Ethereum eyes 25% correction in March, but ETH price bulls have a Silver lining

The price of Ethereum’s native token, Ether (ETH $1,646), shows a growing conflict among traders about the market direction for March. This uncertainty has resulted in ETH price consolidating inside a narrow sideways range between $1,600 and $1,700 since Feb. 15.

25% ETH price correction on the table in March

The uncertainty stems from Ethereum’s long-awaited Shanghai upgrade going live sometime in March.

Several analysts predict the upgrade, which will enable stakers to withdraw their vested tokens from Ethereum’s proof-of-stake (PoS) smart contract, will trigger a short-term sell-off event.

The Ethereum PoS smart contract has attracted more than 17.4 million ETH (~$28.35 billion at the current exchange rate) since its introduction in December 2020, per Etherscan.

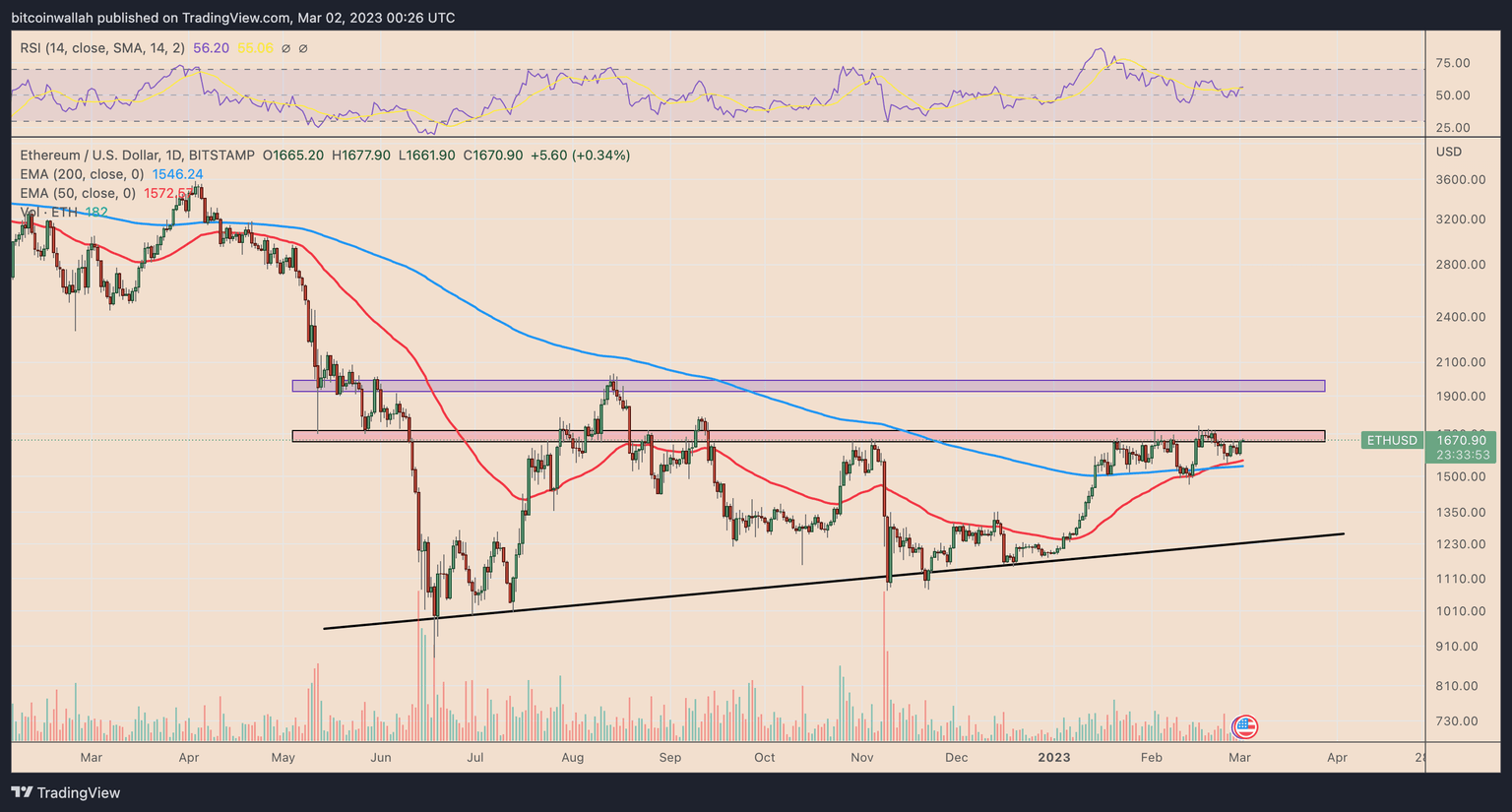

In addition, Ether is finding it difficult to break above the technical resistance range. The Ethereum token has attempted to flip the $1,650–1,700 area to support multiple times since August 2022, as shown by the red bar in the chart below.

ETH/USD daily price chart. Source: TradingView

Interestingly, each failed breakout attempt has resulted in a strong pullback toward a common support line — a multimonth ascending trendline (black).

