- Following the Berlin hard fork, Ethereum’s network is ready to raise its gas limit once again.

- The move can be considered a temporary solution to high gas fees and network congestion.

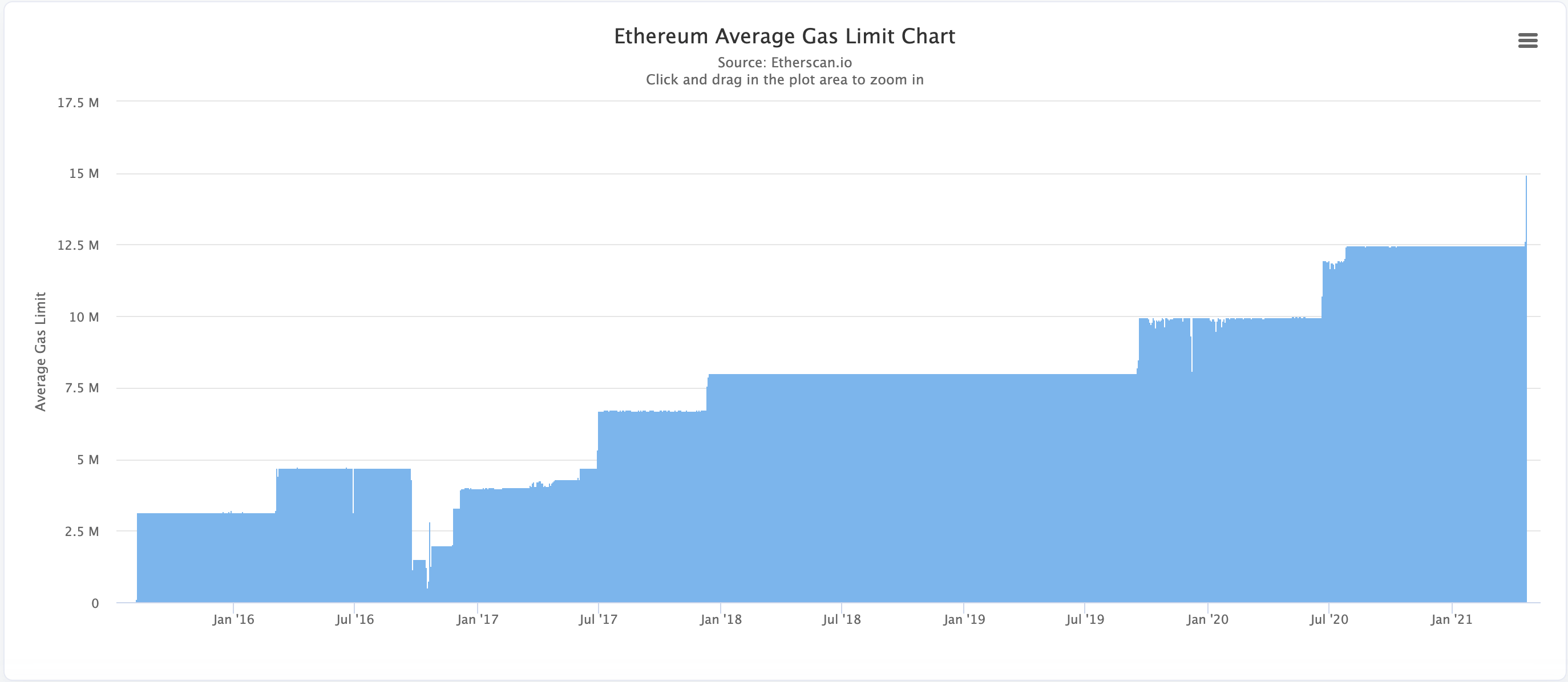

- This is the seventh time in history that Ether’s gas limit has been increased, as the utilization of the network rises with growing popularity around DeFi and NFTs.

The Ethereum network has been plagued with bottleneck scalability issues for the longest time due to increased usage. Given the nature of finite block space, miners have proposed to increase the gas limit to allow for more data to be included in each block.

Gas limit raised for the seventh time in history to reduce network congestion

Ethereum miners raised the gas limit to 15 million to relieve congestion as the network’s on-chain activity increased in tandem with Ether’s price.

Last week, Ethereum co-founder Vitalik Buterin suggested raising the network’s gas limit since recent code optimizations activated through the Berlin hard fork have made the chain safer.

Ethereum average gas limit

According to Buterin, increasing the gas limit on Ethereum makes every application cheaper.

Gas is the unit of which the amount of computational effort to execute operations, whether it be a transaction or smart contract. Miners are paid in an amount in Ether equivalent to the amount of gas it took to execute an operation.

The gas limit proposes a restriction to the amount of data and computational effort required by Ethereum miners to process a block on the network. Due to the influx of on-chain activity with the growing number of decentralized finance (DeFi), gas fees have been surging on Ethereum, with highs costing hundreds of dollars.

More data could be included in each block that is mined by increasing the gas limit, which could contain operations ranging from DeFi, transfers of Ether, smart contracts, or non-fungible tokens (NFTs).

Major mining pools, including Bitfly – the second largest Ethereum mining pool by hash rate – have indicated their intentions to raise the gas limit from 12.5 million to 15 million, citing the successful efficiency improvements from the Berlin hard fork.

Miners can collectively reach a consensus and slowly work towards moving the gas limit higher with each consecutive block. Ethereum’s protocol only allows the adjustment of block gas limits by 0.0976% from the previous block’s limit.

Earlier this month, DeFi’s total value locked reached an all-time high of $60 billion, suggesting that the industry is steadily growing. While high transaction fees and network congestion continue to be an issue, Ethereum 2.0, a parallel network, aims to provide solutions in the future.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.