The median price to send a transaction on the Ethereum blockchain has plummeted to a five-year low, with low-priority transactions dropping to around 1 gwei or lower as activity on layer-2 networks continues to climb.

Ethereum’s median gas fees fell to 1.9 gwei on Aug. 10, according to Dune Analytics data. It is the lowest level since mid-2019 and a nearly 98% drop from its 83.1 gwei year-to-date high in March.

Etherscan gas fee tracking data for Aug. 12 shows that low-priority Ethereum transactions — those sent in around 10 minutes — were priced at 1 gwei or about seven cents.

Source: DarrenSRS

Ethereum’s Dencun upgrade in March saw nine Ethereum Improvement Proposals (EIPs) go live, one of which introduced data blobs, or proto-danksharding, which aimed to decrease the transaction costs for layer-2 blockchains.

The Ethereum ecosystem has pinned its plans to scale on layer-2 blockchains, which can handle a higher number of transactions for cheaper by abstracting them away from the layer-1 Ethereum blockchain, though it still uses the L1 to verify the transactions took place.

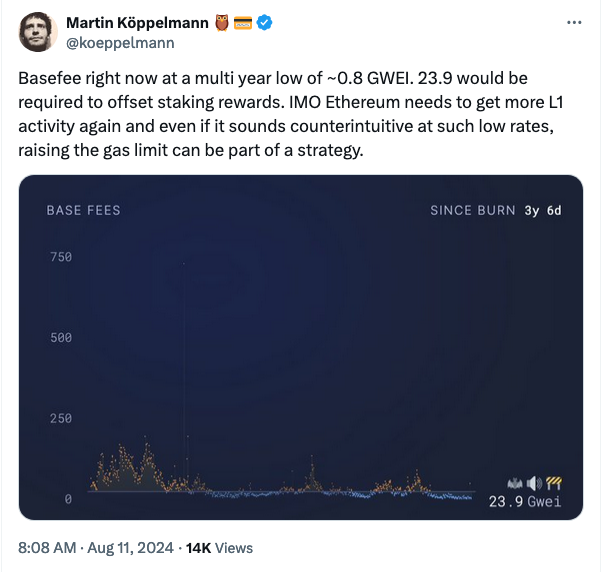

Commenting on the recent plunge in gas fees, Gnosis co-founder Martin Köppelmann posted to X on Aug. 10 that “Ethereum needs to get more L1 activity again.”

Köppelmann outlined his concern that gas fees of at least 23.9 gwei are needed to fund staking rewards, which are payouts given to those who help validate blockchain transactions.

Source: Martin Köppelmann

“Even if it sounds counterintuitive at such low rates, raising the gas limit can be part of a strategy,” he added.

Ethereum’s layer-2 activity has far outstripped the activity on the base blockchain, with L2Beat data showing Base had over 109 million transactions in the last 30 days compared to Ethereum’s 33 million.

Layer 2’s Artbitrum and Taiko saw an additional 97 million combined transactions over the last 30 days.

With fewer Ether (ETH $2,575) being used in transactions and as a payout to stakers, its supply has skyrocketed, with nearly 13,400 ETH worth $34.1 million added to its supply in the past seven days, according to data from ultra sound money.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Arbitrum, Aptos, Starkware, SAND lead $220 million token unlocks next week

Token unlocks data on Friday reveals that the crypto market will see $220 million worth of tokens entering circulation next week amid signs of recovery from the recent market crash.

$560 million Ethereum options expire amid weakening bearish momentum

Ethereum (ETH) is up 0.4% on Friday as ETH ETFs record another day of mild inflows. The recent market crash could also alter earlier predictions of the ETFs, boosting ETH to a new all-time around $5,000.

Key Bitcoin metrics to watch out for ahead of next week following market sell-off

Bitcoin could be set for an interesting week as it struggles to recover from its largest drawdown in the current cycle. This drawdown was sparked by fears of recession, geopolitical tension in the Middle East, and the Japanese yen carry trade.

Ripple set to begin testing stablecoin launch after ending case with SEC

Ripple revealed on Friday that it has begun beta testing for its RLUSD stablecoin, pending regulatory approval for its usage. Meanwhile, XRP has declined over 6% in the past 24 hours but could see a rally after the announcement.

Bitcoin: Can BTC bounce back from recent market crash?

Bitcoin (BTC) trades above $60,000 on Friday after a 7.2% decline and a dip below the $50,000 level earlier in the week, following a test of its daily support level at around $49,900 on Monday.