Ethereum long-term holders could play major role in ETH's price movement in coming weeks

- Ethereum long-term holders now own 78% of ETH's total supply.

- Spot Ethereum ETF issuers have begun marketing their products with a potential "tech play" move in the cards.

- Ethereum options data shows reduced volatility as ETH looks set to reach a new yearly high.

Ethereum (ETH) is down 2% on Friday following increased holdings among long-term holders and ETH ETF issuers launching marketing campaigns for their products. Meanwhile, ETH options data reveals key price dynamics that may see ETH reaching the $4,000 price level in the coming weeks.

Daily digest market movers: ETH long-term holders, ETH tech play

ETH long-term holders (LTHs) may play a major role in determining the direction of its price in the coming months. This is revealed in the ETH Balance by Time Held chart, which shows that 78% of ETH supply is held by LTHs, according to data from IntoTheBlock.

ETH Balance by Time Held

LTHs are typically interpreted as addresses that have held onto their tokens for over a year. Historically, heavy selling pressure from LTHs often signifies the peak of a bull cycle.

Considering that ETH LTHs' holdings are growing, ETH could still see considerable price growth in the current cycle.

As earlier reported, LTHs may be anticipating higher prices from the upcoming launch of spot Ethereum ETFs. This is unlike Bitcoin LTHs, which have continued to shed their holdings since the beginning of the year.

Meanwhile, spot ETH ETF issuers have stepped up their marketing efforts. Asset manager VanEck seems to be leaning toward the decentralized applications side of the top smart contract blockchain. In a recent tweet on X, VanEck said, "Ethereum is like an open-source app store."

This follows a series of marketing videos from Bitwise comparing Ethereum against "Big Finance." Bitwise’s Ryan Rasmussen stated that Ethereum may resonate more with Wall Street than Bitcoin. "Why? Well, most investors don't own gold. But almost every investor owns tech," he said.

Unlike Big Finance, Ethereum doesn't clock out at 4 p.m. pic.twitter.com/0gCJi3wlXp

— Bitwise (@BitwiseInvest) June 20, 2024

ETH technical analysis: Ethereum could reach a new yearly high following insights from key options data

Ethereum traded around $3,390 on Friday, down 2% in the past 24 hours. ETH has seen about $24.84 million in liquidations, with long liquidations accounting for 81% and shorts for 19%.

According to Greekslive data, over 1.04M ETH options expired on Friday with a Put/Call Ratio (PCR) of 0.59, a Max Pain point of $3,100 and a notional value of $3.6 billion.

Options are derivative instruments that give you the right to buy (call) or sell (put) an underlying asset based on predetermined prices at a specific date.

While many expected the options expiry to cause high volatility for ETH today, its price has remained relatively unchanged in the past 24 hours. This aligns with ETH's implied volatility (IV), which is at a low level, sitting below 60% for all major terms.

"It will be a cost-effective option to buy some call options while the IV is low," said Greekslive.

