Ethereum could slip under $2,000 in March, odds climb to 10%

- Ethereum noted nearly $140 million in liquidations in the past 24 hours, nearly $65 million in bullish bets were liquidated.

- Ether holds above support at $2,600, experts predict a drop under $2,000, a psychologically important level.

- ETH implied volatility on the daily and weekly timeframes has climbed, making short-term downside swings more likely.

Ethereum (ETH) trades at $2,830 on Tuesday. The second-largest cryptocurrency held steady above key support at $2,600, even as $140 million in derivatives positions were liquidated in the past 24 hours.

Ethereum could correct under $2,000 for these three reasons

On-chain metrics like the total supply of Ether, Network Realized Profit/Loss (NPL), Supply held by whales (off exchanges) and the funding rates across exchanges support a bearish thesis for Ether.

Santiment data shows that the total supply of Ether has continued to increase, meaning that the implementation of EIP-1559 failed to turn ETH deflationary. NPL shows large negative spikes in February 2025, meaning a large number of traders are selling ETH and realizing losses, likely de-risking their portfolio.

ETH NPL recorded over $921 million in realized losses on Monday and crossed $181 million early on Tuesday.

The funding rate has turned negative in the last two days as derivatives traders turned bearish on Ether. Supply held by whales off exchanges has declined, a notable drop was observed on January 30.

A decline in supply held by whales off exchanges and large-volume realization of losses are typically associated with an expectation of a price drop in the token. On-chain metrics, therefore, support a bearish thesis for the altcoin.

Ethereum on-chain metrics | Source: Santiment

Bullish Ethereum bets on derivatives exchanges liquidated

Coinglass data shows that $140 million in Ethereum derivatives positions were liquidated in the last 24 hours, a majority of which were long positions or bullish bets on Ether.

Sean Dawson, Head of Research at Derive.xyz told FXStreet in an exclusive interview:

“In the last 24 hours, crypto markets saw a staggering $2.3 billion in liquidations, with over $600 million of that coming from ETH and its derivatives. ETH’s price dropped by 18%, which caused a huge spike in market volatility. This means there was a lot of uncertainty in the market, with traders buying both types of options (puts and calls) to either protect themselves from further losses or to take advantage of a potential price rebound.

ETH’s 1-day implied volatility (a measure of price fluctuation expectations) surged from 60% to 145% before settling at 88%. Similarly, its 7-day volatility jumped from 66% to 122% and is now around 75%. This indicates that traders expect larger and more unpredictable price movements in the short term, especially following the sharp drop in ETH’s price, which has increased uncertainty in the market.”

Dawson said that traders continue to expect a decline in Ethereum price, and there is a shift in market sentiment.

“The chance of ETH settling below $2K by March 28 has increased from 4% to 10% in the last 24 hours as bearish sentiment takes hold. The chance of ETH reaching over $4K by March 28 has more than halved, dropping from 15% to 7%,” he added.

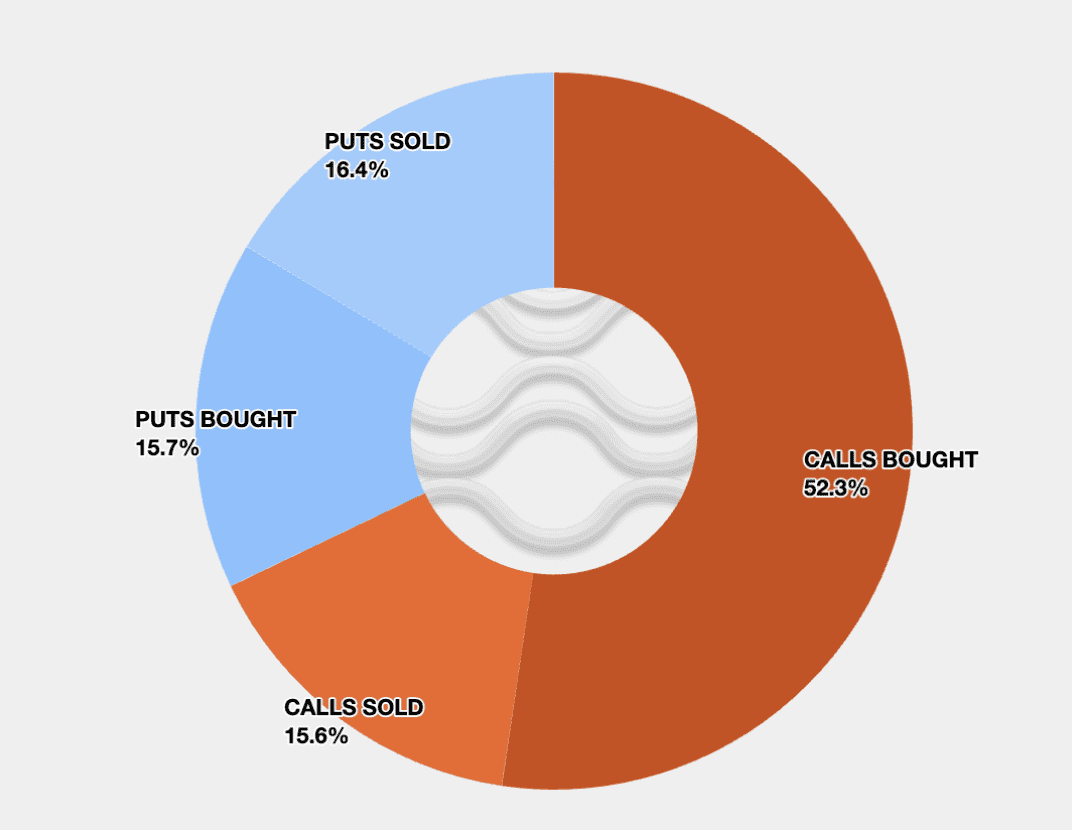

According to puts/calls data from Amberdata, ETH’s contracts saw 52.3% of calls bought, indicating traders are looking for leverage and expecting a potential bounce in the altcoin.

