- Ethereum ETF inflows and positive funding rates could help maintain bullish momentum.

- Investors need to be cautious of ETH's rising exchange reserve.

- Ethereum could retest the $2,707 resistance after bouncing off the 50-day SMA.

Ethereum (ETH) traded around $2,640 on Thursday, up more than 2% following increased bullish bias among investors, as evidenced by ETH ETF net inflows and an uptrend in funding rates. However, investors may be wary of a potential correction from ETH's rising exchange reserve.

Ethereum ETF inflows and positive funding rates paint bullish outlook

Ethereum ETFs recorded net inflows of $43.2 million on Wednesday, bringing their total inflows within the past two days to over $105 million. BlackRock's ETHA and Grayscale Mini Ethereum Trust were largely responsible for the positive flows, with inflows of $9.4 million and $26.6 million, respectively.

The high inflows follow renewed investor interest in Ethereum since the US Federal Reserve (Fed) decision to cut rates by 50 basis points (bps) on September 18.

Several investors have earlier predicted that ETH ETFs' underperformance was due to their launch during the summer holiday season. As investors return from the holiday and a historically positive Q4 season approaches, ETH ETFs may begin to record more inflows — especially if Grayscale's ETHE exodus cools.

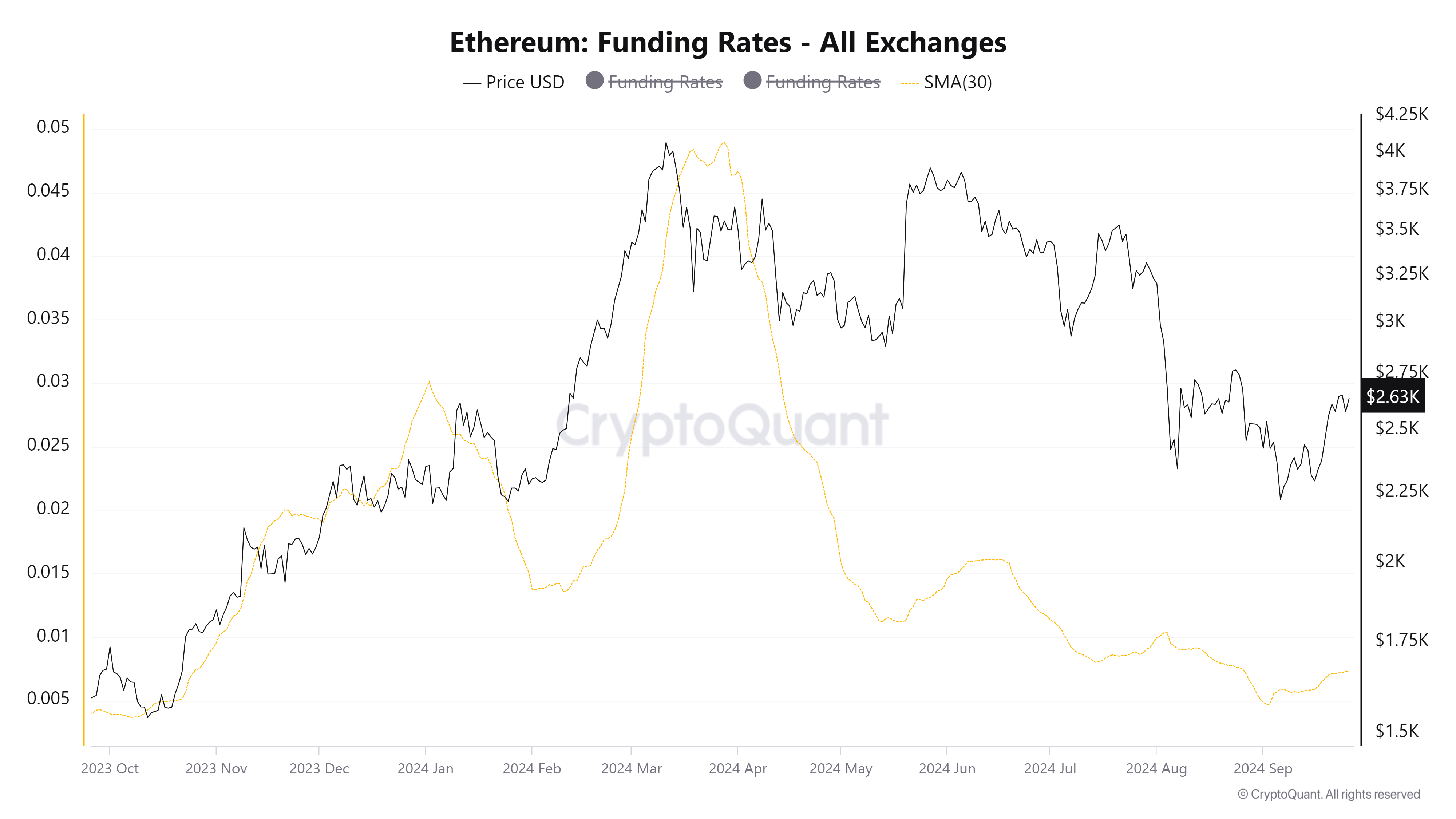

The bullish outlook is supported by a shift to an uptrend in Ethereum's 30-day simple moving average (SMA) funding rate.

Funding rates are periodic payments between perpetual traders to maintain parity between an asset's spot price and futures contracts. A positive funding rate indicates long positions are dominant in the market, while vice versa for a negative funding rate.

Ethereum Exchange Funding Rates

Since reaching a low on September 3, the funding rate 30-day SMA has been rising, indicating growing bullish sentiment among traders.

However, investors need to be cautious of ETH's rising exchange reserve, which has taken a slightly upward turn in the past month. Rising exchange reserves could lead to increased selling pressure and a subsequent price decline.

Ethereum Exchange Reserve

Ethereum finds support around 50-day SMA

