Ethereum Price Analysis: ETH/USD defies bearish sentiments, consolidates above $240

- Ethereum consolidation above $240 could be the foundation for a lift-off above $250 and towards $280.

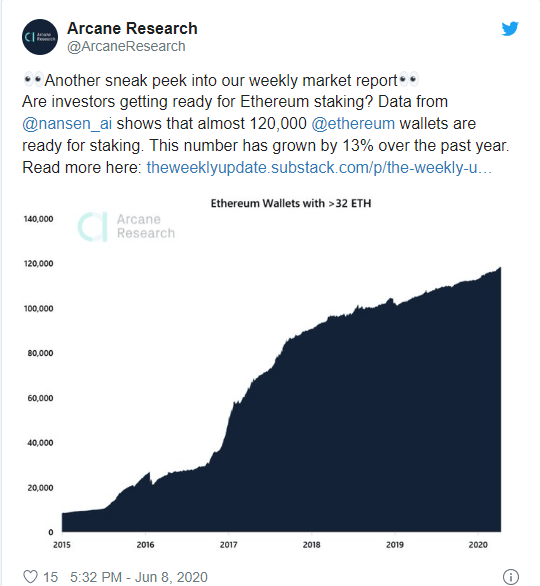

- Investors get ready for the Ethereum 2.0 staking by stocking at least 32 ETH, the minimum for a validating node.

Ethereum has defied bearish calls from some analysts who believe that the second-largest cryptocurrency is poised for acute declines following the failed attempt to sustain gains above $250. Consequently, ETH/USD has approached this week’s trading with the utmost calm, strongly defending support above $240. On the upside, selling pressure is present at $245 and $250 respectively.

ETH/USD, on the other hand, is trading at $243 amid a sideways trend supported by various technical indicators. The RSI is moving horizontally slightly under the overbought region (70). Also emphasizing the consolidation is the MACD. The indicator is settled in the positive region (13.05). There is no bearish or bullish divergence, which means that the tag of war is of equal strength.

The same daily chart shows that bulls could have an upper hand but lack the energy and catalyst to enforce a breakout and follow it through. The 50 SMA, for instance, is above the longer-term 200-day SMA. As the gap between the moving averages widens so does the bullish strength. Other than $240, support areas include $235, $225 as well as $200. An ascending trendline is in line to offer support as well.

ETH/USD daily chart

%20(30)-637272670139113318.png&w=1536&q=95)

Ethereum 2.0 staking poised for a massive debut

As the cryptocurrency community awaits the eventual launch of Ethereum 2.0, investors are getting ready for the staking feature by stocking on Ether tokens. Staking will be at the core of the Ethereum network following the launch because of the benefits it offers to investors and the security and trust it would bring to the network. A report released by crypto analytics firm Arcane Research reckons that Ethereum wallets with 32 ETH or more are almost at 120,000 in number. 32 ETH is the minimum tokens required to access the staking feature in the new protocol to run a validating node. This number has grown by 13% in the past 12 months.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren