Ethereum falters as it faces supply inflation and whale offloading pressure

- Ethereum's token supply has increased by nearly 10,000 ETH within the past week, signaling a lower burn rate.

- Ethereum's price continued to decline on Tuesday amid the broader weakness in the altcoin space.

- The Ethereum Foundation executed a sale of 1,700 ETH pressuring the price further.

Ethereum is in the middle of a weak altcoin market while facing challenges of supply inflation and selling pressure from whales or large investors. Ethereum Foundation converted ETH worth $2.74 million into USDC on Monday.

Ethereum's supply grows amid broader market weakness

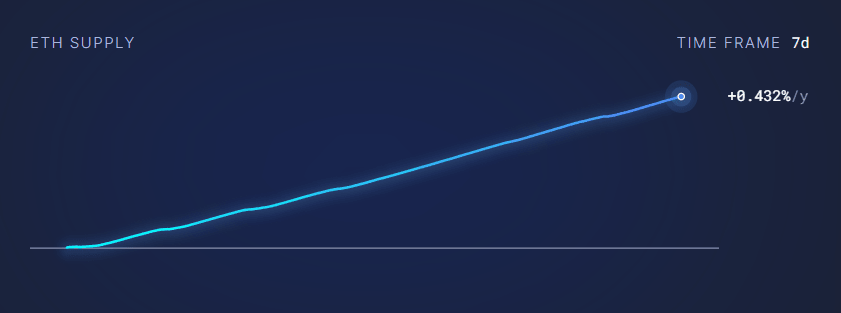

Ethereum, the second-largest cryptocurrency by market capitalization, has facing inflationary pressure in the last seven days. Data from ultrasound.money reveal that token supply in the week increased by nearly 10,000 ETH, equivalent to an annual supply inflation rate of 0.43%.

This surge in supply follows the burning of approximately 6,140 ETH, against the issuance of 16,100 ETH during this timeframe.

ETH supply in 7-day period

The dwindling burn rate has contributed to the expanding supply, exerting inflationary pressure on Ethereum's price.

At the time of writing, Ethereum (ETH) is trading at around $1,570, boasting a 24-hour trading volume of $9.6 billion, according to CoinGecko data. Over the last 24 hours, Ethereum has experienced a modest 1% decline, while its value has depreciated by nearly 5% in the past seven days.

However, supply inflation isn't the sole factor affecting Ethereum's price. The broader weakness in the altcoin market is casting a shadow over the Layer 1 king. Investor sentiment had already been tepid following the underwhelming launch of Ethereum futures ETFs.

Additionally, CoinShares' Digital Asset Fund Flows Weekly Report, released on Monday, revealed that the asset attracted approximately $10 million in the week but Ethereum has witnessed year-to-date outflows exceeding $100 million.

Ethereum price could remain lukewarm due to offloading

Ethereum Foundation converted 1,700 ETH to USDC through Uniswap V3, data revealed on Monday. The conversion translated to $2.74 million, exerting downward pressure of over 1% on price.

#Ethereum Foundation's #crypto swap on #Uniswap causes market fluctuation

— TheWignus (@TheWignus) October 10, 2023

Meanwhile, crypto whales have been consistently offloading Ethereum since February, as observed by crypto analyst Ali Martinez.

He pointed out that the favorable price movement has led to the redistribution or sale of more than 5 million ETH. Martinez also observed that currently there are no signs of a trend reversal by accumulating ETH.

However, buying and increased activity could potentially bolster Ethereum's price amid broader market weakness. Only if the inflows regain strength, investors can anticipate a price upswing. Up until then, we need to also monitor level of supply inflation to understand Ethereum's price trajectory.

Author

Shraddha Sharma

FXStreet

With an educational background in Investment Banking and Finance, Shraddha has about four years of experience as a financial journalist, covering business, markets, and cryptocurrencies.