- Ethereum price prepares for a 30% breakout from a bullish consolidation pattern.

- On-chain metrics support the bullish thesis as ETH moves closer into price discovery mode.

- The 50 and 100 twelve-hour EMA will play a vital role in keeping Ether’s uptrend intact.

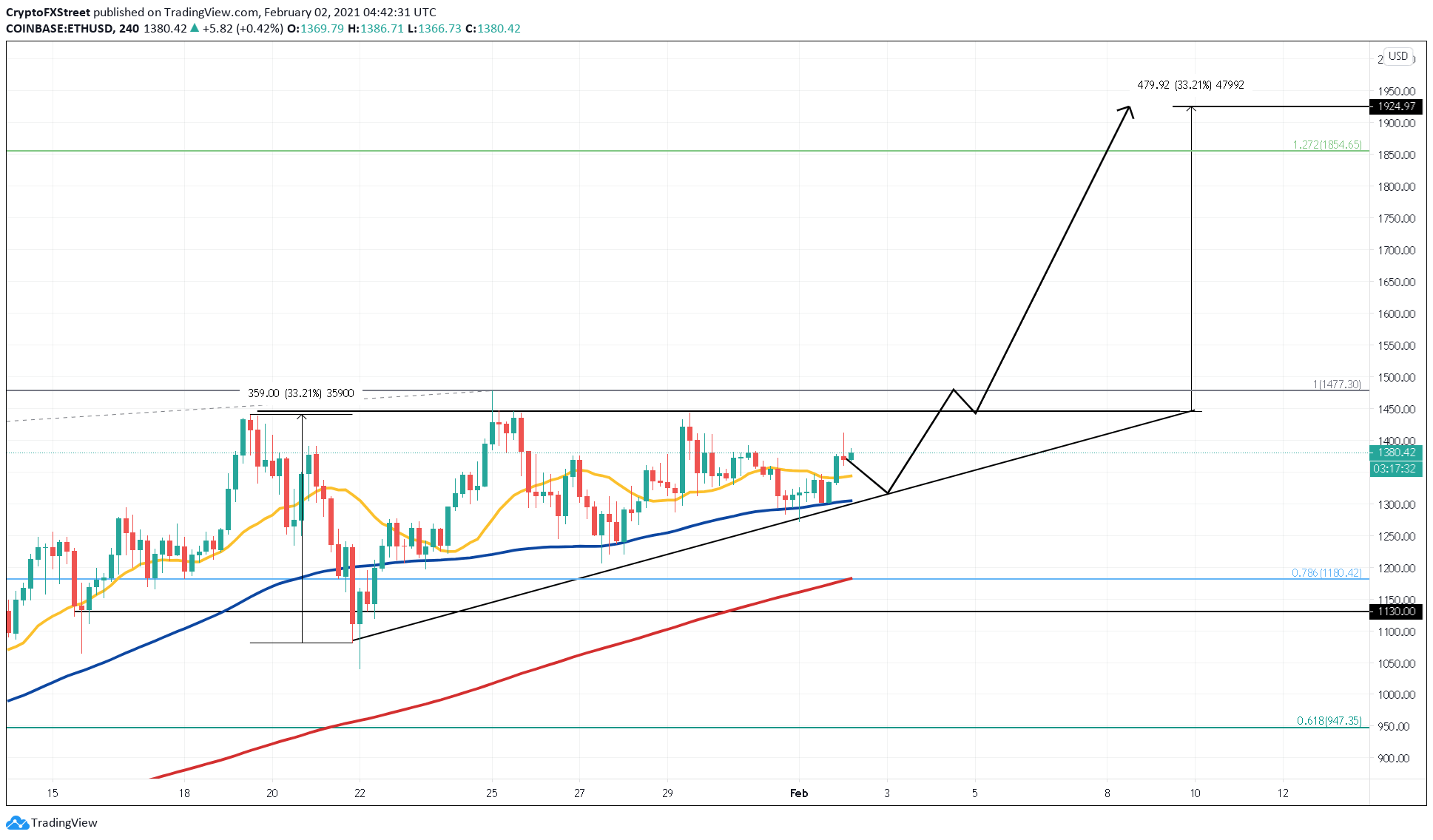

Ethereum price is ready for a significant upswing as the price nears the x-axis of an ascending triangle. A candlestick close above $1,450 would confirm a bullish breakout that may propel ETH towards $1,900, representing a 30% increase.

Ethereum price primed for new all-time highs

Ethereum price is ready for a breakout after a two-week consolidation period where it mostly traded inside an ascending triangle. ETH’s recent move above the 50 twelve-hour EMA shows that bulls want to push prices towards the triangle’s upper trendline.

A subsequent 12-hour candlestick close above the resistance barrier at $1,450 not only confirms a bullish breakout but also could see Ether’s market value rise by more than 30%.

