Ethereum-killer Cardano might crash 20% as ADA revisits a support level twice

- Cardano price failed to sustain its uptrend, resulting in a 37% correction over the past month.

- ADA could crash 20% to $0.80 if the $1 psychological level fails to hold up.

- A daily candlestick close above the 50-day SMA at $1.20 will be the start of a potential upswing.

Cardano price has been on a downswing for the past month and has revisited a crucial support level twice in this range. A breakdown of this barrier could lead to a steep correction to levels last seen a year ago.

Cardano price faces a decisive moment

Cardano price set up a higher high at $1.64, coinciding with the 100-day Simple Moving Average (SMA) on January 18. Since then, ADA has been on a downtrend and revisited the $1 level twice in the past month.

As the so-called “Ethereum killer” tags the $1 barrier again, the possibility of a breakdown increases. Moreover, a double bottom and a sell-side liquidity zone at $0.803 make it more appealing for market makers to knock the altcoin lower.

Therefore, investors need to exercise caution and be prepared for a downswing. In an optimistic scenario, a resurgence of buyers could see Cardano price hold its ground around the $1 support level and consolidate before rethinking the directional bias.

ADA/USDT 1-day chart

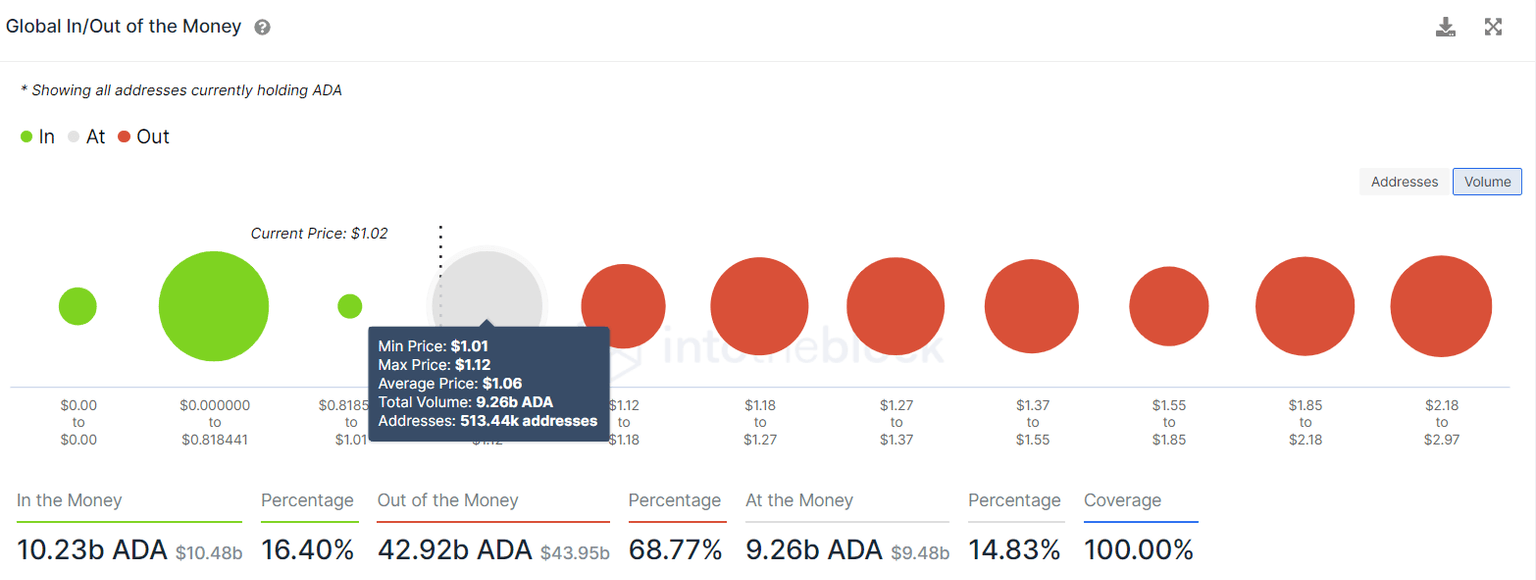

Further depicting the grim nature of Cardano price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This on-chain index suggests that failing to hold above a significant support level at $1 could see ADA revisit the support cluster at $0.90, where roughly 53,070 addresses purchased 452.53 million tokens. This level is relatively weak and is likely to be breached quickly should the price ever revisit this area.

ADA GIOM

This reduction in the number of large transactions worth $100,000 or more from 3,620 to 2,050 aligns perfectly with the recent downswing in Cardano price. The 43% slump suggests that high networth investors are losing interest in Cardano at the current price levels.

ADA large transactions

While things look grim for Cardano price, a bounce off the $1 barrier could trigger a massive uptrend if buyers band together. If this upswing pushes ADA to produce a daily candlestick close above $1.20 or the 50-day SMA, it will signal the potential start of an uptrend.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.