Ethereum (ETH/USD)forecasting the rally following corrective pullback

ETHUSD ended cycle from June 22, 2021 ($1700) low at September 3, 2021 (4025) peak and started pulling back. Rally from June 22, 2021 low was in 5 waves and hence we expected the pullback to hold above June 22, 2021 low for extension higher. We told members that pullback was a buying opportunity for at least 1 more leg higher and ideally for a break to new all-time high. Let’s take a look at some charts below to see how we forecasted the rally following the correction.

ETH/USD September 19, 2021, 4 hour Elliott Wave update

ETH/USD September 22, 2021, 4 hour Elliott Wave update

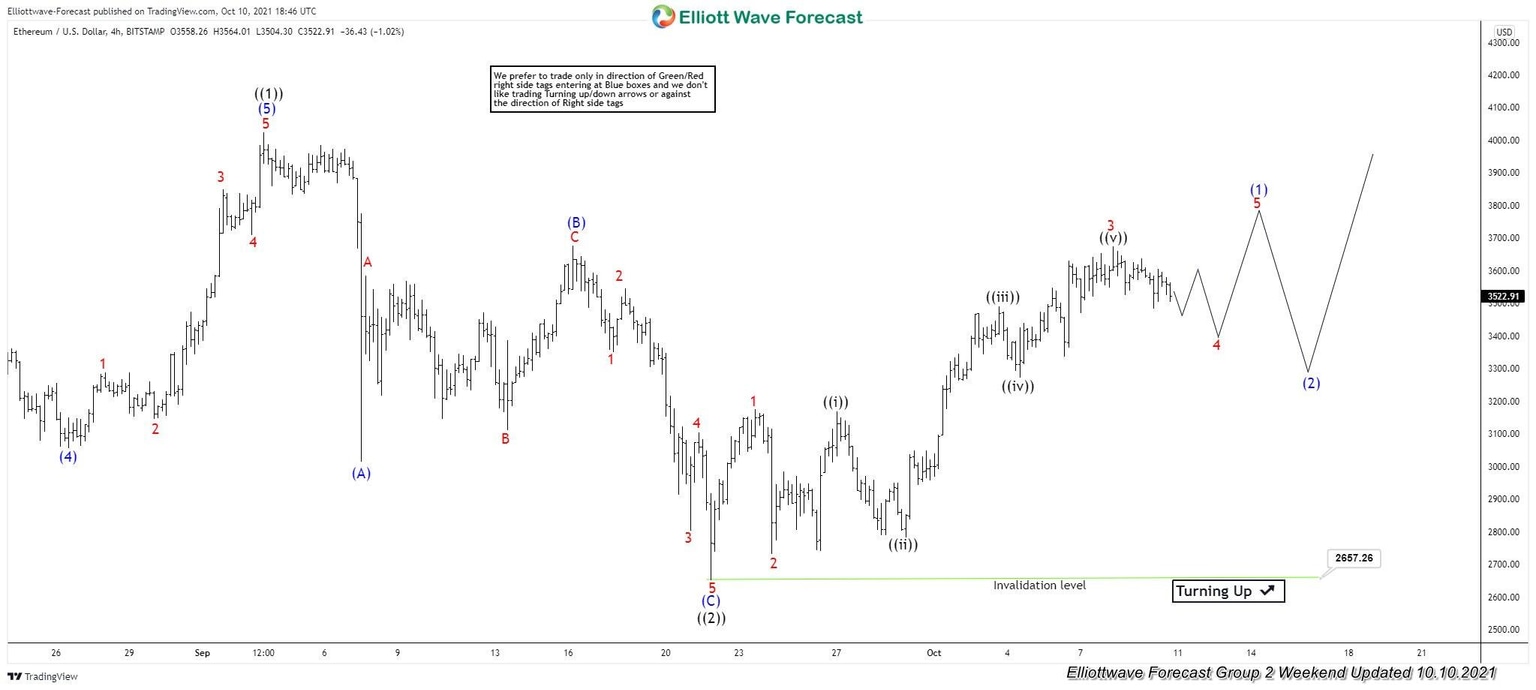

Ethereum October 10, 2021, 4 hour Elliott Wave update

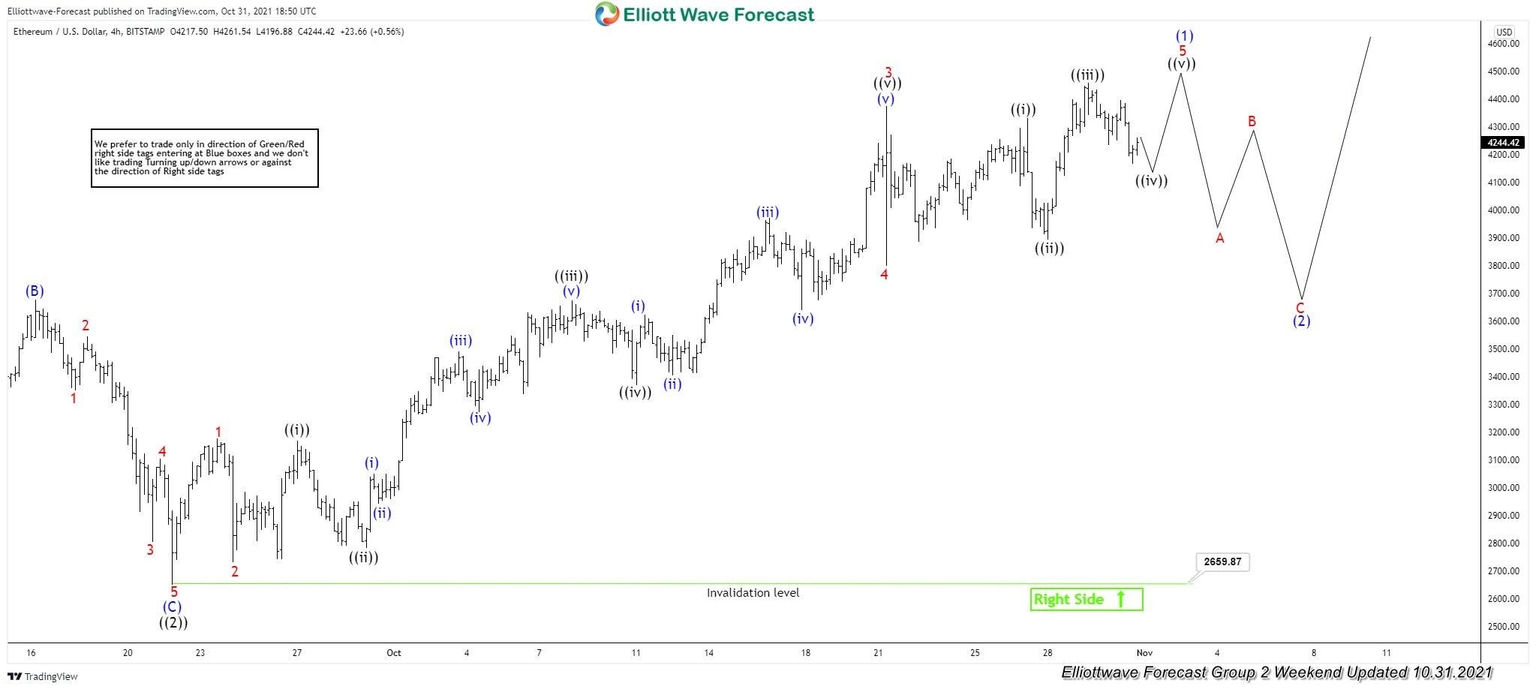

Ethereum October 31, 2021, 4 hour Elliott Wave analysis

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com