Ethereum miner returns $21.5 million in transaction fees

- Decentralized exchange DeversiFi reports 7676 Ether was paid erroneously in a transaction on its platform.

- Miner of block 13307440 has confirmed that $21.5 million will be returned to the wallet that initiated the transaction.

- Traders in the community suggest "fixing high fees" as the exchange continues to investigate the cause of error.

A hardware wallet paid $22.5 million in Ether in a recent transaction on the Ethereum network. What happened next boosts the trust of the crypto community in trustless networks.

Miner confirms return of $21.5 million worth of Ether paid in excess

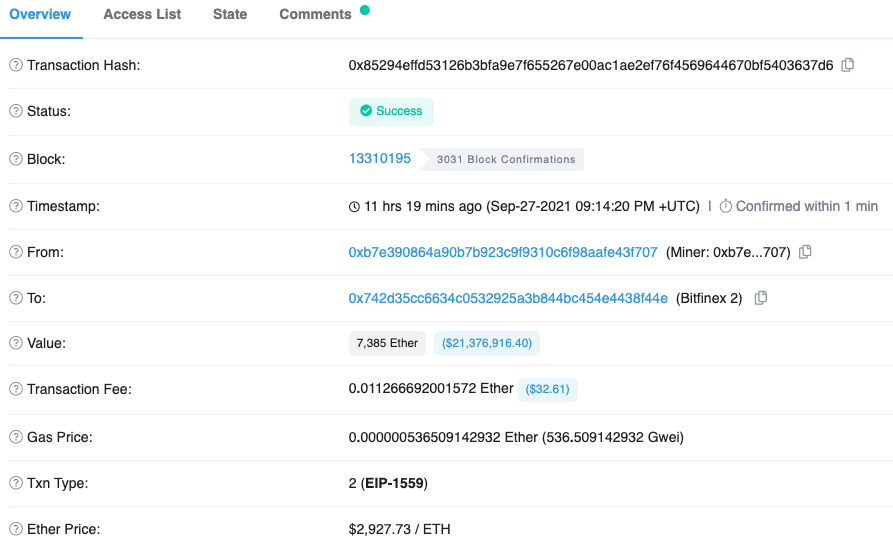

A hardware wallet deposited on the decentralized exchange DeversiFi's interface and paid an erroneously high gas fee on September 27 at 11:10 GMT. The platform stated that it has started investigating the cause and explained that it is an internal issue for the DEX – no customer funds were affected.

A deposit transaction made using DeversiFi with an erroneously high-gas fee.

Within 7 hours of the initial transaction, the miner returned 7385 Ether, worth $21.5 million, to the Bitfinex wallet that had paid excess fees in error.

Paolo Ardoino, CTO of Bitfinex and Tether, confirmed that no users were affected by the error in transaction fees, and the DEX involved in the transaction has assured involved parties. Furthermore, Ardoino stated that, in the worst-case scenario, Bitfinex would settle the issue with company funds.

No user will be affected. Deversifi already confirmed that they will take care of it. And worst case scenario Finex will take care of it with it's company funds.

— Paolo Ardoino (@paoloardoino) September 27, 2021

No user will be affected whatsoever.

Nevertheless, DeversiFi and Bitfinex did not have to resort to the worst-case scenario. Instead, the miner returned the funds in a single transaction to the wallet that initiated the transfer.

Miner returned 7385 Ether paid in error.

The transaction was processed in block 13307440, and the miner could have refused to return the funds since this was a non-hacking event. By returning 7385 Ether, the miner affirmed the trust of the crypto community in the trustless blockchain network.

The issue was identified as a fat-finger error, and a Bitfinex spokesperson stated that,

in transactions such as these, the fees are shouldered by third-party integrations with Bitfinex. DeversiFi has also confirmed this in their recent statement. We look forward to DeversiFi's investigation and to their having this matter sorted on their side.

While the issue was settled between the hardware wallet and the miner, the crypto community is debating whether burning transaction fees are a pro or con. Larry Cermak, director of research at The Block, explained that only 0.0001% of the $24 million fees was burnt, nearly $25.

The Avalanche network burns all transaction fees. Had this error been made on the Avalanche blockchain, the $24 million would have been burnt, and the miner would have failed to return anything at all.

For those that are making this mistake - not all fees on Ethereum are burnt. Only 0.0001% of the $24M fee was burnt so about $25

— Larry Cermak (@lawmaster) September 27, 2021

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.