Ethereum Layer 2 Optimism beats MATIC to the curb, sees massive spike in active addresses

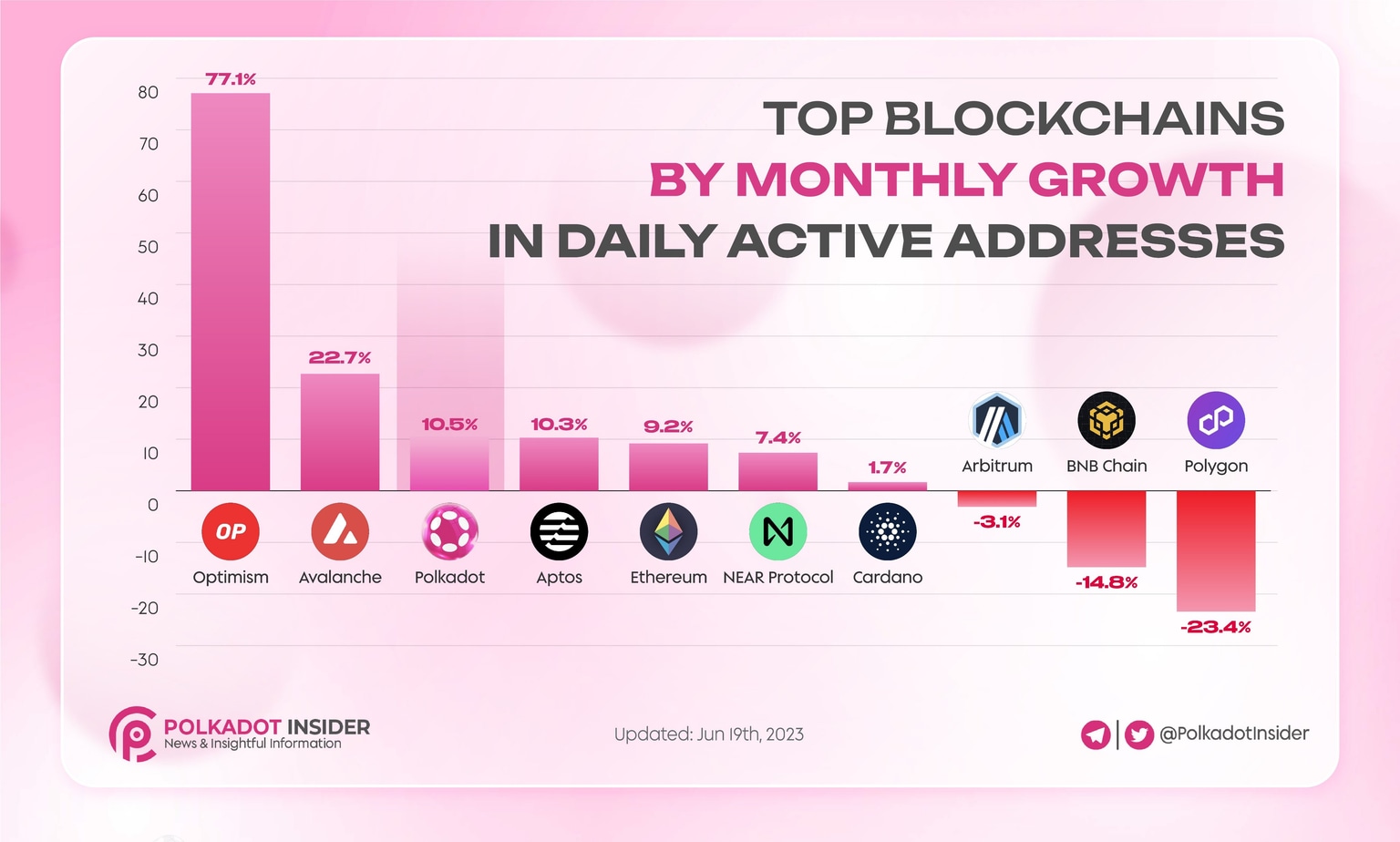

- Optimism registered a 77% growth in daily active users over the past month, while competitor Polygon noted a decline of 23%.

- OP price started a recovery in response to the Bedrock upgrade and rising adoption.

- MATIC price is struggling to wipe out its losses since the US SEC labeled the token as a security.

The competition among Ethereum Layer 2 scaling solutions has intensified after the US Securities and Exchange Commission’s (SEC) crackdown. Polygon network’s MATIC was the largest Layer 2 scaling solution before the SEC labeled the token as a “security.”

Crypto intelligence trackers have recorded a decline in daily user activity on the MATIC network, while Optimism (OP) observed a significant increase. This signals OP is likely dethroning MATIC in terms of daily activity and user adoption.

Also read: Cardano, MATIC and Solana attempt to recover amidst exchange delisting and SEC crackdown

Optimism dethrones MATIC in daily user activity

Based on data from Polkadot Insider, a tracker for crypto activity of several projects, Optimism added 77.1% new daily active users over the past month. In the same timeframe, MATIC suffered a loss of 23.4% daily active users.

Growth in daily active addresses across several blockchains

The declining activity on the MATIC network can be attributed to the Securities and Exchange Commission’s labeling the asset as a security. Since MATIC was tagged as a security, the token suffered delisting from social trading platforms like eToro and exchanges like Robinhood.

During the same time, Optimism released a key technical development, the Bedrock update. The Bedrock upgrade cut deposit confirmation times by 90%, fueling a bullish sentiment among OP users and driving the token’s adoption.

Over the past 30 days, MATIC and OP prices declined nearly 30%. However, Optimism beats MATIC in user activity, signaling a faster recovery in the Layer 2 token rather than Polygon.

Since Monday, OP price has rallied over 6% while MATIC has failed to score gains in the same timeframe.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.