Ethereum ETF approval could spur 60% rally as ETH buying increases

-

The approval of spot ether exchange-traded funds (ETF) in the U.S. could lead to a significant rise in the token's value, mirroring the market reaction seen with bitcoin ETFs.

-

Bitcoin rose to over $73,000 from $42,000 in the two weeks after the ETF started trading on Jan. 11, CoinGecko data shows.

-

The decision on the ether ETF is expected soon, with significant buying activity observed on both centralized and blockchain-based exchanges.

Approval of spot Ether (ETH) exchange-traded funds (ETF) in the U.S. could drive a rally of as much as 60% in the second-largest cryptocurrency in the coming months, QCP Capital said in a Thursday broadcast on Telegram

The forecast echoes the market reaction after spot bitcoin ETFs were approved in January, the Singapore-based firm said. Bitcoin rose to over $73,000 from $42,000 in the two weeks after the ETFs started trading on Jan. 11, CoinGecko data shows.

"With Friday implied volatility above 100%, the market is expecting fireworks," QCP said. "VanEck’s ETF has been listed by the DTCC. We think approval is now highly likely with trading expected as early as next week.”

Implied volatility measures the market's expectation of future price fluctuations for a financial instrument.

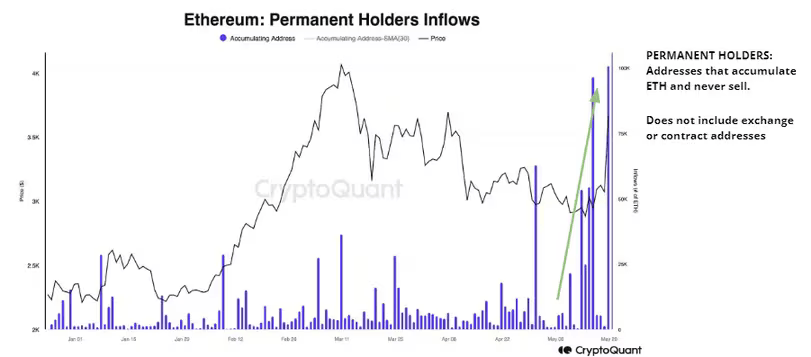

Buying activity increased on both centralized and blockchain-based crypto exchanges, on-chain analytics firm CryptoQuant said in a Wednesday report. Holders bought over 100,000 ETH in spot markets on Tuesday, the highest daily level since September 2023, as reports of a favorable decision emerged and some analysts bumped odds to over 75% from the earlier 25%.

Ether holder inflows crossed the 100,000 mark on Wednesday, the highest daily flow since September. (CryptoQuant)

Open interest on ether-tracked futures spiked in tandem to a record $14 billion. That's 67% of bitcoin open interest as of Wednesday, an unusually high level.

Activity also increased at the Chicago Mercantile Exchange, an exchange favored by institutions, with ether futures hitting a record notional $2.85 billion of trading on Tuesday, according to a spokesperson. Ether options traded a record 1,135 contracts ($216 million).

“Traders seem to be getting more exposure now to ETH relative to Bitcoin,” CryptoQuant said. "The largest daily spot buying from ETH permanent holders so far in 2024."

Ether prices in the coming days could be volatile after investors sent 62,000 ETH to exchanges, the most since early March, it said. "High exchange flows are typically associated with price volatility.”

On the flip side, the firm’s analysts warned of a “significant price correction” should the ETF application be dismissed.

Six issuers, including BlackRock, filed updated copies of their ether ETF proposals this week ahead of a decision due today. All removed plans to stake the token, which suggests the activity may have been a regulatory roadblock.

Staking is the process of locking a cryptocurrency for a set period of time to help support the operation of a blockchain, in turn for a reward. These rewards are largely considered passive income among crypto traders.

As of Thursday, annualized yields on ether staking were nearly 3%, according to data from popular staking service Lido.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.