Ethereum Price Analysis: ETH 2.0 is on the way, as price sits on top of healthy support

- Uniswap has become the first DeFi project with more than $2B total value locked.

- Spadina, the final ETH 2.0 testnet, has gone live.

The present state of DeFi

Ethereum is currently the preferred blockchain for decentralized finance (DeFi) projects. This is why to judge Ethereum’s health, it makes sense first to see how the DeFi-verse is doing. Firstly, as reported before, the total value locked within DeFi protocols has surpassed $11 billion. At the same time, Uniswap has become the first decentralized finance (DeFi) protocol to have over $2 billion in TVL.

Uniswap has become the largest decentralized finance protocol by trading volume. Until recently, Uniswap suffered pressure from competitors like SushiSwap. However, the launch of UNI governance tokens precipitated value back into the protocol. Governance tokens allow holders a vote on important decisions about the future development of the issuing protocol.

Uniswap has served over 100,000 unique trading addresses in the past week alone. This is followed by Kyber Network, which saw less than 2,000 unique addresses use its protocol in the same timeframe. Speaking of Kyber, they were the biggest gainers of the day, TVL-wise, with 14.87%.

Latest on ETH 2.0

The highly-anticipated launch of Ethereum 2.0 is an area of particular interest for long-term Ethereum holders. In particular, the surging DeFi demand has resulted in skyrocketing ETH gas fees. This gas fee problem has put ETH 2.0 into the spotlight. Ethereum’s transition from a proof-of-work model to a proof-of-stake is expected to bring more scalability to the blockchain.

In that aspect, there is some good news for ETH holders. As earlier reported by FXStreet, the final ETH 2.0 testnet, Spadina, has gone live.

Along with this, Consensys Founder, Joseph Lubin took to Twitter to assure his followers that Eth2 is happening, if there were any doubts.

Areas of particular interest to me right now are Eth2 (it’s happening!), gas optimization & scalability solutions, risk management, and network-based collaboration. We’re focusing on many of these in Mesh and we look forward to sharing more news & updates soon.#ConsenSysMesh

— Joseph Lubin (@ethereumJoseph) September 28, 2020

iTrust Capital also tweeted that the Ethereum 2.0 launch could be sooner than later.

We are hearing from sources that Ethereum 2.0 launch announcement is coming within the next few weeks.

— iTrustCapital (@iTrustCapital00) September 28, 2020

Is your portfolio positioned accordingly?

Let’s now look into Ethereum’s network health and check if on-chain metrics gives us some helpful indicator about its current state.

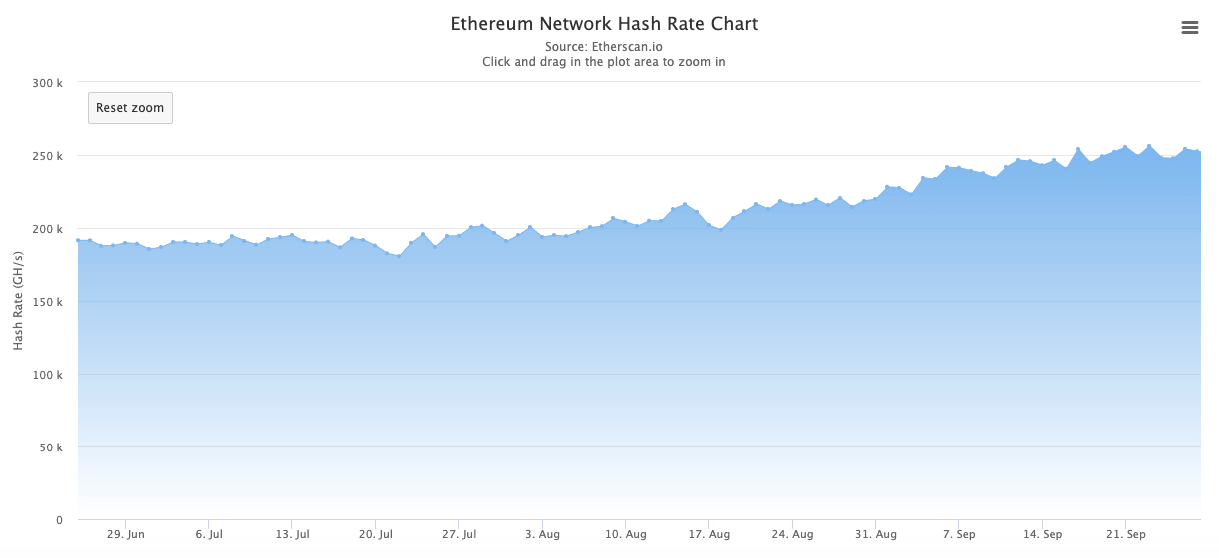

Ethereum hashrate and difficulty

As per Etherscan, over the last four months, the difficulty of the network has increased steadily. Difficulty is a metric that measures how tough it is for the miners to mine the protocol.

As per the chart, it has become increasingly difficult to mine on Ethereum over the last four months. Along with this, the network hashrate has also progressively increased in the same period.

