Ethereum price aims for new yearly highs ahead of ETH 2.0 upgrade

- Ethereum price managed to bounce back up from a low point of $481 on November 26.

- The next critical resistance level is established at $623, the 2020-high.

Like the majority of cryptocurrencies, Ethereum has managed to recover from its 23% crash and it’s aiming to hit higher highs on Monday. There seems to be very little opposition above as bulls are eying up $720.

Ethereum price needs to climb above $623 to reach higher highs

The current price of ETH is $604 after a slight rejection from $615. The nearest and most critical resistance level is located at $623, which is the 2020-high established on November 24. On the daily chart, the MACD turned red briefly on November 28 before recovering in the next 24 hours.

ETH/USD daily chart

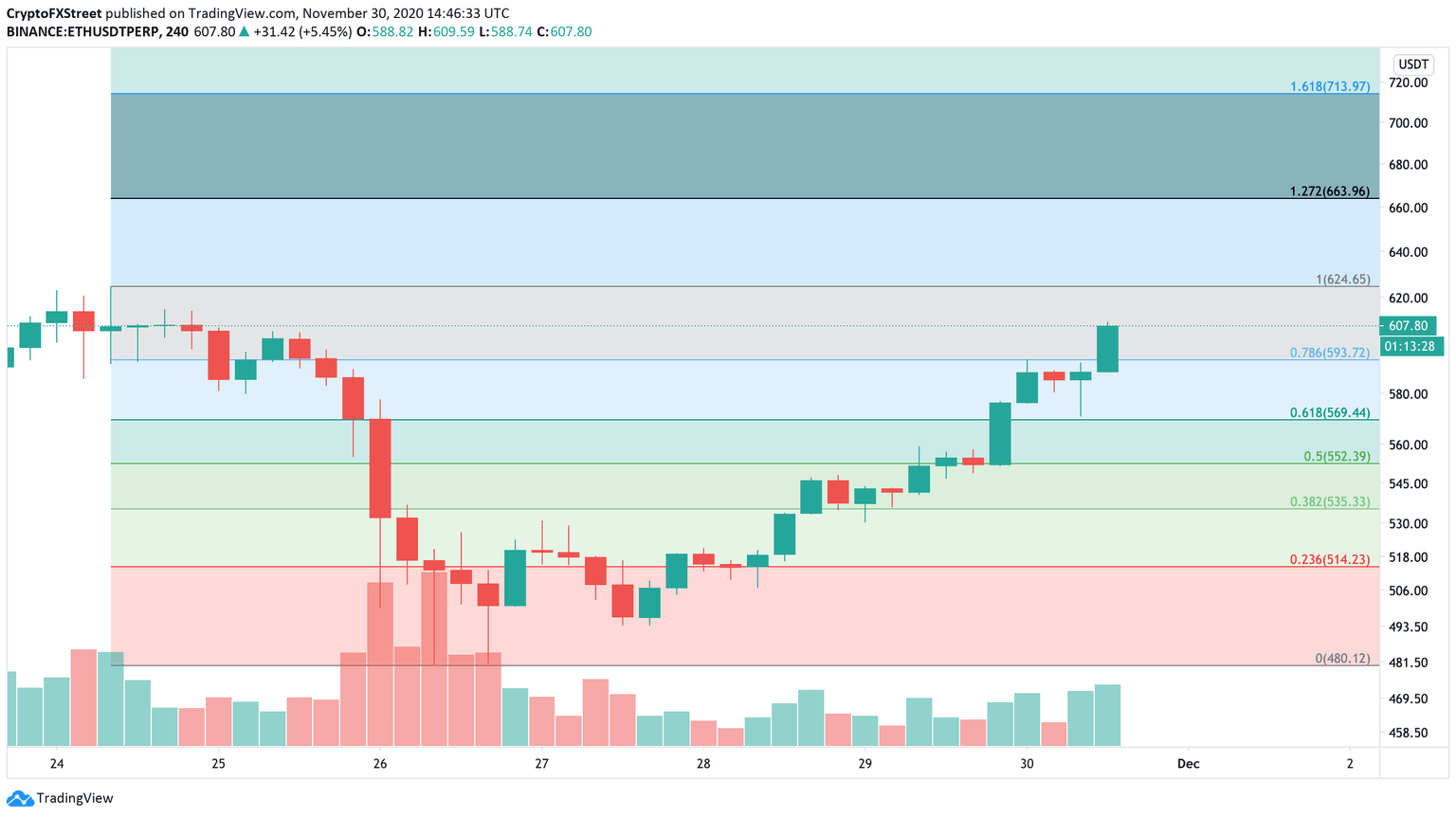

Using the Fibonacci Retracement indicator on the 4-hour chart, we can determine some potential price targets for ETH bulls. The nearest level at 1 is $624 which coincides with the high of $623, a major resistance level. A breakout above this point can quickly push Ethereum price to the 1.618 Fib level at $720.

ETH/USD 4-hour chart

On the other hand, the TD Sequential indicator has presented a sell signal on the 4-hour chart – in the form of a green nine candle – while the RSI just touched overextended levels, adding even more selling pressure. Validation of the signal could push Ethereum price to the 100-SMA at $560.

ETH/USD 4-hour chart

Other potential bearish price targets for Ethereum include the low of $547, which is right below the 100-SMA at $560. Then comes the 50-SMA at $520 and finally the last low established on November 26 at $481.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.