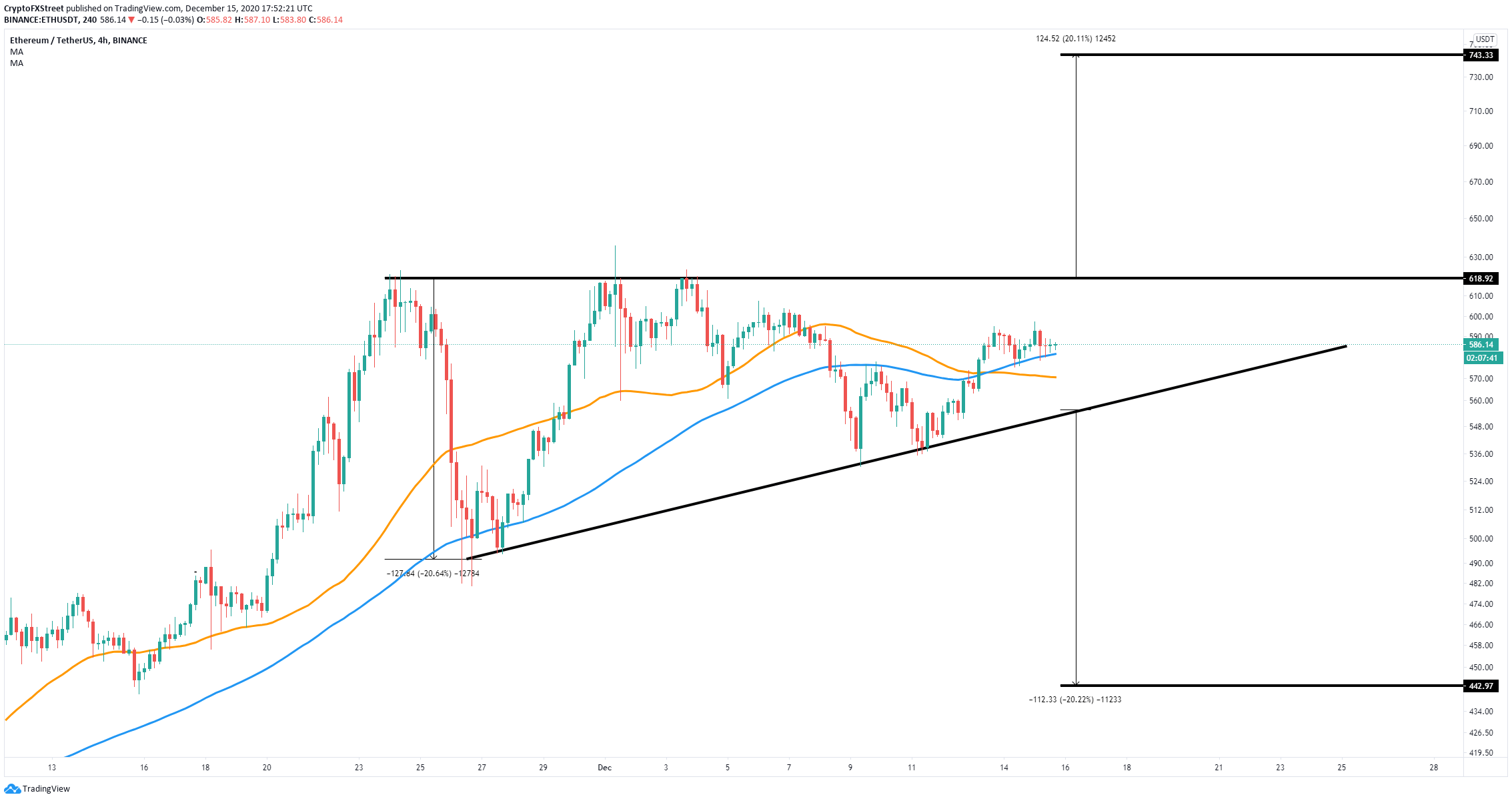

- Ethereum price remains bounded inside an ascending triangle pattern on the 4-hour chart.

- Almost 1.5 million ETH have been locked in the Eth2 deposit contract.

With around 1,498,753 Ethereum locked out of circulation, the bullish momentum of the digital asset continues soaring. It currently trades at $586 and aims for a potential price target of $618 in the short-term.

Ethereum price needs to defend a crucial support level to rebound higher

Ethereum has established an ascending triangle pattern on the 4-hour chart and climbed above the 50-SMA and most recently above the 100-SMA, which now act as support level. The digital asset has defended this last moving average several times in a row and looks ready for a rebound.

ETH/USD 4-hour chart

The next potential price target of a rebound would be the upper trendline resistance level of the pattern at $619. A breakout above this level would quickly push Ethereum price towards a high of $743.

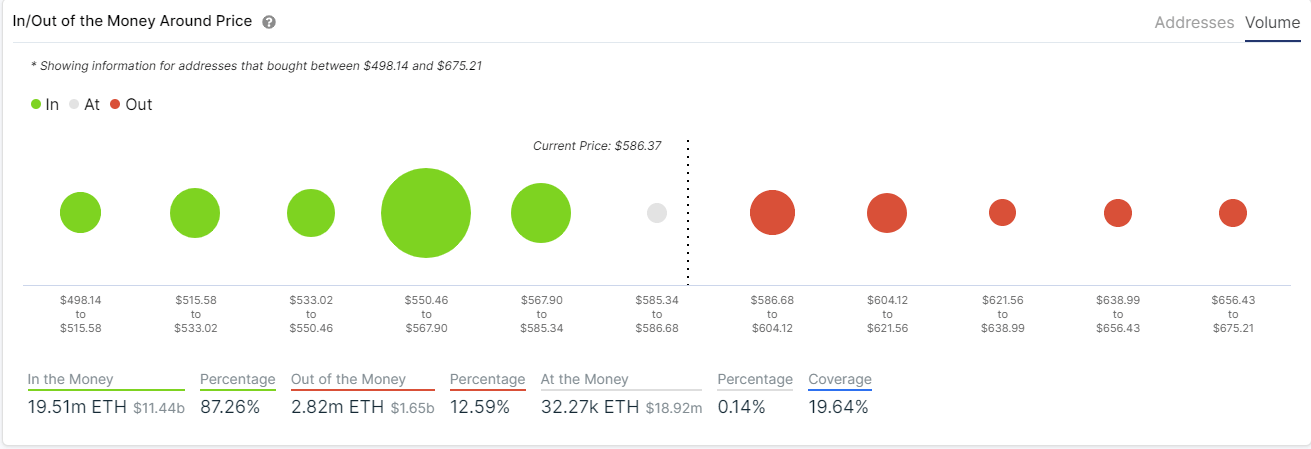

ETH IOMAP chart

The In/Out of the Money Around Price (IOMAP) chart shows practically no resistance above $600 which adds credence to the bullish outlook. However, the most vital support area between $550 and $567 needs to hold.

A breakdown below this significant range could quickly push Ethereum price towards the lower trendline level of the triangle pattern at $560. A further breakdown below this point would put Ethereum at a price target of $443.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.