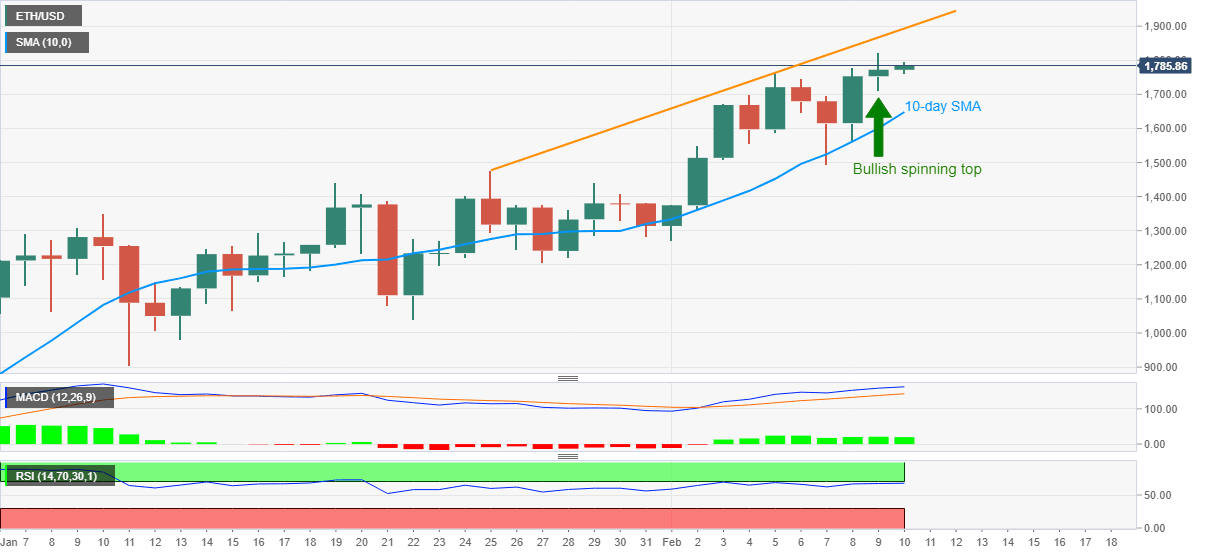

Ethereum Price Analysis: Tuesday’s spinning top tests ETH bulls bracing for fresh record top around $2,000

- ETH/USD rises for third day in a row, probes intraday high off-late.

- Tuesday’s candle suggests the buyers are tired, overbought RSI also challenges further upside.

- Two-week-old rising trend line lures the bulls, 10-day SMA restricts immediate downside.

ETH/USD rises to $1,793, up 1.20% intraday, during early Wednesday. The cryptocurrency pair refreshed an all-time high the previous day before easing from $1,824.53. In doing so, the altcoin marked the buyers’ exhaustion via daily candlestick.

Other than the candlestick formation showing a battle of the bulls and the bears, overbought RSI conditions also raise doubts on the ETH/USD upside.

As a result, intraday sellers may take risk of entry if witnessing a downside break of the nearby support, namely a 10-day SMA of $1,648.50.

However, the previous month’s top near $1,477 and the monthly low around $1,270 can test the bears afterward.

Meanwhile, an upside clearance of Tuesday’s high will direct ETH/USD buyers to an ascending resistance line from January 25, currently around $1,895.

It should, however, be noted that the quote’s sustained run-up past-$1,895, may not hesitate to confirm the market chatters favoring the $2,000 as the next price.

ETH/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.