Hashrate is used to measure the computational power of the network. The hashrate is directly related to the speed and security of the network. This shows that the miners have kept pace with the difficulty, which is a positive sign.

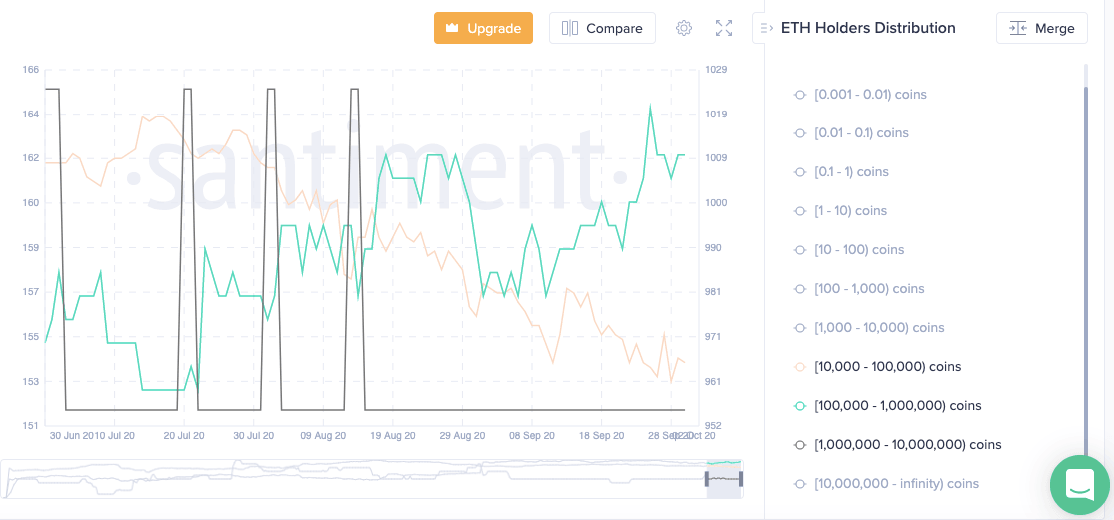

Ethereum holder distribution

Since this Monday, the number of holders in the 10,000-100,000 and 100,000-1,000,000 brackets have gone up from 962 and 162 to 967 and 163. This is a positive sign for Ethereum since this shows that whales are currently consolidating their positions, instead of merely dumping their holdings.

Ethereum whales and miners

Up next, let’s look at the amount of ETH held whales and miners. From July 20, 2020, to September 2, 2020, the miners had been in a dumping spree, as their balance dropped from 1.17 million to 1.07 million. Following that, their balance has grown up steadily to 1.12M.

In the same three month-time frame, the balance held by whales has gone up progressively. While there was a slight dip on the 5th and 16th September, the whales have stayed bullish. As of press time, they have increased their holdings to 12.86 million.

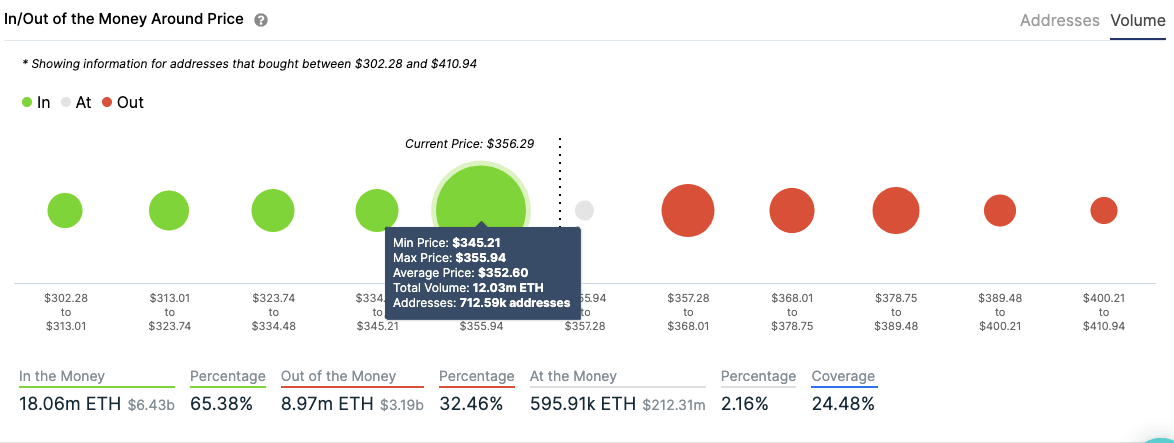

But what about price movements? For that, let’s check out IntoTheBlock’s In/Out of the Money Around Price (IOMAP).

Ethereum IOMAP

As per the IOMAP, the price is sitting on top of a strong support wall at $350. At this level, 712.59k addresses had previously bought around 12M ETH. This wall is robust enough to absorb the strong selling pressure. On the upside, there are moderate-to-weak resistance levels. If the buyers take control, then they can potentially take the price up to $400. However, the $360 resistance wall remains a barrier that the price hasn’t been able to jump over the last few days.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.