- ETH/USD is sliding towards the critical short-term support level.

- A sustainable move above $151.60 will improve the technical picture.

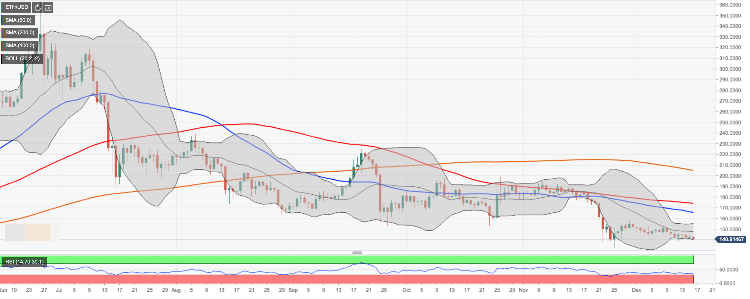

ETH/USD has resumed the sell-off after a short-lived consolidation period. The second-largest digital asset has lost about 1.3% of its value since the beginning of Monday and slipped under $141.00 handle. At the time of writing, ETH/USD is changing hands at $140.60 amid expanding volatility.

Ethereum developer Justin Drake proposed to launch Ethereim 2.0 Phase 0 on July 30, 2020, on the fifth birthday of the network. However, other developers believe that there is no point in postponing the release, considering that it is almost production-ready.

It is worth mentioning that Ethereum rolled out the Istanbul update and deployed a block explorer for the testnet of Ethereum 2.0 earlier in December. The phase 0 of Serenity will be implemented in the first quarter of 2010.

Ethereum's technical picture

From the mid-term point of view, ETH/USD needs to recover above the resistance area of $151.00 - $151.60, which served as an upside boundary of the previous consolidation channel. However, the road to the target level is packed with technical hurdles, including a combination of SMA50 (Simple Moving Average) 4-hour and the upper line of 4-hour Bollinger Band and at $145.00 and SMA100 4-hour the middle line of the daily Bollinger Band at $147.00.

A sustainable move above $151.60 will open up the way for a more sustainable recovery towards the longer-term target at $165.40 (SMA50 daily). The coin has been trading below the line since November 18.

On the downside, once $140.00 gives way, the sell-off will gain traction with the next focus on $136.50 ( the lower line of the weekly Bollinger Band). If it is broken, ETH/USD will enter an uncharted territory with the next support as low as $120.50, which is the lowest level since December 2018.

ETH/USD, the daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Monero Price Forecast: XMR soars over 19% amid rising demand for privacy coins

Monero (XMR) price is extending its gains by 19% at the time of writing on Monday, following a 9.33% rally the previous week. On-chain metrics support this price surge, with XMR’s open interest reaching its highest level since December 20.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH stabilize while XRP shows strength

Bitcoin and Ethereum prices are stabilizing at around $93,500 and $1,770 at the time of writing on Monday, following a rally of over 10% and 12% the previous week. Ripple price also rallied 8.3% and closed above its key resistance level last week, indicating an uptrend ahead.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.