Ethereum eyes $2,000 target as institutional investors pour capital into ETH funds

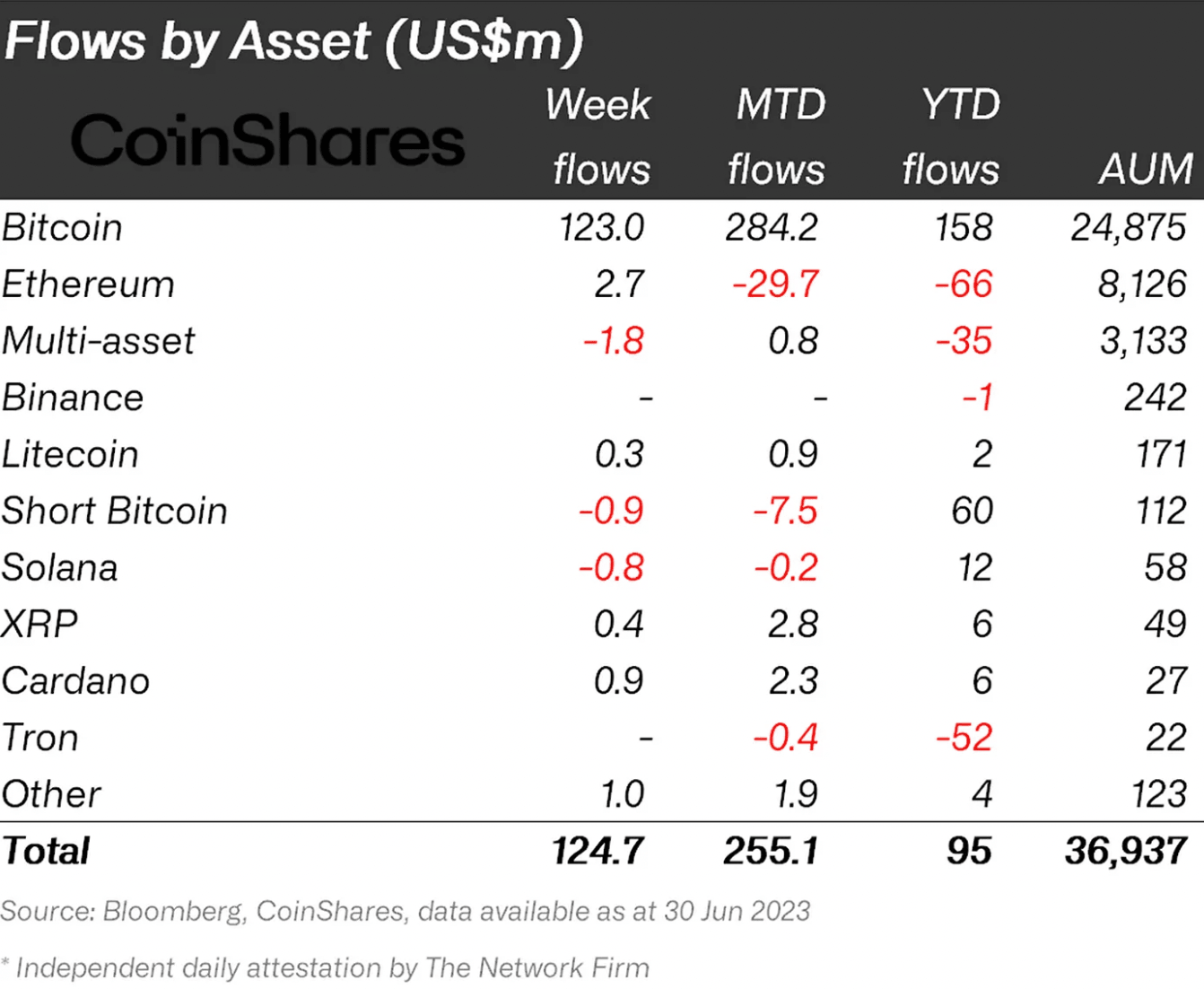

- Ethereum investment products received an inflow of $2.7 million from institutional investors, according to a recent report.

- Ether recorded the second largest capital inflow after Bitcoin CoinShares data shows.

- The altcoin is inching closer to the $2,000 psychological target amid rising capital inflow and interest from investors.

Ethereum ranks highest among altcoins in terms of institutional capital inflow, according to CoinShares’ latest report. While Bitcoin dominates the capital inflow from investors, Ethereum funds have observed a $2.7 million inflow over the past week.

