Ethereum developers announced the date of Istanbul hard fork

- The major update is scheduled for December 4.

- ETH/USD has retreated from the recent high.

Ethereum developers will activate a major update on the Ethereum mainnet at block 9 056 000. It will be mined approximately on December 4. However, the team will postpone the fork until January 8 if something unexpected happens.

Notably, the fork on the testnet split it into two chains, but developers believe that the fork will be activated as planned. They also approved EIP 2124 that will allow users to detect the chain supported by the majority of users.

Ethereum’s technical picture

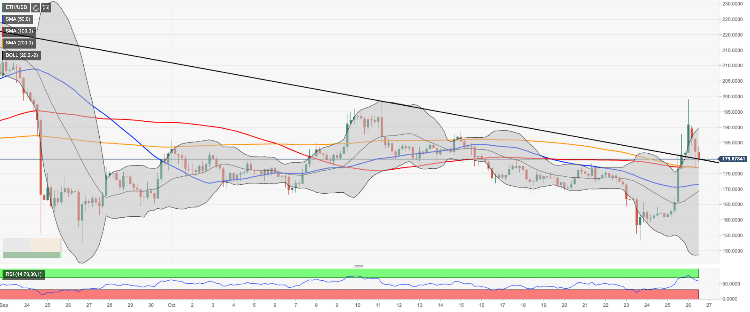

ETH/USD topped at $199.04 during early Asian hours on Saturday and retreated to $180.30 by the time of writing. The downside correction stopped short of the critical support created by the long-term downside trendline at $180.00. Once it is out of the way, the sell-off is likely to gain traction with the next focus on$177.00. It is created by a confluence of SMA100 (Simple Moving Average) and SMA200 (four-hour chart).

On the upside, the initial resistance awaits us on approach to $190.00 (the upper line of four-hour Bollinger Band) followed by $199.00.

ETH/USD, the four-hour chart

Author

Tanya Abrosimova

Independent Analyst