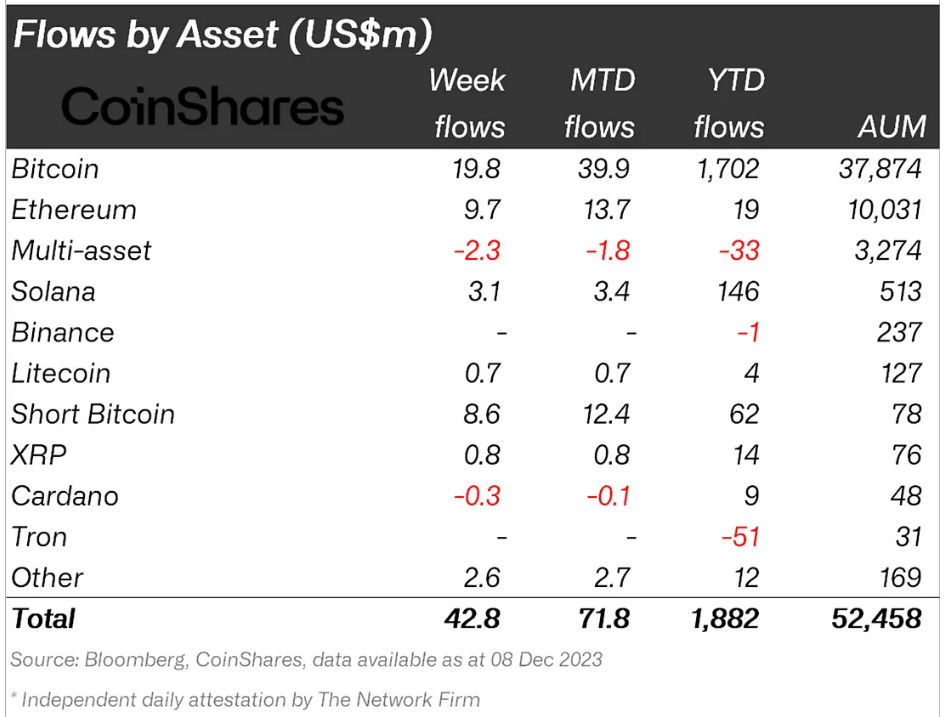

Watch out for institutions

One key factor that might act as a headwind to Ethereum price reaching the target of $4,000 is the lack of institutional interest ETH has been witnessing. Year to date, the crypto asset only managed to rake in $19 million, which is far lower than Solana's $146 million worth of inflows and astronomically less than Bitcoin's $1.7 billion.

Ethereum's year-to-date institutional flows

If this trend continues in 2024 as well, ETH might struggle to capitalize on the rest of the bullish cues since institutions are expected to drive the next bull run, and lack of interest from them may not play in Ethereum's favor.

Summary

To summarize the outlook for Ethereum in 2024, the best advice is to sit on holdings, wait and gain. A bullish year for the broader crypto market and a bullish year for ETH investors is the forecast. But that does not mean the Silver to Bitcoin's Gold is completely immune to bearish outcomes.

While an increase to $4,000 is possible, it is not a certainty since regulatory changes and unprecedented crashes plague the crypto market. Furthermore, considering the performance in 2023, ETH has not necessarily been the favorite asset of institutional investors. This lack of interest, if noted in 2024 as well, could act as an opposing force on ETH's potential growth.

Thus, it is advised always to do your own research and make the most ETH-ducated decision.

Ethereum development FAQs

What is the next big Ethereum software update?

After the Merge, the Ethereum community is looking at the Sharding upgrade next, which has been slated for sometime later in the year. The development can be summarized in four words, “scalability through more efficient data storage.” The software update will increase the capacity of the blockchain, widening the amount of data that can be stored or accessed. At the same time, all services running atop the Ethereum blockchain will enjoy significantly reduced transaction fees.

What is the difference between hard fork and soft fork?

A fork is the splitting of a blockchain after developers agree and proceed to implement upgrades. The decision comes after these developers reach a consensus for a software upgrade. The ensuing part will see one part continue with the status as is, while the other one will proceed with new features combined with the former ones. A hard fork basically entails permanent divergence of a new side chain from the original one, while a soft fork is doing the same, only difference being that it is temporary.

What is EIP-4844?

EIP-4844 is an improvement proposal for the Ethereum network. The upgrade promises reduced gas fees, which is a valuable offering considering the high transaction cost that continues to daunt crypto players. It has been a long-standing concern for the Ethereum network. The proposal is also referred to as “proto-Danksharding,” with an unmatched ability to increase the speed of transactions on the Ethereum blockchain. At the same time, it helps to reduce the transaction cost as everything becomes decentralized.

What is gas in the context of Ethereum?

Gas token is a new, innovative Ethereum contract where users can tokenize gas on the Ethereum network. This means they can store gas when it is cheap and start to deploy the gas once the market has shifted to the north. The use of Gas token helps to subsidize high gas prices on transactions, meaning investors can do everything from arbitraging decentralized exchanges to buying into initial coin offerings (ICOs) early.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, Ethereum and XRP steady as China slaps 125% tariff on US, weekend sell-off looming?

The Cryptocurrency market shows stability at the time of writing on Friday, with Bitcoin (BTC) holding steady at $82,584, Ethereum (ETH) at $1,569, and Ripple (XRP) maintaining its position above $2.00.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

Bitcoin, Ethereum, Dogecoin and Cardano stabilze – Why crypto is in limbo

Bitcoin, Ethereum, Dogecoin and Cardano stabilize on Friday as crypto market capitalization steadies around $2.69 trillion. Crypto traders are recovering from the swing in token prices and the Monday bloodbath.

Can FTX’s 186,000 unstaked SOL dampen Solana price breakout hopes?

Solana price edges higher and trades at $117.31 at the time of writing on Friday, marking a 3.4% increase from the $112.80 open. The smart contracts token corrected lower the previous day, following a sharp recovery to $120 induced by US President Donald Trump’s 90-day tariff pause on Wednesday.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[08.56.59,%2012%20Dec,%202023]-638387666565285710.png)