Ethereum outperforms Bitcoin, ETH regains the majority its flash-crash losses

- Ethereum price, like the broader cryptocurrency market, suffered a massive flash-crash during the early midnight trading on Saturday.

- 17% losses at one point were measured.

- Throughout the remainder of Saturday, buying pressure wiped out nearly all of the overnight losses.

Ethereum price performance on Saturday has been nothing short of spectacular. Considering that most of the altcoin market is down fifteen to twenty percent, Ethereum’s daily close of down only 4% is a testament to its strength.

Ethereum price regains nearly all of its flash-crash loss, handily outperforming the broader market

Ethereum price experienced one of the fastest and deepest flash-crashes since May. The timing of the collapse couldn’t have been more perfect: midnight Eastern Standard Time (New York). Bears could push Etheruem to the $3,503 price level before a bullish reversal occurred.

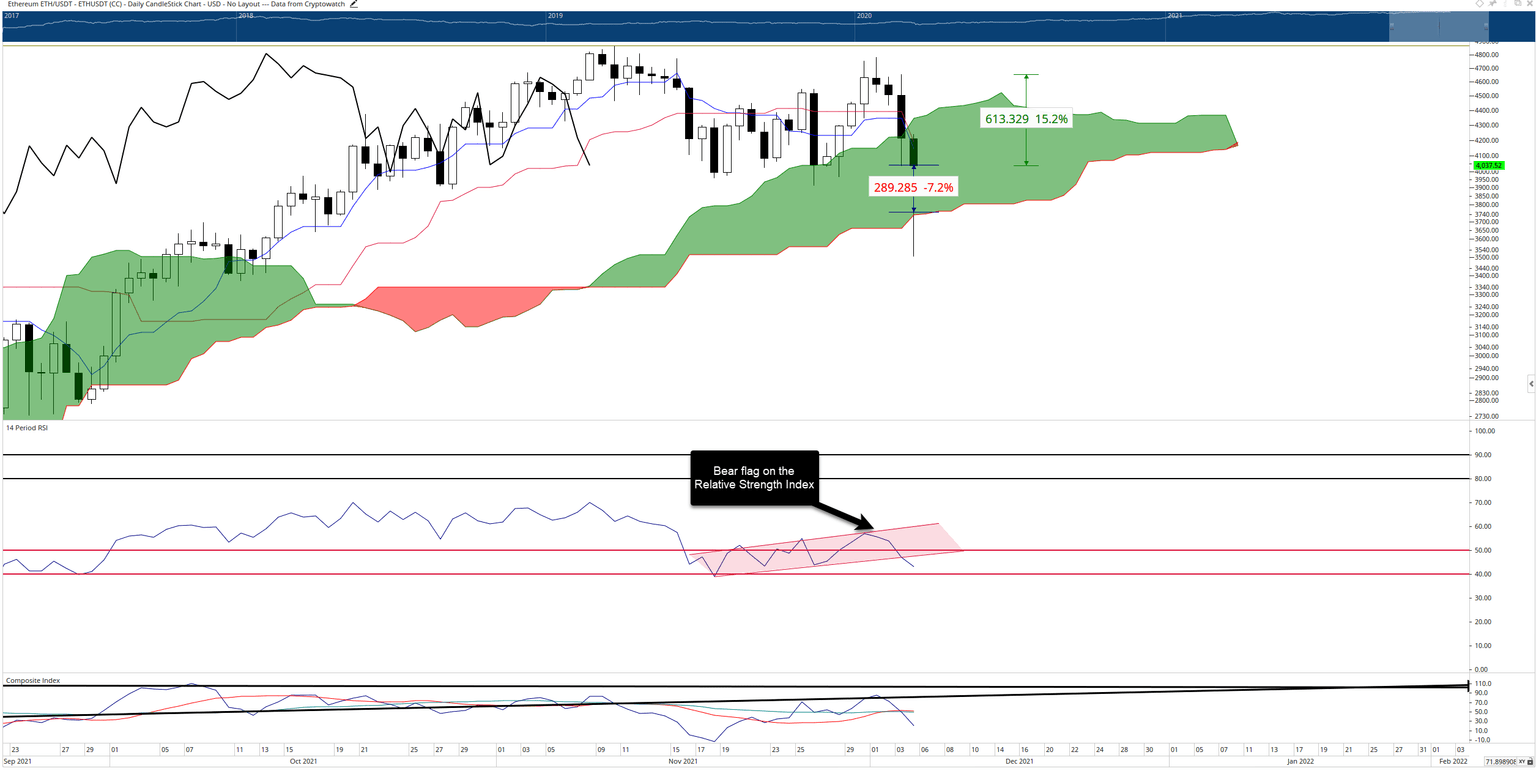

The two primary support levels holding Ethereum price up are Senkou Span B at $3,700 and the third-highest volume node in the 2021 Volume Profile at $3,410. While highly bullish in the short-term, indecision and downside risks remain.

Despite the massive recovery, Ethereum price remains inside the daily Cloud – an area rife with indecision, volatility, and whipsaws. The Cloud is the place where trading accounts blow up. Etheruem needs a daily close at or above the $4,650 price level to convert to a full-blown bull market.

Ethereum price is tilted more bearish here, especially with the Chikou Span below the candlesticks and in open space. Adding to the bearish outlook is the bear flag breakout on the Relative Strength Index (RSI). However, the final oversold level at 40 in the RSI might yield some support.

ETH/USD Daily Ichimoku Chart

The threshold that bears need to achieve to convert Ethereum price into a bear market is a much more manageable price range than converting to a bull market. For example, whereas Ethereum needs a 15% move above $4,000 to convert into a bull market, short-sellers only need a 7% move below $4,000 to convert Ethereum into a bear market.

Any daily close at or below $3,700 would position Ethereum below the Cloud and into bear market territory.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.