- Ethereum outlook among investors has turned negative based on data from Santiment.

- There is a spike in inflow of Ethereum to exchanges, increasing the selling pressure.

- Analysts believe Ethereum remains at risk of decline, as the altcoin posts nearly 10% losses overnight.

Ahead of Ethereum’s transition to proof-of-stake, there is a spike in ETH inflow to exchanges. As Ethereum piles up across exchange wallets, analysts note a shift in sentiment among traders.

Also read: Ethereum is dirt cheap ahead of the Merge, claims analyst

Ethereum supply on exchanges climbs steadily

In the weeks leading up to Ethereum’s transition from proof-of-work to proof-of-stake, the altcoin’s supply on exchanges has climbed steadily. 13.78% of Ethereum’s total supply is on exchanges based on data from crypto intelligence platform Santiment.

The steadily climbing supply is indicative of an increase in selling pressure on exchanges. With higher Ethereum reserves on exchanges, more ETH is available to sell, putting the altcoin’s price at risk of decline.

Ethereum supply on exchanges

Sentiment on Ethereum turns negative

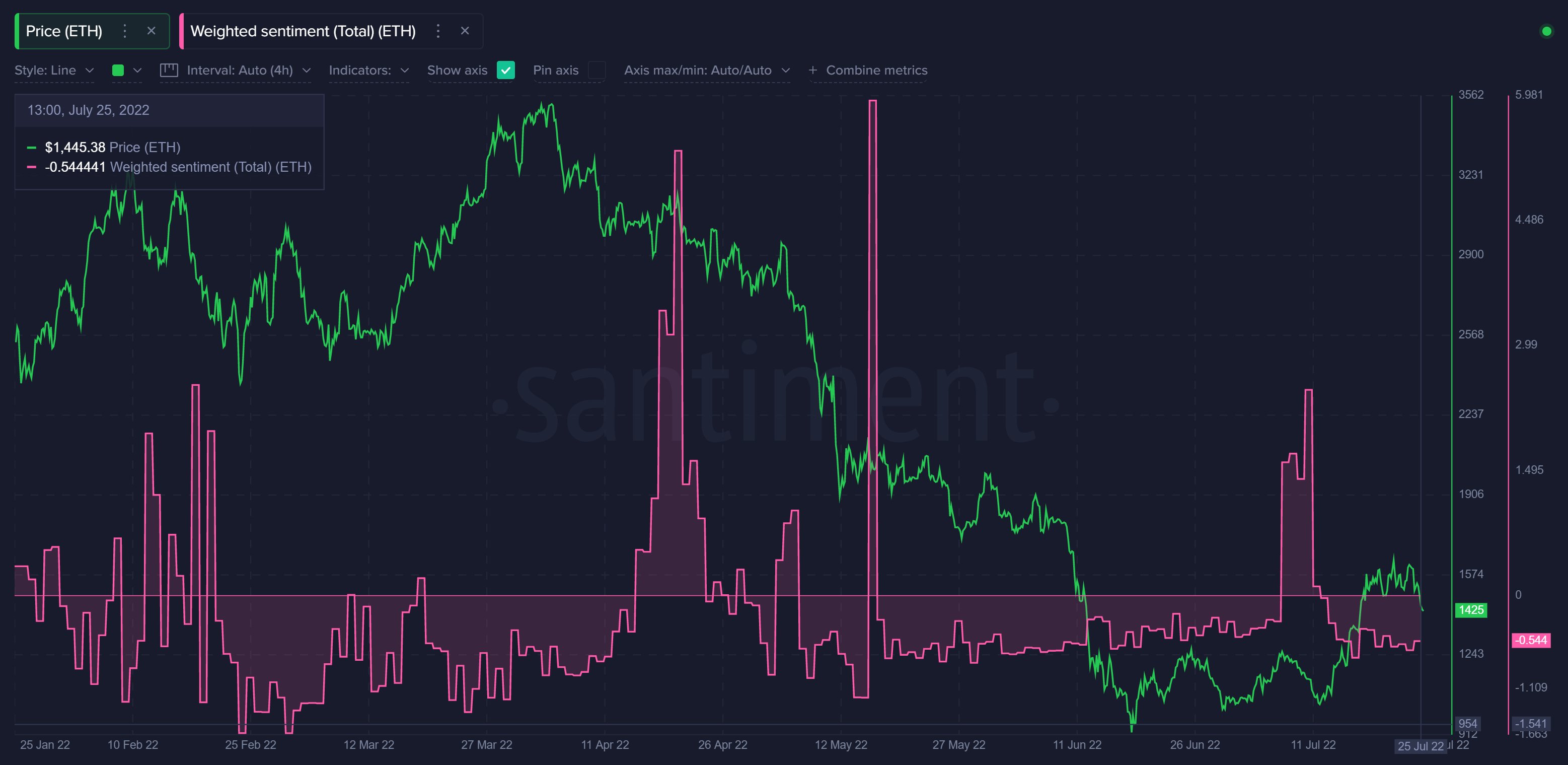

Based on data from Santiment, weighted social sentiment, a metric that combines the positive/negative commentary, and multiplies by the amount of social volume has turned negative. Typically when weighted social sentiment gets too high, it coincides with a price top and when sentiment is negative it coincides with a bottom.

The weighted social sentiment of Ethereum dropped to -0.54, indicating a shift in sentiment from positive to negative, in the weeks leading up to the merge.

Weighted social sentiment

Analysts predict decline in Ethereum price

PostyXBT, a leading crypto analyst, identified that Ethereum’s structure has broken down. The analyst argued that 'bounces are for shorting' vibes are back. Ethereum’s market structure and price trend has changed, and the overall outlook is bearish.

ETH Perpetual Futures Contracts

McKenna, a crypto analyst and trader argues that Ethereum is poised for a liquidity grab once the altcoin plummets below $1,460. FXStreet analysts believe that Ethereum could plummet to $1,284 in order to collect liquidity. For more information and specific conditions, check the video below:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.