- ETH/USD bulls are celebrating victory as the coin trades above the critical $200.

- An ultimate resistance is created by $230 handle.

Ethereum, the second-largest cryptocurrency with the current market capitalization of $21 billion, crashed below $200.00 handle and touched $190.00 on Tuesday amid major sell-off on the cryptocurrency market. ETH/USD has lost over 13% of its value in recent 24 hours and stayed unchanged since the beginning of Wednesday. By the time of writing, the coin managed to regain ground and settled $201.00.

Read also: Set Labs unveils Ethereum strategy trading bots

https://www.fxstreet.com/cryptocurrencies/news/set-labs-unveils-ethereum-trading-strategy-bots-201907162254

Ethereum's technical picture

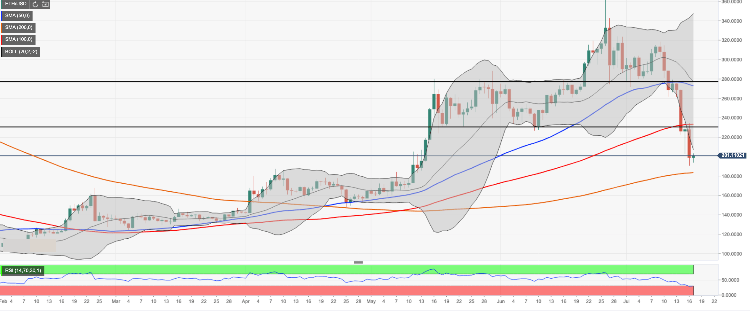

On the daily chart, a sustainable move above $200 will mitigate the immediate bearish pressure and create a precondition for an extended upside towards $230.00, which is the lower boundary of the recently broken channel strengthened by SMA100 (Simple Moving Average) on a daily chart.

On the downside, the initial support is created by the recent low of $190.60 closely followed by psychological $190.00 and the lower boundary of 4-hour Bollinger Band. A sustainable move below this handle will open up the way towards the next bearish aim of $183.00 (SMA200, daily chart)

ETH/USD 1-day chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC remains calm before a storm

Bitcoin price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday. A K33 Research report explains how the markets are relatively calm and shaping up for volatility as investors absorb the tariff announcements.

Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

US President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

Ethereum Price Forecast: Whales increase buying pressure as developers set April 30 for Pectra mainnet upgrade

Ethereum developers tentatively scheduled the Pectra mainnet upgrade for April 30 in the latest ACDC call. Whales have stepped up their buying pressure in hopes of a price uptick upon Pectra going live on mainnet.

BTC stabilizes while ETH and XRP show weakness

Bitcoin price stabilizes at around $87,000 on Friday, as its RSI indicates indecisiveness among traders. However, Ethereum and Ripple show signs of weakness as they face resistance around their key levels and face a pullback this week.

Bitcoin: BTC remains calm before a storm

Bitcoin (BTC) price has been consolidating between $85,000 and $88,000 this week, approaching the lower boundary of the consolidation range when writing on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.