ETH/USDT 4-hour chart

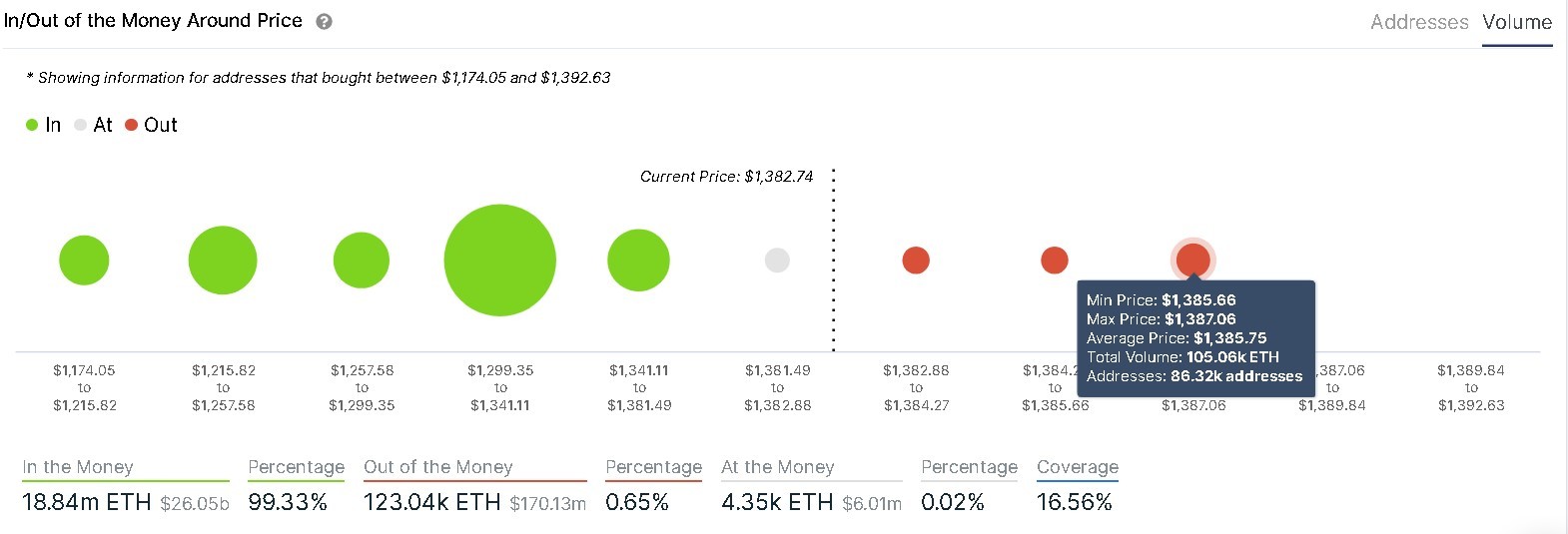

Adding credence to the bullish scenario is IntoTheBlock’s In/Out of the Money Around Price model. This on-chain metric shows clear sailing for ETH with very little resistance ahead.

Only a small cluster of investors have purchased around 100,000 ETH for a market value of $1,385. Although such an insignificant supply wall could momentarily keep rising prices at bay, Ethereum will enter price discovery mode if it manages to slice through it.

Ethereum IOMAP

Moreover, Ethereum’s supply on exchanges has taken a massive nosedive over the past two weeks, indicating a substantial decrease in sell-pressure. It also suggests that investors are confident that ETH will achieve its upside potential, which adds fuel to the optimistic view.

%20[10.47.11,%2002%20Feb,%202021]-637478425767769207.png)

Ethereum Coin Supply on Exchanges chart

Although the bullish scenario is plausible, Ethereum price has faced multiple rejections at the $1,450 resistance level. Hence, a failure to breach this hurdle can invalidate the bullish outlook and lead to a steep correction.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Is Altcoin Season here as Bitcoin reaches a new all-time high?

Bitcoin reaches a new all-time high of $98,384 on Thursday, with altcoins following the suit. Reports highlight that the recent surge in altcoins was fueled by the victory of crypto-friendly candidate Donal Trump in the US presidential election.

Shanghai court confirms legal recognition of crypto ownership

A Shanghai court has confirmed that owning digital assets, including Bitcoin, is legal under Chinese law. Judge Sun Jie of the Shanghai Songjiang People’s Court shared this opinion through the WeChat account of the Shanghai High People’s Court.

BTC hits an all-time high above $97,850, inches away from the $100K mark

Bitcoin hit a new all-time high of $97,852 on Thursday, and the technical outlook suggests a possible continuation of the rally to $100,000. BTC futures have surged past the $100,000 price mark on Deribit, and Lookonchain data shows whales are accumulating.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: New high of $100K or correction to $78K?

Bitcoin surged to a new all-time high of $93,265 in the first half of the week, followed by a slight decline in the latter half. Reports highlight that Bitcoin’s current level is still not overvalued and could target levels above $100,000 in the coming weeks.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.