Ethereum Layer 2 tokens rally as mainstream cryptocurrencies crumble under SEC’s regulatory crackdown

- Ethereum Layer 2 tokens Optimism, Arbitrum and ImmutableX started price rallies in response to the SEC’s regulatory crackdown.

- Optimism completed its Bedrock hard fork earlier today, reducing the Layer 2 solution’s gas fees by 40%.

- OP, ARB and IMX prices yielded between 3% and 6% gains for holders since Tuesday.

Ethereum struggled to erase losses from the SEC’s enforcement action on two of the largest crypto exchanges in the ecosystem, Binance and Coinbase. The altcoin’s price climbed back above the key $1,800 level; ETH is trading at $1,877 at the time of writing.

While mainstream cryptocurrencies took a hit after the US financial regulator’s actions, Layer 2 tokens, Optimism (OP), Arbitrum (ARB) and Immutable X (IMX) yielded gains for holders. The price rallies in Layer 2 tokens are likely a spillover effect of decentralized exchanges’ popularity after the legal woes faced by Binance and Coinbase.

Also read: US SEC sues Coinbase a day after move against Binance

Ethereum Layer 2 tokens OP, ARB and IMX begin price rallies

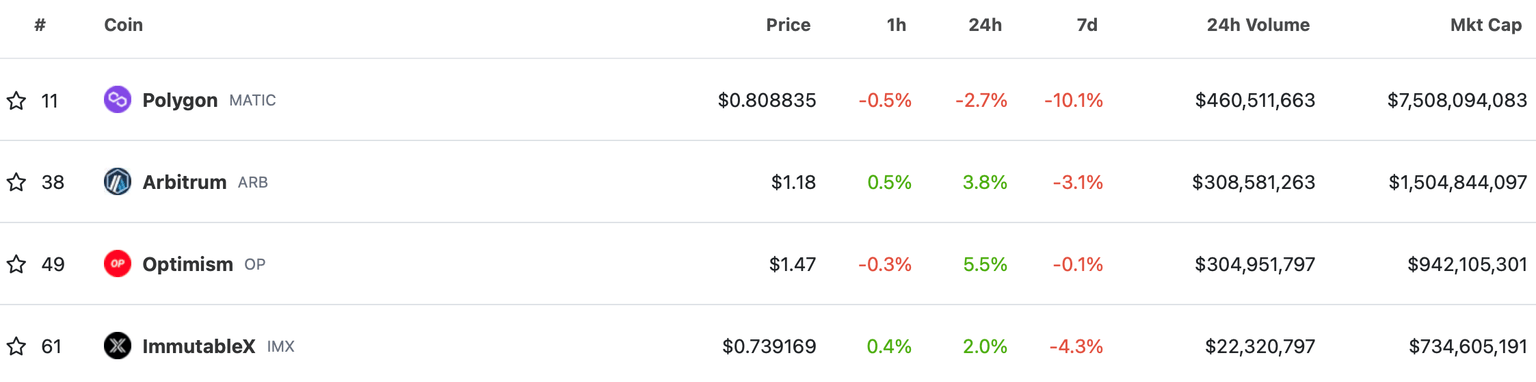

Large market capitalization cryptocurrencies crumbled under selling pressure from the SEC’s actions while Layer 2 scaling solutions started to rally instead. OP, ARB and IMX prices rallied 5.5%, 3.8% and 2.0% respectively.

Ethereum Layer 2 tokens

There are two key catalysts driving the prices of Layer 2 tokens. The first is the rising popularity of decentralized exchanges. In the light of centralized exchanges crumbling under regulatory pressure from the SEC, DEXes have gained popularity and relevance since Monday. DEX markets and trading on decentralized platforms is likely fueling a rally in tokens like OP, ARB and IMX.

The second bullish catalyst is the technical updates in OP and ARB ecosystems.

Optimism completes Bedrock hard fork, Arbitrum to open vote for budget proposal

OP mainnet migrated to Bedrock and the move was completed successfully earlier today. The upgrade is known as Bedrock hard fork and it cuts deposit-confirmation time from 10 minutes to 1 minute, and lowers gas fees by 40%.

✅OP Mainnet’s migration to Bedrock has concluded and the Bedrock sequencer has started up.

— Optimism (✨_✨) (@optimismFND) June 6, 2023

Key external OP Mainnet infrastructure is starting to come back online. You can track infrastructure status here:https://t.co/XTtaArdI03

The hard fork marks a key technical milestone for Optimism.

The Arbitrum community is gearing up to hold the Arbitrum Improvement Proposal (AIP) voting on June 9. The ARB network published the proposal draft on June 6 and it has three elements: a lockup, budget, and transparency reporting regarding the 7.5% of the ARB tokens distributed to the Foundation's "Administrative Budget Wallet."

Find out more about it here.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.