Ethereum traded around $2,640 on Thursday, up 2.6% on the day. In the past 24 hours, ETH has recorded over $21 million in liquidations, with long and short liquidations accounting for $7.47 million and $13.97 million, respectively.

On the 4-hour chart, Ethereum reclaimed the $2,595 support after bouncing off the 50-day SMA. If the bullish momentum continues, ETH could rally to test the $2,707 resistance. A successful move above this level could see ETH aim to reclaim the $2,817 price level, which held as a key support level for over four months.

The Relative Strength Index (RSI) and Stochastic Oscillator momentum indicators are above their neutral levels, indicating a bullish bias.

ETH/USDT 4-hour chart

On the downside, if ETH breaks the $2,595 level, the 50-day, 100-day and 200-day SMAs could provide support to prices. A daily candlestick close below $2,395 will spark heavy bearish momentum for ETH.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP Price Prediction: Bearish technicals, on-chain indicators signal 68% potential crash

XRP faces increasing bearish sentiment from macro, micro and fundamental factors in April. Weak on-chain indicators ranging from network growth, total supply and active addresses reinforce an impending crash.

Bitcoin Price Forecast: Tariff volatility sweeps over $200 billion from crypto markets

Bitcoin price hovers around $83,000 on Thursday after it failed to close above the $85,000 resistance level the previous day. Volatility fueled by Trump’s tariffs swept $200 billion from total market capitalization, liquidating over $178 million in BTC.

SOL is the winner as Solana chain turns into battleground for meme coin launchpad and DEX

Solana (SOL) gains nearly 2% in the last 24 hours and trades at 118.28 at the time of writing on Thursday. A Decentralized Exchange (DEX) and a meme coin launchpad built on the Solana blockchain have waged a war for users and compete for the trade volume on the chain.

Shibarium, built for the Shiba Inu blockchain, reaches 1 billion in transactions in 18 months after its launch

Shibarium, a Layer-2 blockchain for the Shiba Inu ecosystem, reaches 1 billion transactions 18 months after its launch. This milestone reflects growing adoption and Shibarium’s robust performance.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

-638629890478766641.png)