Ethereum layer 2s to hit $1T market cap by 2030: Van Eck

Ethereum’s layer 2 scaling networks will hit a $1 trillion market capitalization in six years and will be made up of thousands of use case-specific chains, according to analysts from investment manager Van Eck.

Layer-2 blockchains are set to capitalize on Ethereum’s “primary challenge” — its “limited capacity to process, store, and compute data,” Van Eck’s senior digital assets investment analyst Patrick Bush and digital assets research head Matthew Sigel said in an April 3 report.

Busha and Sigel reached their $1 trillion market cap prediction by estimating Ethereum would take up 60% of the market share across all public blockchains and then estimating the volume of assets within the Ethereum ecosystem.

There are currently 46 Ethereum L2s with $39 billion total value locked, the largest being Arbirtum with $18 billion, according to L2BEAT.

“Ethereum’s dominance in smart contracts faces a critical hurdle: scalability,” the analysts wrote. “While the network offers unparalleled security and decentralization, transaction fees and processing times soar when usage intensifies.”

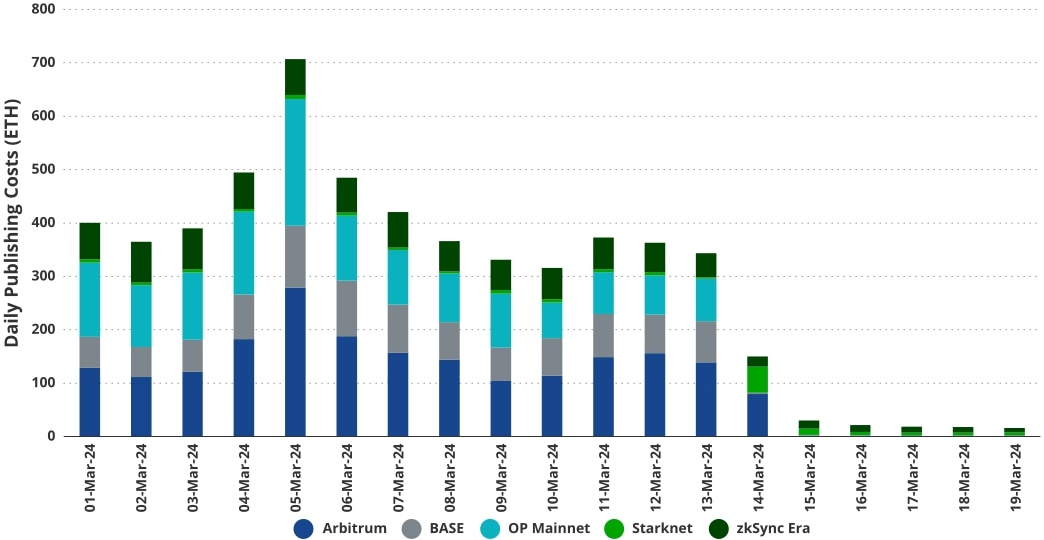

Ethereum’s development is now focused on bettering its ability to process its layer-2’s transaction data, they said — evident in its recent Dencun update which helped to lower L2 transaction fees through the specialized data-saving feature, “Blobs.”

Data publishing costs per L2 network to Ethereum in terms of Ether (ETH). Source: Van Eck

The analysts said there was future potential for “substantially more” revenues to be generated on L2s over the base Ethereum network.

We expect L2 revenues to exceed Ethereum’s because Ethereum cannot match the transaction throughput or user experience of L2s.

T “cutthroat competition,” however, left Bush and Sigel “generally bearish” on the long-term value for a majority of L2-related tokens.

They noted the top seven Ethereum L2 tokens already have a $40 billion fully diluted valuation and “many strong projects” launching over the next 18 months will swell that to $100 billion.

“It seems a bridge too far for the crypto market to absorb even limited amounts of that supply without massive discounts,” they added.

The analysts forecasted a “future of thousands of use-case-specific” L2s with just “a few major players” part of the general-purpose L2 market.

These thousands of use-specific networks would be “segmented by sector, application, or function” with some chains built for a specific purpose, like a decentralized social media-specific L2 with accompanying apps.

The handful of general-purpose chains will be due to the network effect — where those blockchains become more valuable because there are more users, the analysts said.

“It is also clear that most roll-ups will eventually move towards the zero-knowledge framework (ZKU) due to its many advantages,” they added.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.