Source: Derive.xyz, Amberdata

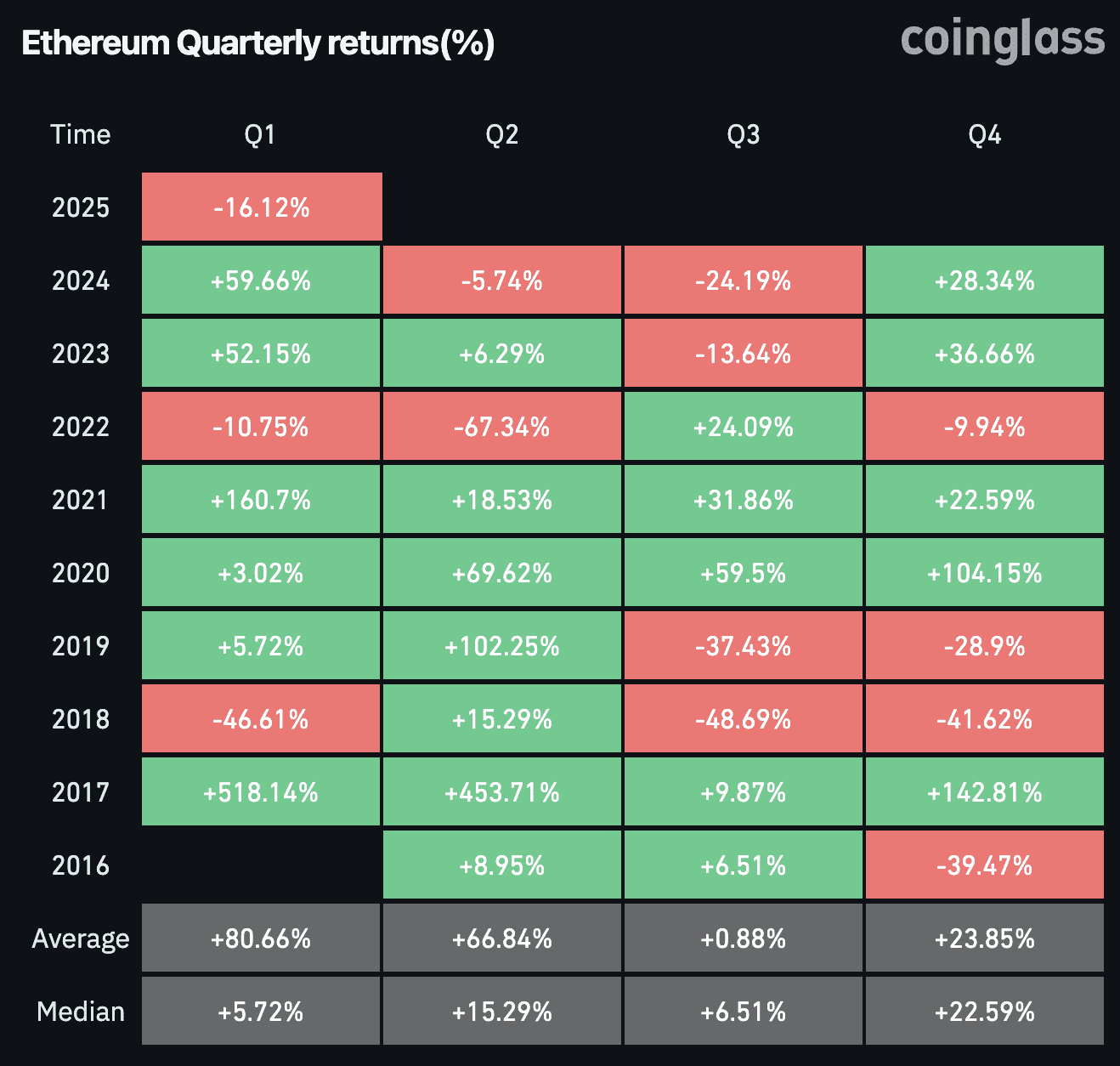

Coinglass data shows that six out of nine times since 2017, Ether has closed Q1 with net gains for holders. It remains to be seen whether ETH dips under $2,000 or begins recovery before the end of the first quarter of 2025.

Ethereum quarterly returns | Source: Coinglass

Ethereum wiped off nearly 2% of its value on Tuesday, according to TradingView data.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.

%2520%5B23.40.20%2C%252004%2520Feb%2C%25202025%5D-638742949491471775.png&w=1536&q=95)