Ethereum killer Cardano rolls out version 8.1.1, likely to catalyze ADA price recovery

- Cardano blockchain’s developers have rolled out the latest version of Node 8.1.1, on June 20.

- The release of the latest node version demonstrates the Cardano community’s commitment to improving its blockchain despite the SEC crackdown.

- ADA price recovery is likely to be catalyzed by the technical development update in the short term.

Cardano (ADA), one of the largest competitors of the Ethereum network, was recently labeled a “security” by the US Securities and Exchange Commission (SEC). The SEC’s crackdown resulted in a steep decline in ADA price, and the altcoin has been struggling to wipe out its losses since June 5.

The Ethereum killer blockchain’s community of developers has released a new version of Node 8.1.1 on the mainnet and invited Staking Pool Operators (SPOs) to upgrade to the release. This development is likely to fuel a recovery in ADA price.

Also read: Cardano, MATIC and Solana attempt to recover amidst exchange delisting and SEC crackdown

Cardano developers release Node version 8.1.1 on the mainnet

Early on June 20, Cardano developers launched Node version 8.1.1 on the ADA blockchain’s mainnet. According to the Github release, the upgrade is mainnet-ready and has significant improvements over the previous version. Developers have strongly urged all SPOs to update to 8.1.1.

The update has been marked as a minor release and fixes previously identified issues for peer-to-peer technologies- running on the Cardano blockchain.

Richard McCrackn is a well-known figure in the Cardano community who tweeted details of the new release to his 60,300 followers. McCrackn broke down the details of the technical update and notes that version 8.1.1 is a significant improvement over 8.0.0. It contains performance upgrades and corrects previously identified concerns.

Cardano SPOs 8.1.1 has been released for mainnet!

— Rick McCracken DIGI (@RichardMcCrackn) June 19, 2023

This update improves node performance at the epoch boundary and corrects previous concerns with P2P/DNS.

It also contains all the performance improvements from 8.0.0. Let's rock and roll! #Cardanohttps://t.co/Bo0ZyXMXRR

Despite the SEC’s regulatory crackdown on Cardano, the community of developers are busy building and improving the competing blockchain. This signals confidence in the developer community, and technical updates typically act as catalysts for the token’s recovery in the short term.

ADA price recovery could be catalyzed by version 8.1.1 release

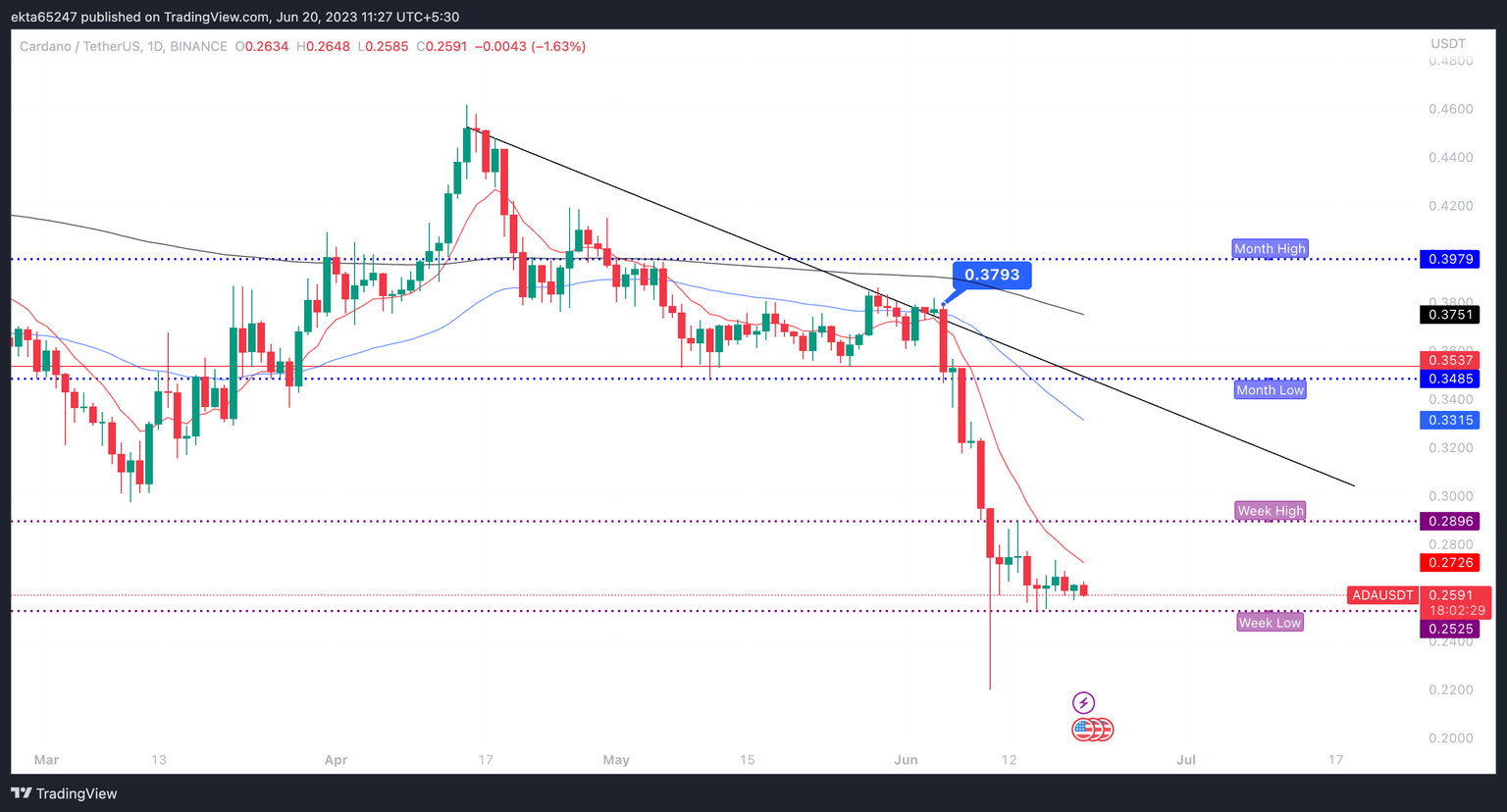

ADA price declined from $0.3793 on June 5 to $0.2591 on Binance at the time of writing. ADA price dropped by 31.7% between June 5 and June 20, a steep decline for the Ethereum killer token.

While Cardano price eyes recovery, technical updates to the ADA blockchain are likely to act as a catalyst. The recent rollout of a new version of the Node could fuel a recovery in the altcoin. The closest resistance for ADA price is the 10-day Exponential Moving Average (EMA) at $0.2726.

ADA/USDT one-day price chart from Binance

Once the ADA price begins its recovery, the $0.3537 level that acted as support throughout May is the next target for the altcoin.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.