Therefore, if history is any indication, ETH’s next correction could potentially land its price near $1,250, down 25% from the current levels. Conversely, a break above $1,650–1,700 positions ETH for the $1,925–2,000 range (purple) as its next upside target.

Future ETH selloffs will be limited — data trackers

From an on-chain perspective, an extended Ether price crash appears less likely.

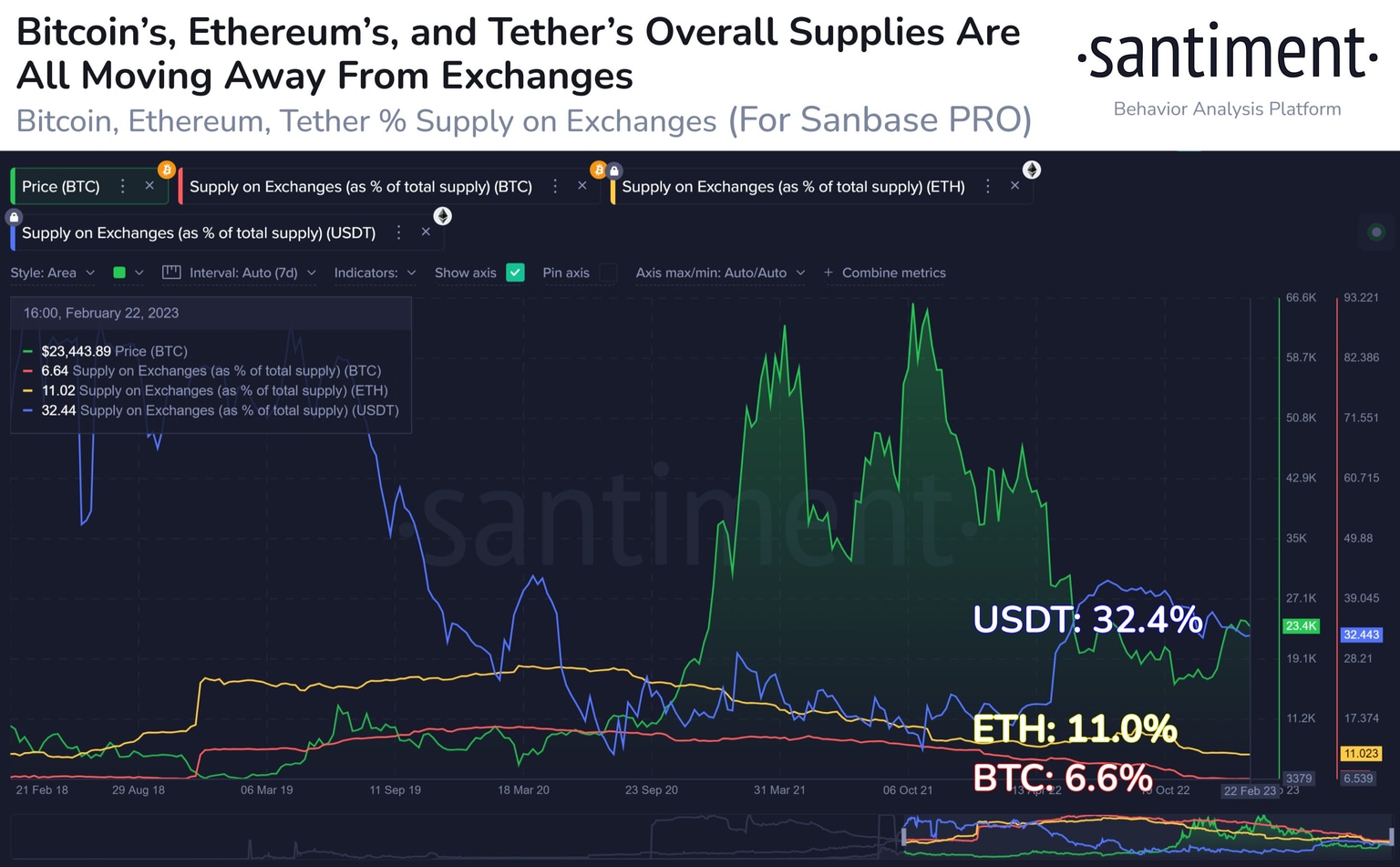

Notably, there’s been a massive drop in ETH supplies on exchanges since September 2022 — falling from around 30% to 11%. Theoretically, this reduces the immediate sell pressure as capital moves to the sidelines.

“The trend in crypto, particularly since September, has been quickly moving self-custody,” Santiment noted, adding:

This trend picked up after the FTX collapse. Regardless, with both BTC and ETH around 5-year low exchange supplies, future sell-offs will be limited.

In addition, data analytics firm CryptoQuant has reached a similar conclusion about potential Ether selloffs in the future, primarily in the wake of the Shanghai hard fork.

CryptoQuant notes that 60% of the staked ETH supply — about 10.3 million ETH — is currently at a loss. Meanwhile, Lido DAO, the largest Ethereum staking provider, holds 30% of all staked ETH at an average loss of $1,000, or 24%.

“Typically, selling pressure arises when participants have extreme profits, which is not the case for staked ETH currently,“ CryptoQuant wrote:

Additionally, the most profitable staked ETH was staked less than a year ago and has not seen significant profit-taking events in the past.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.