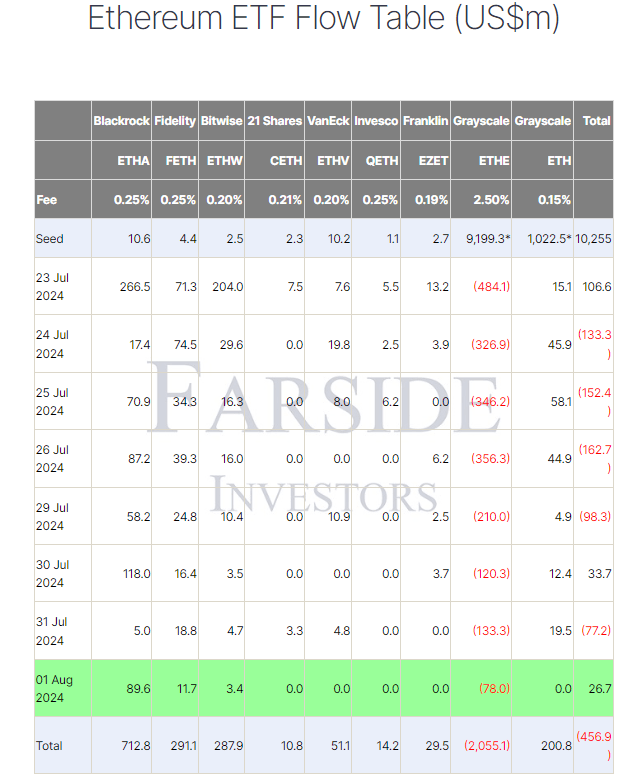

Ethereum ETF flows flip positive despite Grayscale outflows topping $2B

Daily net inflows into the United States spot Ether exchange-traded funds (ETFs) have flipped positive again despite cumulative outflows from the Grayscale Ethereum Trust (ETHE) breaching $2 billion.

On Aug. 1, the Ether (ETH $3,147) ETFs posted a net inflow of $26.7 million, led by a $89.6 million inflow into BlackRock’s iShares Ethereum Trust (ETHA), according to Faride Investors data.

Ethereum ETFs posted a $26.7 million net inflow on Aug. 1. Source: Farside Investors

Grayscale’s Ethereum Trust saw outflows of $78 million on Aug. 1, bringing the cumulative outflows from the fund to just over $2 billion since its conversion to a spot ETF.

Unlike the other eight spot Ether ETFs launched as “newborn” funds on July 23, ETHE was a trust that offered institutional investors exposure to Ether.

Before its conversion, ETHE held $9 billion in Ether on its books. Outflows have now topped 22% of the initial fund as of Aug. 1.

Steno Research senior analyst Mads Eberhardt previously said it’s “likely” the massive outflows from Grayscale’s ETHE will begin to subside by the end of the week, adding that slowed outflows are a bullish catalyst for the price of ETH.

Source: Steno Research

“When it does, it’s up only from there,” Eberhardt wrote in a July 30 post to X.

Earlier, on July 23, Kaiko’s head of indexes, Will Cai, said the price of ETH would be “sensitive” to the inflows into the spot products.

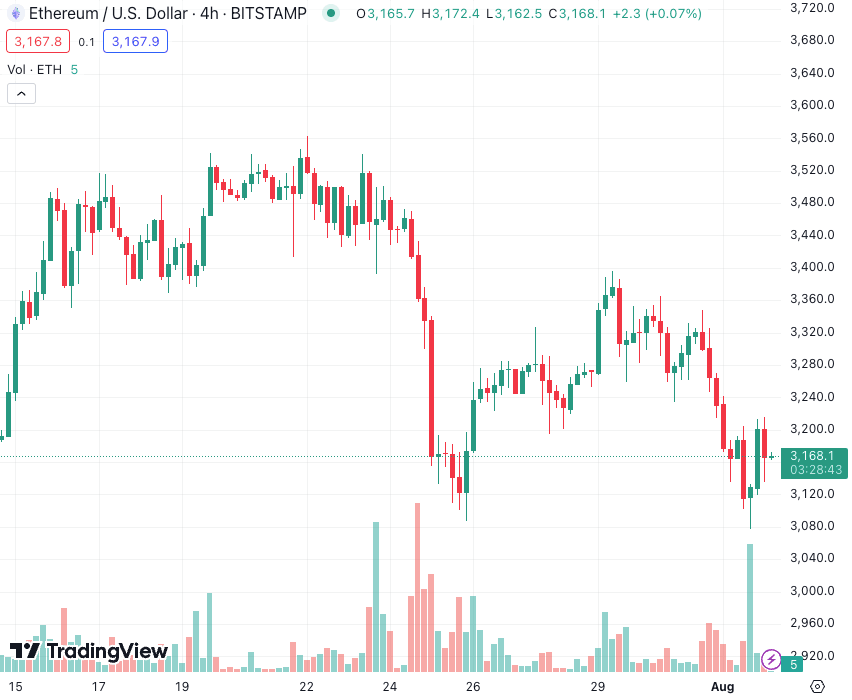

Reflecting this sensitivity, ETH is changing hands for $3,168 at the time of publication, having fallen 8.5% since the ETFs launched, according to TradingView data.

ETH has tumbled 8.5% since the launch of the spot ETF products. Source: TradingView

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.