Here’s why ETH's price could be set to explode

- SEC preparing Ethereum ETFs to launch next week Tuesday after asking issuers to return final S-1s, says Bloomberg analyst.

- Ethereum investment products raked in $72 million in inflows, its highest level since March.

- Ethereum could set a new yearly high in the coming weeks after ETH ETF approval.

Ethereum is up more than 7% on Monday following updates from Bloomberg analysts that the Securities & Exchange Commission (SEC) would potentially greenlight spot ETH ETFs to launch next week Tuesday. The increased inflows across global Ethereum investment products also align with the new development, as traditional investors seem to be preparing for a potential rally ahead of the launch.

Daily digest market movers: Why ETH ETFs could perform well

In an X post on Monday, Bloomberg analyst Eric Balchunas said that the SEC plans to launch Ethereum ETFs on July 23 (next Tuesday) after responding to issuers today. Balchunas highlighted that the SEC asked issuers to submit their final S-1s with fees included on Wednesday before the launch can take place.

This may be highly bullish for the entire crypto market, considering the Bitcoin conference will be taking place next week, and US presidential candidate Donald Trump is listed among the speakers.

Update: Nate's instincts were right, hearing SEC finally gotten back to issuers today, asking them to return FINAL S-1s on Wed (incl fees) and then request effectiveness on Monday after close for a TUESDAY 7/23 LAUNCH. This is provided no unforeseeable last min issues of course! https://t.co/D21FD9Qf94

— Eric Balchunas (@EricBalchunas) July 15, 2024

Reuters also reported that three industry sources confirmed that the SEC gave "preliminary approval" to at least three issuers to launch their spot ETH ETF products next Tuesday, provided they submit their updated S-1s before the week runs out.

Eight issuers, including Grayscale, Fidelity, BlackRock, 21Shares, VanEck, Bitwise, Franklin Templeton and Invesco, will potentially launch their spot ETH ETFs on the same day.

The SEC approved issuers' ETH ETF 19b-4 filings last week but needs to greenlight their S-1 registration statements before the products can begin trading. Issuers submitted their updated S-1s with the SEC last week after the agency made light comments on them.

Meanwhile, traditional investors are turning bullish on Ethereum as the ETH ETF launch draws closer. This is evidenced in the recent weekly performance of global Ethereum ETFs, which witnessed inflows of about $72 million, its highest level since the market rally in March, according to data from CoinShares.

While some analysts have predicted that ETH ETFs may underperform, the recent growth across international Ethereum ETFs suggests otherwise. Additionally, most bullish investors speculate that ETH's low circulating supply due to locked ETH in staking protocols would allow the ETF inflows to spark a significant surge in ETH's price.

Ethereum CME open interest (OI) has also been growing faster than other derivatives exchanges, indicating a growing appetite among US investors for the largest altcoin.

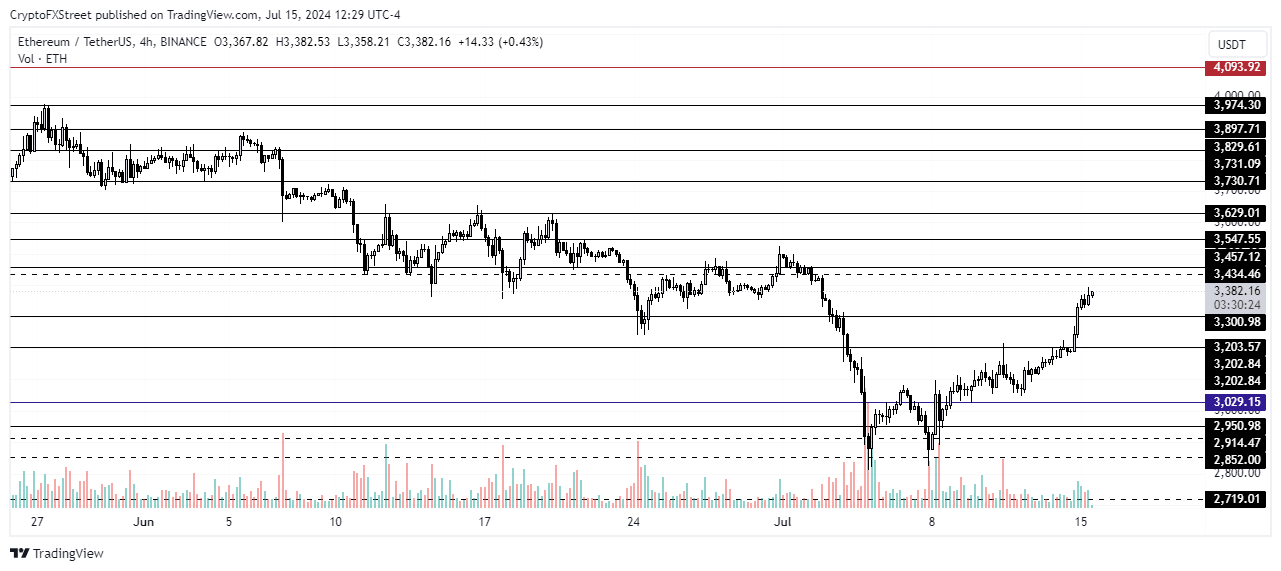

ETH technical analysis: Ethereum could see a new yearly high

Ethereum is trading around $3,430 on Monday, up over 7% on the day. ETH's rise follows a general recovery across the crypto market after crypto investors reacted positively to presidential candidate Donald Trump's escape from gunshots during a rally in Pennsylvania.

As a result, over $23.31 million worth of ETH short positions were liquidated whereas long liquidations significantly reduced to $3.86 million in the past 24 hours.

ETH's Long/Short Ratio, at 1.04, also shows the shift in market sentiment. The Long/Short Ratio estimates the total number of longs versus shorts in the market. A ratio above 1 suggests bulls are in control, and vice versa if it is below 1.

ETH/USDT 4-hour chart

The recent change in market sentiment, combined with the potential approval of spot ETH ETFs on Tuesday, could propel ETH above the $3,974 to $4,093 resistance to set a new yearly high. On the downside, the $3,200 price level could serve as key support.

In the long term, trader @CryptoYoddha predicted that Ethereum could reach $13,654 in 2025 as its consolidation over the past few weeks suggests potential for higher growth.

ETH All-time chart

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi