Ethereum whales increase their holdings following recent price decline

- Ethereum whales and major players are accumulating ETH despite recent decline.

- Grayscale's mini Ethereum trust could send shockwaves across the US crypto ETF market.

- Ethereum could resume month-long movement in key range.

Ethereum's price (ETH) is down nearly 6% on Monday after Mt. Gox announced it would begin repaying creditors their Bitcoin and Bitcoin Cash. However, ETH whales have pounced on the price decline as an opportunity to purchase ETH before the arrival of spot Ethereum ETFs.

Daily digest market movers: Whales create buying pressure

Following news of the defunct exchange Mt.Gox beginning the transfer of Bitcoin and Bitcoin Cash to affected users in July, several Ethereum enthusiasts campaigned for investors to buy/hold ETH. Spot On Chain data reveals that several whales and major players, including Tron Founder Justin Sun, accumulated ETH despite the recent dip. This may be due to bullish sentiment around the potential launch of spot ETH ETFs on July 2.

Meanwhile, according to Nate Geraci, President of the ETF Store, the unveiling of Grayscale's mini ETH trust fees "could send shockwaves through the spot BTC ETF landscape," considering the company also has a mini BTC trust in the works. Many expect the mini ETH trust to have a very low fee below those of other ETH ETF issuers, as it was rumored that Grayscale's mini BTC trust fees would be 0.15%, which would make it the cheapest product in the US crypto ETF landscape.

Also read: Ethereum ETF issuers launch marketing campaign with slight dig at TradFi

Additionally, Roundhill Ball Metaverse ETF (METV) disclosed it now has 6.8% exposure — worth $27 million — to the Canadian-based CI Galaxy spot ETH ETF after a quarterly rebalance of its index. According to its press release, this is the largest Ethereum exposure for a US-based ETF.

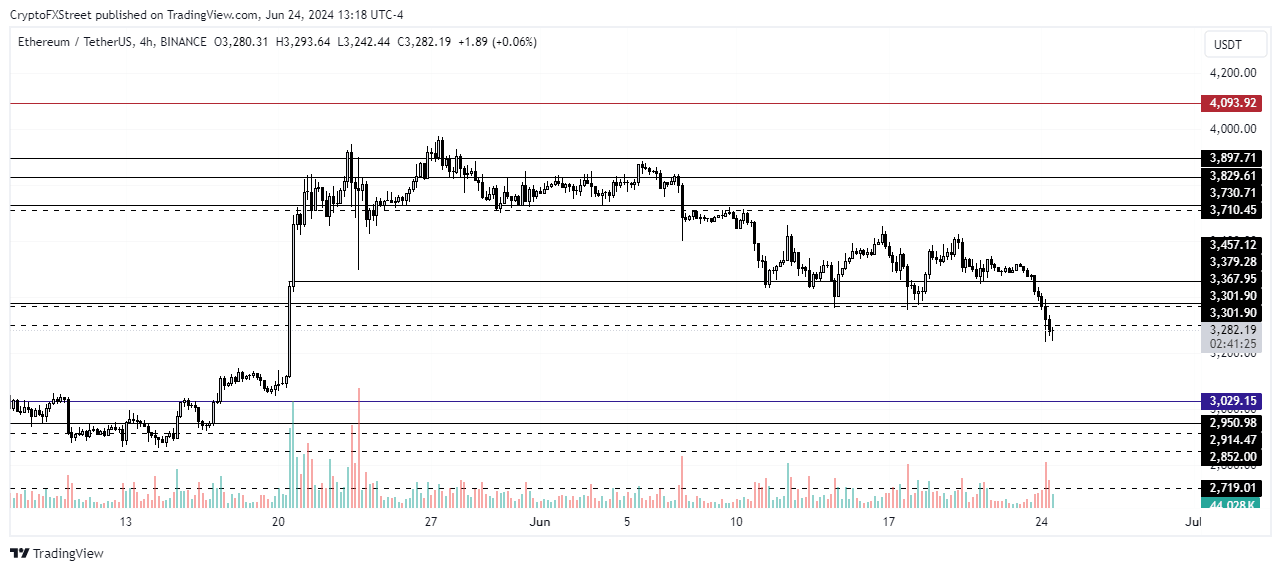

ETH technical analysis: Ethereum could resume consolidation in key range

Ethereum is trading around $3,280 on Monday after FUD from Mt.Gox sparked a selling spree across the general crypto market. Ethereum may be heavily affected despite ETH ETFs on the horizon due to Bitcoin's dominance over the crypto market. Ethereum liquidations crossed $72 million, with long liquidations reaching $63 million and shorts at about $9 million.

ETH/USDT 4-hour chart

Read more: Ethereum ETFs may not cause upward surge in ETH price as many expect

ETH breached the key support level of $3,300, entering a key range extending from $2,852 to $3,300. Notably, ETH traded inside this range for over a month after descending from its yearly high of $4,093 in March. A further decline below the 3,029 support level could see ETH sustaining another month-long move inside the key range.

However, on the other hand, the arrival of ETH ETFs could command buying pressure, boosting Ethereum above the $4,093 resistance.

Ethereum development FAQs

After the Merge, the Ethereum community is looking at the Sharding upgrade next, which has been slated for sometime later in the year. The development can be summarized in four words, “scalability through more efficient data storage.” The software update will increase the capacity of the blockchain, widening the amount of data that can be stored or accessed. At the same time, all services running atop the Ethereum blockchain will enjoy significantly reduced transaction fees.

A fork is the splitting of a blockchain after developers agree and proceed to implement upgrades. The decision comes after these developers reach a consensus for a software upgrade. The ensuing part will see one part continue with the status as is, while the other one will proceed with new features combined with the former ones. A hard fork basically entails permanent divergence of a new side chain from the original one, while a soft fork is doing the same, only difference being that it is temporary.

EIP-4844 is an improvement proposal for the Ethereum network. The upgrade promises reduced gas fees, which is a valuable offering considering the high transaction cost that continues to daunt crypto players. It has been a long-standing concern for the Ethereum network. The proposal is also referred to as “proto-Danksharding,” with an unmatched ability to increase the speed of transactions on the Ethereum blockchain. At the same time, it helps to reduce the transaction cost as everything becomes decentralized.

Gas token is a new, innovative Ethereum contract where users can tokenize gas on the Ethereum network. This means they can store gas when it is cheap and start to deploy the gas once the market has shifted to the north. The use of Gas token helps to subsidize high gas prices on transactions, meaning investors can do everything from arbitraging decentralized exchanges to buying into initial coin offerings (ICOs) early.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi