Ethereum Price Analysis: ETH/USD volatility is about to explode

- Ethereum has been range-bound for too long.

- The first critical resistance is created by $215.00.

Ethereum (ETH) has been trading in a tight range since the start of the week. On Thursday, May 28, the second-largest digital asset by market value is changing hands at $206.50, down 1% since the start of the day.

The experts believe that Ethereum’s volatility is about to catapult with the potentially bullish outcome. Recently, the FXStreet reported on the factors behind ETH growth, which include the development activity, gas usage, mean dollar investment age, and miner’s balance.

Notably, ETH correlation to BTC has decreased to 0.32 recently, which means that the price movements of the second-largest digital coin are mostly unrelated to Bitcoin.

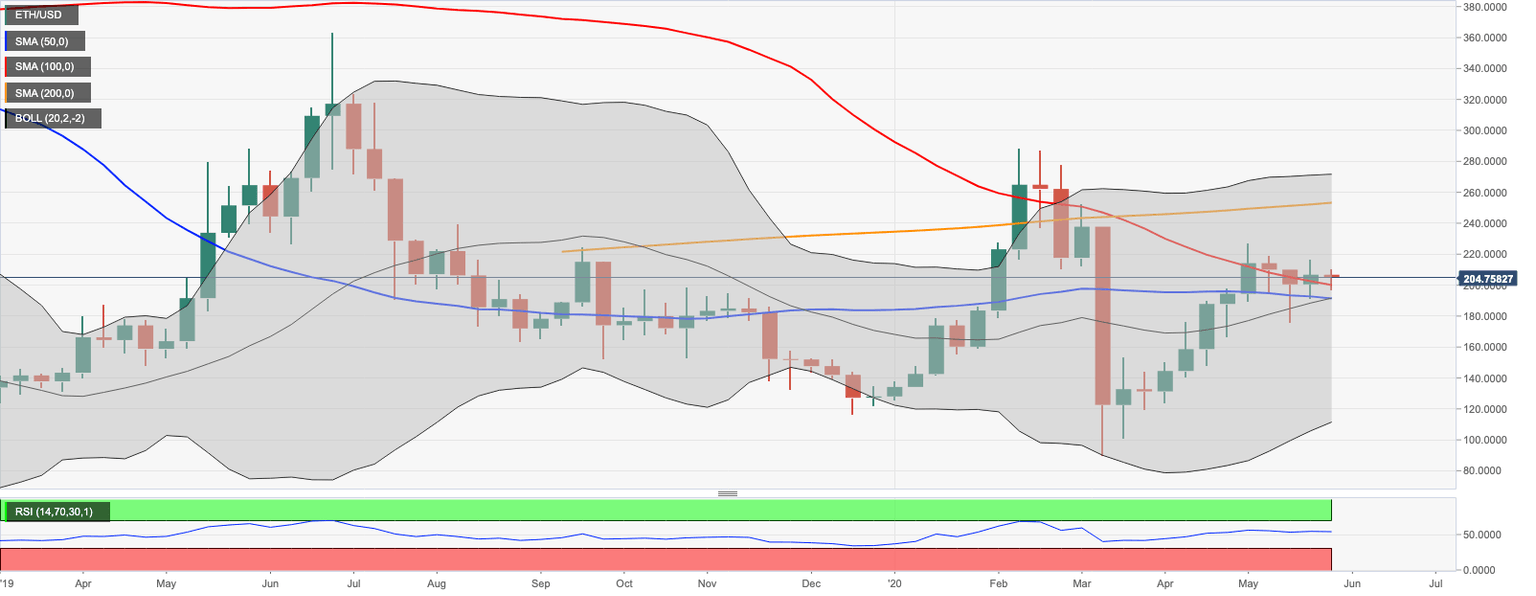

ETH/USD: Technical picture

ETH/USD reached the recovery high at $209.00 and retreated to $205.00 by the time of writing. The second-largest digital asst with the current market value of $23 billion has been trading in a tight range limited by $200.00 on the downside and $215.00 on the upside since the middle of May. While the price is well supported by the psychological $200.00, the recovery impulse is not strong enough to take it above the upper limit of the range.

The initial resistance is created by $210.00. Once it is out of the way, the upside is likely to gain traction with the next focus on the above-mentioned $215.00. The next resistance levels are created at the highest level of the previous week at $217.00 and $220.00.

On the downside, if ETH breaks below $200.00, the sell-off will extend towards the lowest level of the previous week at $191.49 with weekly SMA50 and the middle line of the weekly Bollinger Band located below that level.

ETH/USD weekly chart

Author

Tanya Abrosimova

Independent Analyst