Ethereum gas fees drop to lowest levels since August 2021

Gas fees for transactions on the Ethereum (ETH) blockchain have dropped to the lowest levels since August. But they’re still not cheap.

According to data sourced from Coinmetrics and shared by CryptoRank Platform, the seven-day moving average cost of an Ethereum transaction as of March 9 totaled $11.14, placing it back amongst the levels recorded mid-last year before it surged dramatically to as high as $55 at the tail end of 2021.

At the time of writing there appears to be minimal network congestion, with Etherscan data estimating gas fees to cost around 30 Gwei ($1.53) for a low-speed confirmation to 32 Gwei ($1.64) for a high-speed confirmation.

Ycharts data also shows that the average gas price of Ether has been dropping rapidly since the start of the year, plunging all the way from 218 Gwei on Jan.10 to 40.82 Gwei as on yesterday.

Amid booming growth of Ethereum’s nonfungible token (NFT) and decentralized finance (DeFi) sectors in 2021, the network has come under fire on multiple occasions for its outrageously expensive gas fees.

Lower congestion and lower fees appear correlated with waning speculation or interest in NFTs and DeFi during the start of this year compared to late 2021. I

n terms of the last 30 days, DappRadar data shows that nine out the 10 top marketplaces on Ethereum have seen decreased trading volume, with first-placed LooksRare and second-placed OpenSea both shedding 78.27% and 34.75% apiece. Other notable losses include SuperRare and Rarible with 73.29% and 80.65% each.

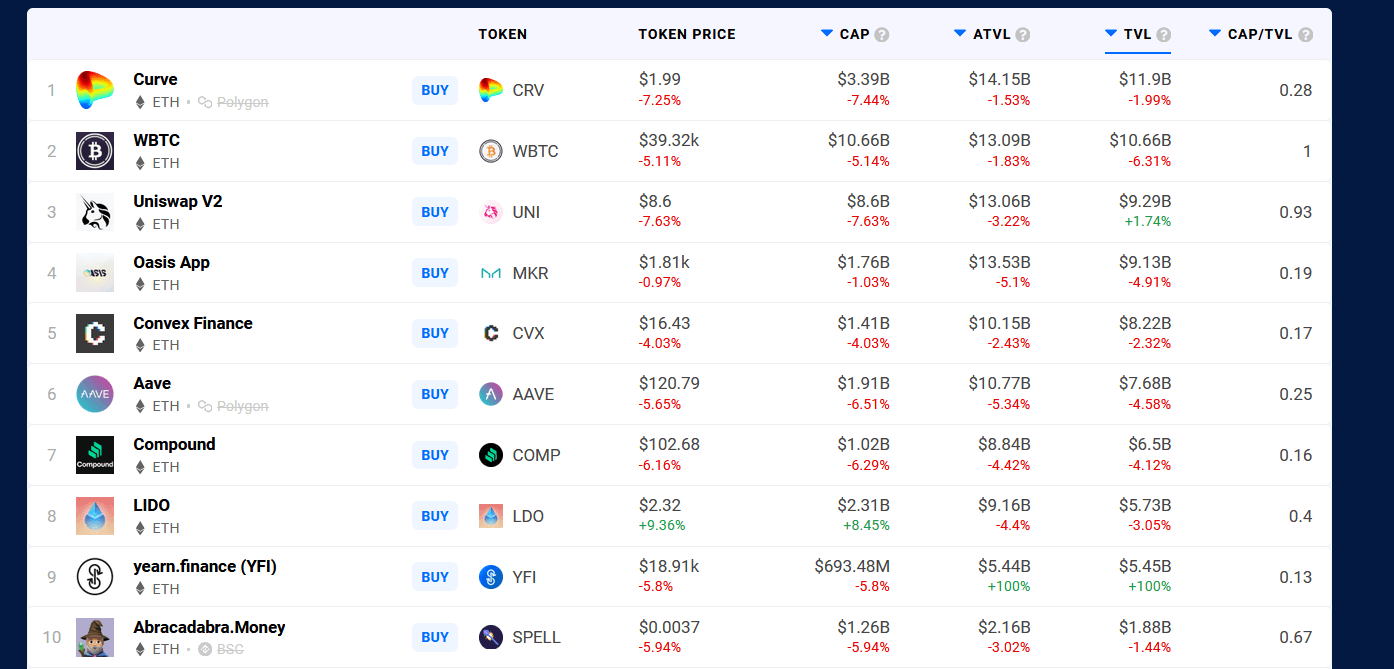

Ethereum-based DeFi too is also suffering too, with eight out of the top 10 projects in all-seeing red over the past month in terms of total value locked (TVL) and native asset token price.

DeFi project TVL losses: DappRadar

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.