- Canada’s Ontario Securities Commission approved three Ethereum ETFs on April 20.

- This move comes after the recently launched Bitcoin ETF surpassed $1 billion in AUM.

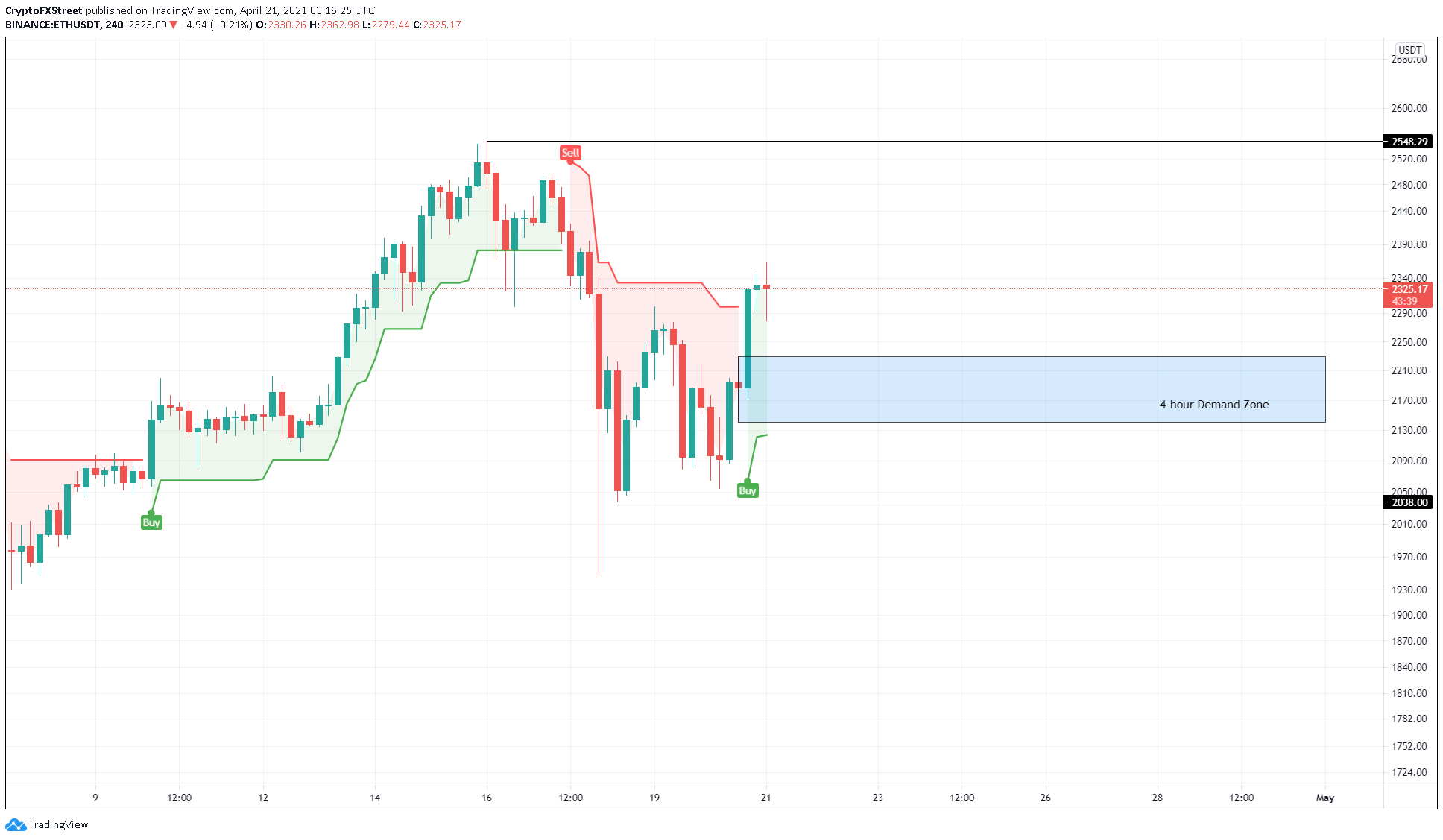

- Ethereum price looks to surge 15% to retest recently set up highs around $2,548.

Ethereum price is looking to climb higher as three new ETFs gain approval in Canada, pushing ETH adoption to another level.

Canada takes lead

Canada’s Ontario Securities Commission approved Ethereum Exchange Traded Fund (ETF) for CI Global Asset Management (ETHX), Purpose Investment (ETHH), and Evolve ETFs (ETHR) on Monday.

This move comes after Purpose Investment’s Bitcoin ETF, launched in February, crossed the threshold of $1 billion in assets under management (AUM). Hence, the addition of three new ETFs has put Canada at the forefront of the cryptocurrency race.

Canada's decision comes when Ethereum is gaining mainstream adoption as PayPal-owned Venmo recently announced that it would allow its users to purchase BTC, ETH and other cryptocurrencies.

Although the DeFi Summer and the ongoing bull run helped put ETH in the minds of institutional investors, the ETFs will attract institutions and high net worth individuals toward the programmable money, Ether.

While Canada leapfrogs ahead of the US, Chinese tech giant Meitu seems to be taking the high road as it invested millions in purchasing ETH and BTC. While MicroStrategy, Tesla and others hopped on the Bitcoin bandwagon, Meitu is the first Chinese listed company in the world to purchase large quantities of ETH.

Ethereum price shows signs of quick rally

Ethereum price stabilized around the swing low at $2,038 and bounced 13% to $2,324, where it is currently trading. This surge has created a higher high and suggests a shift in trend. Now, ETH could be on its way to retest its all-time high at $2,548.

The demand zone that extends from $2,140 to $2,230 will play a pivotal role in helping Ethereum price scale up. A bounce from this level confirms ETH’s bullish outlook and sets the stage for a 15% upswing.

The recently spawned buy signal from the SuperTrend indicator adds credence to this bull rally.

ETH/USDT 4-hour chart

If the retest of the said demand barrier fails to hold, and Etheruem price produces a decisive close below $2,140, it would invalidate the bullish thesis and kick-start a bearish one. In such a scenario, investors can expect ETH to retest the swing low at $2,038 and even $1,946 under extreme conditions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Litecoin Price Prediction: LTC tries to retake $100 resistance as miners halt sell-off

Litecoin price grazed 105 mark on Monday, rebounding 22% from the one-month low of $87 recorded during last week’s market crash. On-chain data shows sell pressure among LTC miners has subsided. Is the bottom in?

Bitcoin fails to recover as Metaplanet buys the dip

Bitcoin price struggles around $95,000 after erasing gains from Friday’s relief rally over the weekend. Bitcoin’s weekly price chart posts the first major decline since President-elect Donald Trump’s win in November.

SEC Commissioner Hester Pierce sheds light on Ethereum ETF staking under new administration

In a Friday interview with Coinage, SEC Commissioner Hester Peirce discussed her optimism about upcoming regulatory changes as the agency transitions to new leadership under President Trump’s pick for new Chair, Paul Atkins.

Bitcoin dives 3% from its recent all-time high, is this the cycle top?

Bitcoin investors panicked after the Fed's hawkish rate cut decision, hitting the market with high selling pressure. Bitcoin's four-year market cycle pattern indicates that the recent correction could be temporary.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.