- ETH/USD retreats from a multi-month high amid technical correction.

- The critical support is created by SMA50 weekly at $228.

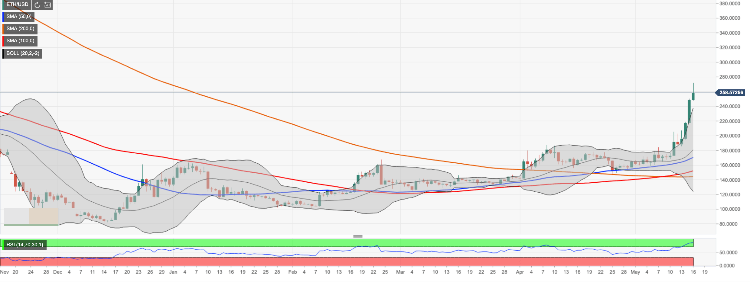

ETH/USD topped at $272.15 during early Asian hours and retreated to $252 by the time of writing. Despite the setback, ETH is still nearly 20% higher from this time on Wednesday with over 56% of gains on a week-on-week basis. Ethereum is the second largest coin with the current market value of $28.3 billion and an average daily trading volume of $15 billion, which is the highest on record.

Looking technically, ETH/USD is supported by $246.00. This handle is strengthened by the middle line of the 1-hour Bollinger Band. Once it is cleared, the sell-off may continue with the next focus on $240 and further on $237.60, which is the upper boundary of the daily Bollinger Band. Another strong support is created by a confluence of SMA50 weekly and SMA50 daily around $228. The daily RSI (Relative Strength Index) stays in the overbought territory, though there are no clear signals of reversal as of yet. It means that the price will resume the upside movement once the short-term technical correction is over.

On the upside, a sustainable move above the recent high of $272.15 will bring psychological $300 in focus. The last time ETH/USD traded above this handle in August 2018. Once it is cleared, the upside is likely to gain traction with the next aim at $379 (SMA100 weekly)

ETH/USD 1-day chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Bitcoin Weekly Forecast: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin continues to climb this week after breaking its resistance barrier, aiming for a new all-time high. US spot Bitcoin ETFs posted $1.86 billion in inflows until Thursday, the largest streak of inflows since mid-July.

Crypto Today: Main tokens gain as Bitcoin is less than 10% away from all-time high

Bitcoin climbs above $68,000 and pulls back as market participants turn greedy, according to the indicator that checks trader sentiment. Ethereum holds gains above $2,600 and XRP hovers around $0.55 on Friday.

Solana Price Forecast: SOL gains 2% as community discusses Firedancer validator for better performance

Solana gains 2% as its community discusses performance improvements through its new validator, Firedancer. Bitcoin’s Layer 2 project Solv Protocol launched BTC staking token on the Solana blockchain.

Bitcoin: Will the “Uptober” rally reach a fresh all-time high?

Bitcoin (BTC) rallied nearly 8% so far this week until Friday after breaking its resistance barrier, aiming for a fresh all-time high (ATH). This rise in Bitcoin’s price is supported by an increase in institutional demand, which showcased a $1.86 billion inflows this week, the largest streak of inflows since mid-July. Rising apparent demand and institutional reports suggest that the current BTC cycle resembles the third halving, when prices increased sharply.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.