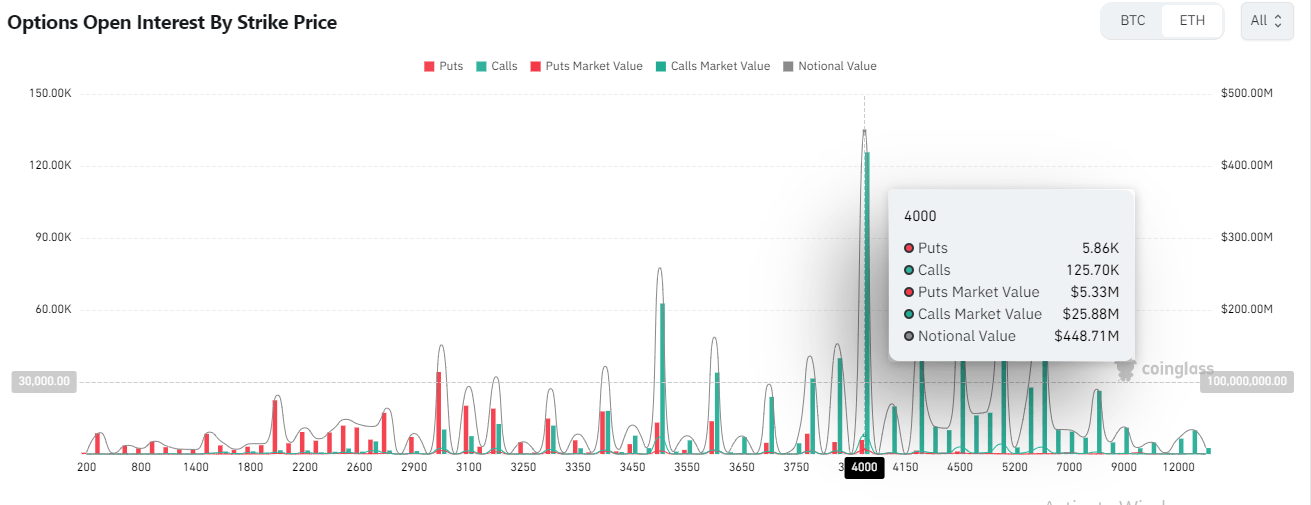

ETH Deribit Options Open Interest

Additionally, Deribit's exchange PCR has fallen to 0.27 from around 0.36 earlier in the month, according to data from Coinglass. This suggests most traders are bullish, especially with the potential launch of spot ETH ETFs. The $4,000 price level is key to watch out for as it's the strike price of over $420 million worth of calls on Deribit.

While ETH looks set to follow a horizontal trend over the weekend, it may begin to see gains as the spot ETH ETF news saturates the market.

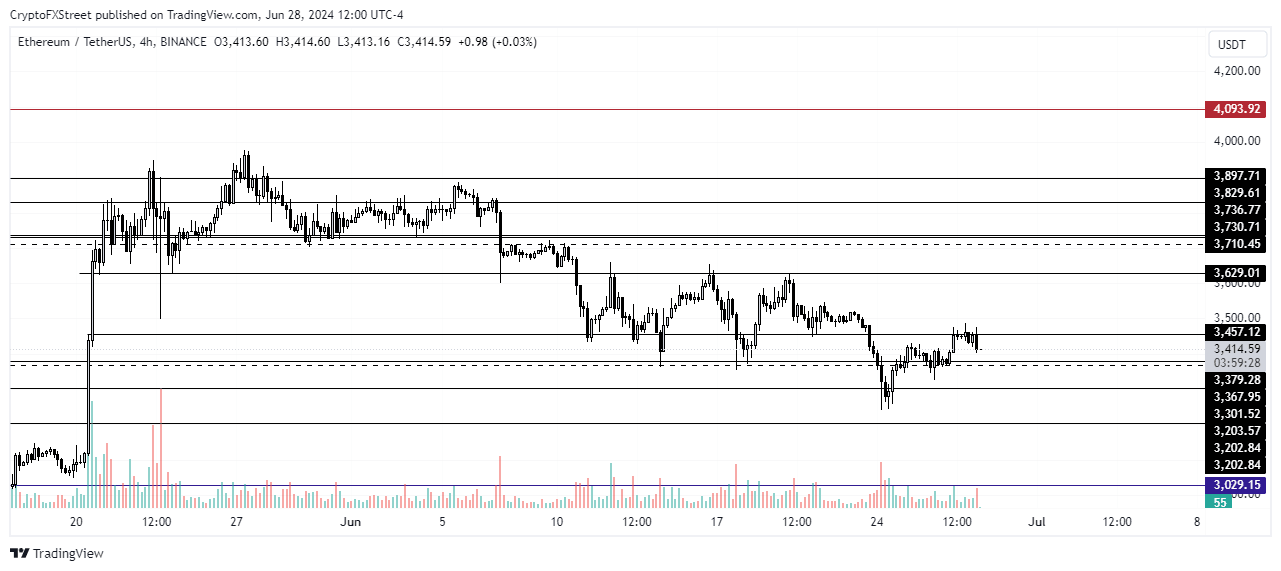

ETH/USDT 4-hour chart

ETH has to overcome the $3,629 resistance — a level it has failed to sustain a move above in the past three weeks — before it could see a further move up. A successful, sustained move above this level could see ETH rise more than 18% to test the resistance of $4,093 and potentially reach a new yearly high.

The $3,203 level may prove a crucial support for the bullish run. A breach below this level would invalidate the bullish thesis, potentially causing ETH to face a major correction.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi