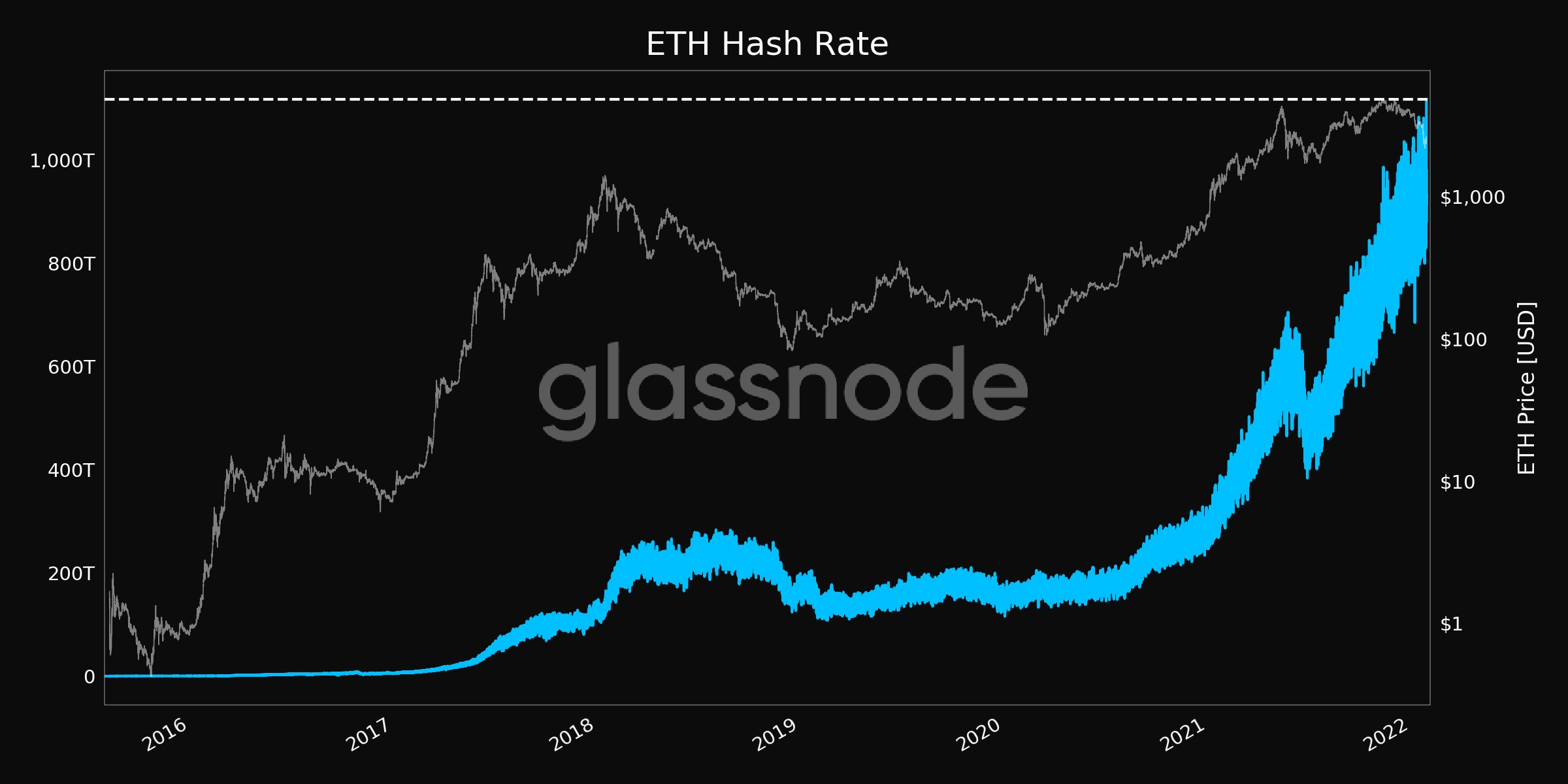

Over the previous year, Ether (ETH) has increased in value to the point that it significantly outperformed Bitcoin (BTC) in terms of returns. The rise of Ethereum has made mining on its network more lucrative over time. This appears to have resulted in additional miners, resulting in an expansion of the network's hash rate.

The hash rate for Ethereum has hit a new high, approaching record levels of 1.11 PH/s according to data from Glassnodes on Jan. 27. The previous ATH was reached previously on Jan. 13, when the ETH price fell from $4,460 to $3,160.

Source: Glassnodes

When the hash rate rises, it indicates that more nodes are joining the network, and the network is becoming more decentralized. As a result, such an increase helps to cement blockchain security. However, if the hash rate is too low, it may be detrimental to the network since there would be fewer nodes, resulting in slow transactions and less security.

In December 2021, Ethereum network participants implemented the Arrow Glacier upgrade, which pushed back the switch to proof of stake consensus. It also means that Ethereum mining has a long way to go before it comes to an end. A transition from the proof of work (PoW) algorithm to the Proof of Stake (PoS) algorithm is required before reaching ETH2, which is referred to as The Merge. At that moment, the difficulty bomb will go off, essentially shutting down ETH mining and putting the network into an "ice age" that lasts until the switch is completed.

After the switch to proof-of-stake, however, ETH will no longer be mined; instead, transactions will be validated by staking on special nodes.

Presently, the network's hash rate has increased past one petahash. The number is equivalent to around 1,000 TH/s and indicates that the network's hash rate has risen more than 66,000% since March 2016, when it began being recorded on the network.

As reported by Cointelegraph, the Ethereum Foundation criticized the branding of Eth2, saying it did not adequately reflect what was going on with the network during its round of upgrades. "ETH2" and the terminology used to distinguish a proof-of-stake chain from a proof-of-work chain may be phased out in the near future, according to the post.

Among the reasons for the shift are a bad mental model for first-time users, scam prevention, inclusion, and stake clarity. The switch from a PoW to a PoS consensus mechanism is scheduled to occur in the second or third quarter of this year.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Crypto Today: BNB, OKB, BGB tokens rally as BTC, Shiba Inu and Chainlink lead market rebound

Cryptocurrencies sector rose by 0.13% in early European trading on Friday, adding $352 million in aggregate valuation. With BNB, OKB and BGB attracting demand amid intense market volatility, the exchange-based native tokens sector added $1.9 billion.

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US SEC is considering declaring XRP as a commodity in the ongoing settlement talks with Ripple Labs. FOX News reports suggest Ethereum's regulatory status remains a key reference for XRP’s litigation verdict.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: BTC at risk of $75,000 reversal as Trump’s trade war overshadows US easing inflation

Bitcoin price remained constrained within a tight 8% channel between $76,000 and $84,472 this week. With conflicting market catalysts preventing prolonged directional swings, here are key factors that moved BTC prices this week, as well as key indicators to watch in the weeks ahead.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.