Ethereum Price Analysis: ETH’s run-up to $2,000 will not be easy

- Ethereum price had a significant breakout above $1,500 but it’s slowing down.

- Several on-chain metrics have turned against Ethereum in the short-term.

- However, the smart-contracts giant could still soar higher.

Ethereum was underperforming in comparison to many altcoins, especially DeFi projects, for the past several weeks. Finally, the smart-contracts giant managed to crack the $1,500 resistance level but without a lot of continuation.

Ethereum price is bullish but climbing higher will be tough

One of the main factors behind the most recent Ethereum breakout is Grayscale reopening its Ethereum trust to investors on Monday 1, February. The trust fund has added around 25,000 ETH right after opening worth around $37 million.

ETH supply on exchanges

However, in the past 48 hours, the percentage of ETH inside exchanges has seen a notable spike from 20.45% to 20.63% which indicates that some investors are looking to sell and take profits, increasing the selling pressure of Ethereum.

ETH MVRV (30d)

Additionally, the MVRV (30d) has crossed 20% which shows that on average, investors are up one-fifth of their initial investment. The last two tops on January 25 and 19 were accurately predicted by the MVRV crossing above 20% up to 28%. This indicates that Ethereum is at risk of another correction in the short-term.

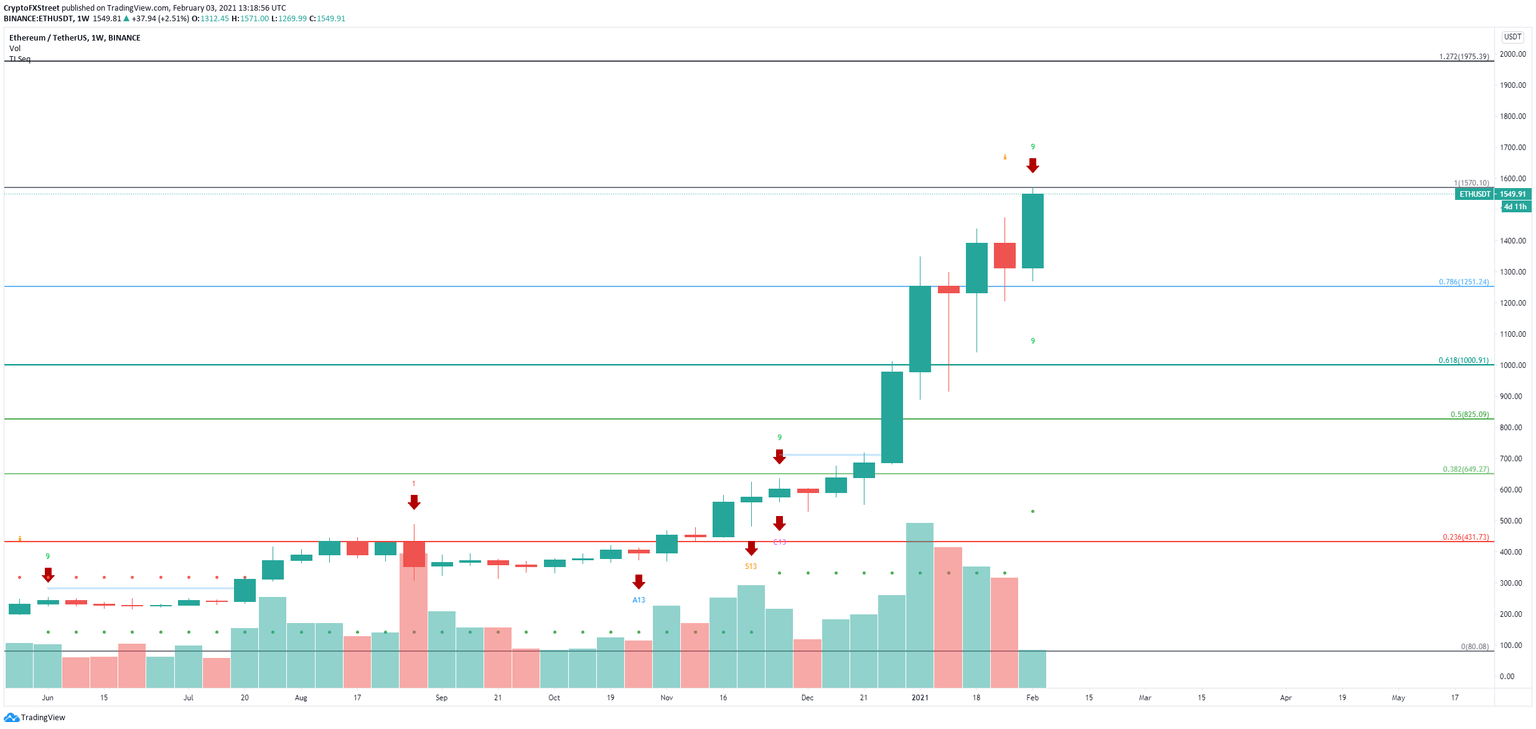

ETH/USD weekly chart

On the weekly chart, the TD Sequential indicator has just presented a sell signal. The nearest support level is located at $1,251 which is the 78.6% Fibonacci retracement level. Losing this point can push Ethereum price down to the psychological level at $1,000 which is also the 61.8% Fib level.

ETH active addresses

However, there are some positive metrics in favor of ETH as well. For instance, the number of active addresses over the past 24 hours has seen a massive spike to 535,000, the highest peak since January 10, which indicates the breakout has some strength behind it.

The Eth2 deposit contract now holds 2.93 million ETH worth more than $4.55 billion and the number of Ethereum coins locked inside DeFi protocols has continued to rise to 7.38 million currently, which means that around 10.3 million ETH are locked representing close to $16 billion at current prices. The next bullish price target for Ethereum is $2,000 which coincides with the 127.2% Fibonacci level.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B14.07.10%2C%252003%2520Feb%2C%25202021%5D-637479556496500322.png&w=1536&q=95)

%2520%5B14.11.24%2C%252003%2520Feb%2C%25202021%5D-637479556521656122.png&w=1536&q=95)

%2520%5B14.14.53%2C%252003%2520Feb%2C%25202021%5D-637479556554312593.png&w=1536&q=95)