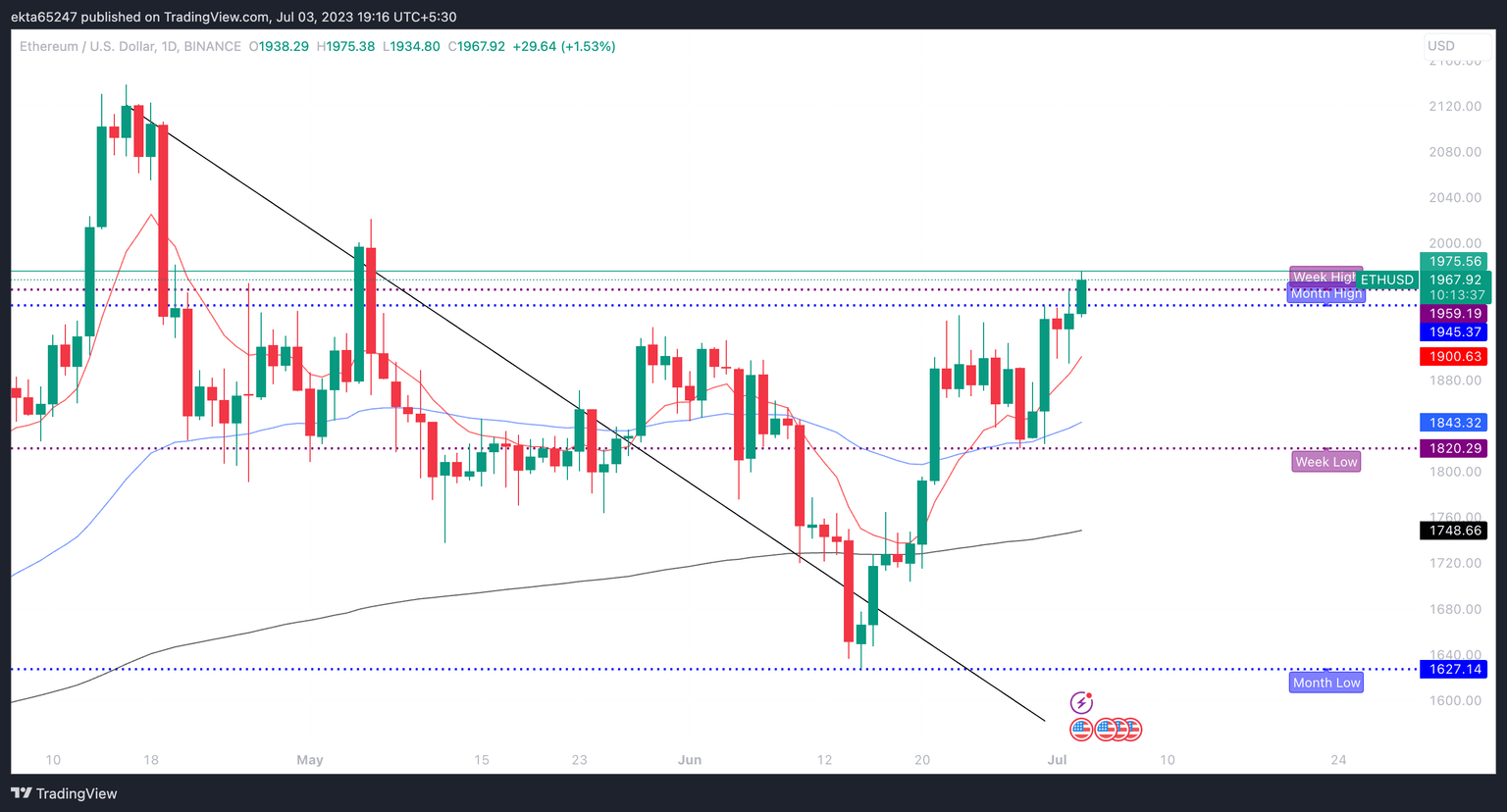

Ethereum price is in an upward trend on Binance and the altcoin is closer to breaking past the key psychological target of $2,000.

Also read: Ethereum creator Vitalik Buterin believes staked Ether is at risk of being stolen

Ethereum attracts $2.7 million capital from institutional investors

While Bitcoin, the largest cryptocurrency by market capitalization, scooped up the biggest chunk of inflows from institutional investors, Ethereum funds amassed $2.7 million. After months of outflow from crypto funds, Ethereum funds have garnered the attention of institutional clients.

CoinShares fund flows report by asset

Outflows this week were from funds that are short Bitcoin and Ethereum competitors like Solana. The interest from institutional clients and the corresponding capital inflow fuel a bullish thesis for Ethereum price recovery.

At the time of writing, ETH is exchanging hands at $1,975.56 on Binance.

Ethereum price eyes $2,000 target

Ethereum price has been in an upward trend since mid-June 2023. The altcoin climbed to $1,975.56 at the time of writing, wiping out losses from May. Ethereum price is currently above all three 10, 20 and 200-day Exponential Moving Averages (EMAs) at $1900.63, $1,843.32, and $1,748.66, respectively.

ETH/USD one-day price chart

If Ethereum price continues its uptrend, it is likely to hit the $2,000 target in the short term. A decisive break past $2,000 would confirm the bullish sentiment among ETH holders.

A decline below the 10-day EMA at $1,900.63 could invalidate the bullish thesis, with next support at the $1,840 zone.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.