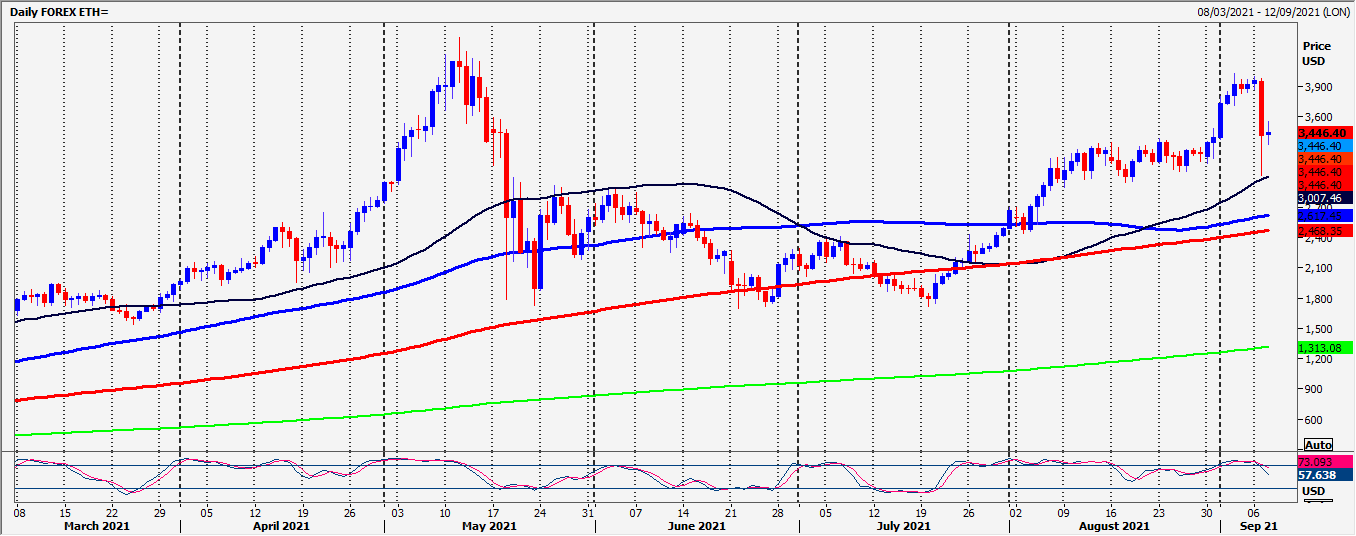

Ethereum first resistance at 3480/3500

Bitcoin unexpectedly crashed back below support at 50500/50000 & our buying opportunity at 46400/46000.

A surprise 10000 pip crashed (20%) leaves a dramatic bull trap, with longs from the last 20 days potential facing losses.

Ripple unexpectedly crashed back to 2 week lows wiping out 40% of the 6 week gains.

Ethereum unexpectedly crashed back to 4 week lows wiping out 40% of the 6 week gains.

Daily analysis

Bitcoin massive bearish engulfing candle on the daily & weekly chart signal further potential losses. A classic bull trap. Holding below 47500/47000 targets 46000. Holding below the 200 day moving average at 46000 today is more negative targeting 45300/100, perhaps as far as 44300/44000. Further losses retest yesterday’s low at 43000/42900 but I would not gamble on this holding again today. A break lower targets only minor support at 41500/100. A break below 40000 is the next sell signal.

Holding above the 200 day moving average at 46000 gives some short term hope to bulls but there are likely to be a lot of longs in shock looking for an exit to minimise losses. First resistance at 47200/400. We should struggle to beat this level but further gains meet resistance at 49000/500.

Ripple also has an important bearish engulfing candle (although less severe than Bitcoin). Longs from the last week potential facing losses. Holding below 11170/11340 risks a retest of yesterday’s low at 10550/10250. There is a good chance this will not hold today. Further losses target 9700/9650. If we continue lower look for 9050/30, perhaps as far as strong support at 8600/8550.

Bulls need prices above 11750 but expect strong resistance at 12000/12100 & again at 12550/12650.

Ethereum first resistance at 3480/3500. Holding here tests first support at 3410/00. Below 3350/20 signals further losses to 3270/50, perhaps as far as second support at 3150/3050. A break below 3000 should be a sell signal initially targeting 2890/50. Expect strong support at 2650/2600 but longs need stops below 2500.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk