- Ethereum bulls hold dearly the rising channel support, in anticipation of recovery towards $300.

- Hancock, a developer contributing to the development of ETH proposes the elimination of the ‘difficulty bomb’

Ethereum price is teetering at $252 amid increased selling activity. The downward action that dominated the crypto market the entire weekend session did not spare Ether. It is the same action still in play on Monday towards the end of the Asian session. ETH/USD has lost over 2.5% in value on the day while the bears’ grip could potentially increase.

Ethereum price technical analysis

Looking back at ETH/USD price performance over the last couple of months, we can easily tell that the crypto has been in a bullish phase. Attempts made to end the bullish action have been thwarted with Ethereum bouncing off the channel support on several accounts. The channel resistance has also made it difficult for rapid price action to the north.

Meanwhile, the weekend support at $240 has to stay intact if Ethereum bulls have a fighting chance to advance above $300. The short term support at $250 needs to stand tall as well. However, technical analysis shows that the bears are largely in control. For instance, the RSI is not only under the average but also still pointing south. If the trend spills over into the European session, there is a possibility of the support $240 being shuttered as Ether spirals towards $300.

Recovery is needed above $260, which could encourage more bulls to enter the market and push ETH/USD above $270. The 50 SMA provides immediate support at $250 above the 100 SMA at $225.

ETH/USD 4-hour chart

The controversial Ethereum difficulty bomb

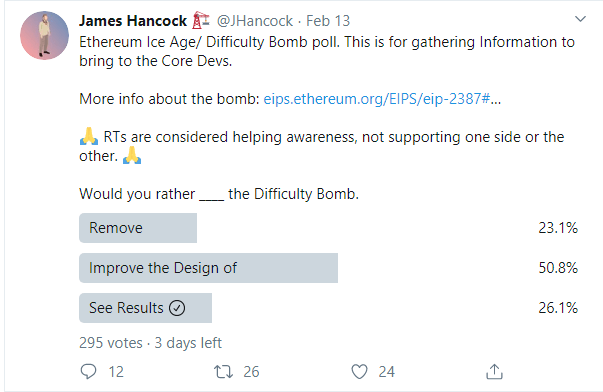

The Ethereum blockchain contains a code that is supposed to increase the time spent in mining one Ether block., otherwise called, the ‘Ethereum difficulty bomb.’ The bomb is from time to time delayed, however, James Hancock, a developer who contributes to the development of the Ethereum network, in his latest published research proposes an Ethereum Improvement Proposal (EIP 2125). The research shows a process through which the difficulty bomb could be eliminated entirely. He proposes a fix which he calls the Difficulty Freeze. Hancock explains:

Under the Difficulty Freeze, it is more likely that issuance would increase; however, clients are motivated to prevent this and keep clients syncing effectively. This means it is much less likely to occur.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, crypto market remain in uptrend following 25 bps Fed rate cut

Fed Chair Jerome Powell stated that the FOMC lowered the Fed funds rate by 25 basis points. The rate cut comes after Bitcoin reached a new all-time high price upon Donald Trump's election victory. Ethereum and Solana also retained gains of 7% and 4%, respectively, following the rate cut.

XRP sees bullish momentum following $123 million increase in open interest

XRP exchange reserves in Binance and Upbit have declined by nearly $13 million. In the past three days, investors opened over $123 million worth of XRP positions. XRP needs to overcome key descending trendline resistance to stage a rally to $0.6640.

Coinbase launches wrapped Bitcoin token on Solana network

Crypto exchange Coinbase announced on Thursday that it has launched its synthetic Bitcoin token, cbBTC token, on the Solana network, marking its first token issuance on the Layer-1 platform. The new token will allow users to stake Bitcoin on Solana and use it as lending collateral.

Solana Price Forecast: Investors stake $1.3B SOL amid November winning streak

Buoyed by Donald Trump's victory at the polls, the global crypto market entered its third consecutive day on an uptrend on November 7, 2024. Amid the ongoing rally, Solana emerged one of the biggest gainers on Thursday, as demand for native memecoins further propelled market demand for SOL.

Bitcoin: New all-time high at $78,900 looks feasible

Bitcoin price declines over 2% this week, but the bounce from a key technical level on the weekly chart signals chances of hitting a new all-time high in the short term. US spot Bitcoin ETFs posted $596 million in inflows until Thursday despite the increased profit-taking activity.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637175079909981335.png)