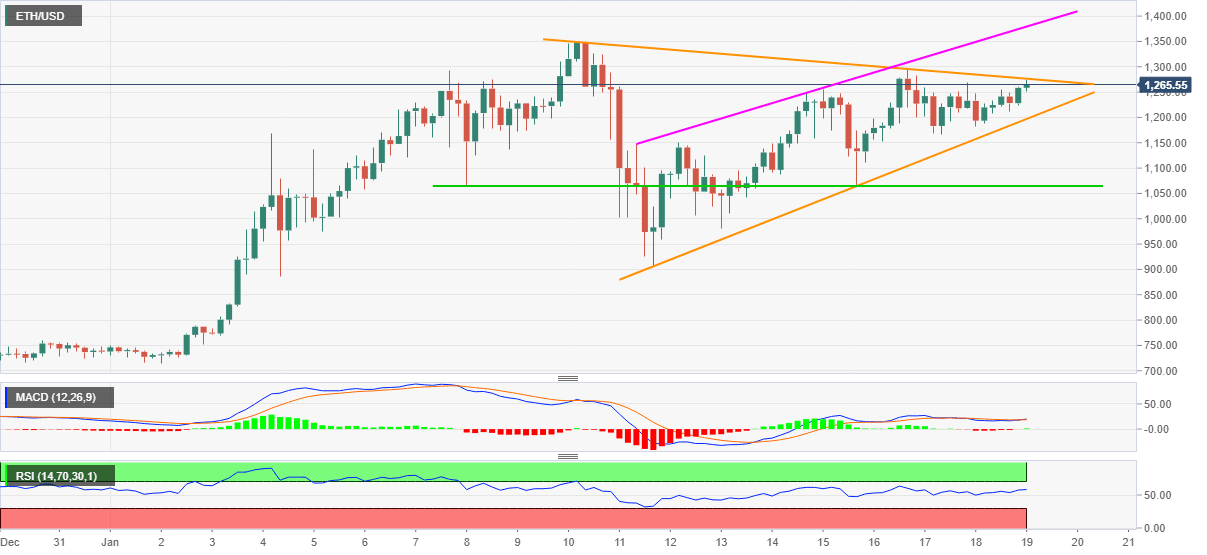

Ethereum Price Analysis: ETH bulls facing an uphill task inside short-term triangle

- ETH/USD eases from nine-day-old triangle resistance, three-day top.

- Normal RSI conditions battle mixed MACD amid immediate upside.

- Monthly top, one-week-old ascending trend line favor bulls.

ETH/USD steps back from short-term resistance while declining to $1,256 during early Tuesday. In addition to easing from the immediate triangle’s upper line, Ethereum also drops from a three day high by press time.

Even so, the bears aren’t convinced of entry as RSI remains far from overbought conditions even as MACD dwindles. Also favoring the upside momentum is an ascending trend line from January 11.

Hence, ETH/USD buyers can eye for the monthly peak surrounding $1,350 despite recent failures to cross the $1,277 hurdle.

During the quote’s sustained upside past-$1,350, an upward sloping trend line from January 11, at $1,380 now, will be the key to watch.

On the flip side, ETH/USD weakness below the triangle support line, currently around $1,197, can recall 11-day-long horizontal support near $1,064.

If at all the Ethereum sellers dominate past-$1,064, the $1,000 threshold and last week’s low around $905 can entertain them ahead of the monthly low near $715.

ETH/USD four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.