Ethereum could bounce off key support level as Middle East crisis weigh on crypto market

- Ethereum ETF sees $48.6 million in outflows amid growing Middle East war.

- Ethereum exchange net outflow suggests investors may be buying the dip.

- Ethereum could bounce off the $2,395 support level as funding rates have remained largely positive.

Ethereum (ETH) trades around the $2,400 psychological level on Wednesday, down over 4% following $48.6 million outflows from ETF investors as the war between Israel, Hamas, Hezbollah and Iran is hurting market sentiment. However, buying pressure from spot traders on crypto exchanges could see the top altcoin bounce off the $2,395 support level.

Ethereum spot traders and ETF investors display mixed sentiment

Ethereum and the larger crypto market declined on Wednesday after Iran directed missiles at Israel on Tuesday, broadening the war between Israel and Hezbollah in Lebanon.

After Israeli officials said they would respond, investors are becoming more cautious and quickly flipping from their risk-on attitude displayed in the past two weeks.

The change in market sentiment is visible in Ethereum ETFs switching from high inflows last week to increased outflows on Tuesday. Following the market decline, the products recorded $48.6 million in outflows. The outflows were dominated by $26.6 million leaving Grayscale's ETHE and Fidelity's FETH seeing an exodus of $25 million — their highest day of outflow since launch.

However, spot traders may not be overly bearish as ETF investors following the ETH exchange flows in the past 24 hours. According to CryptoQuant's data, investors are likely buying the dip, considering ETH has seen an exchange net outflow of nearly 40,000 ETH in the past few hours.

Ethereum Exchange Netflow

Exchange net flow is the difference between coins flowing in and out of an exchange. Unlike crypto ETFs, outflows indicate rising buying pressure, while vice versa for inflows.

Ethereum could bounce off $2,395 support level

Ethereum is trading around $2,400 on Wednesday, down over 4% on the day. The top altcoin has sustained $63.55 million in liquidations in the past 24 hours, with long and short liquidations accounting for $55.48 million and $8.07 million, respectively.

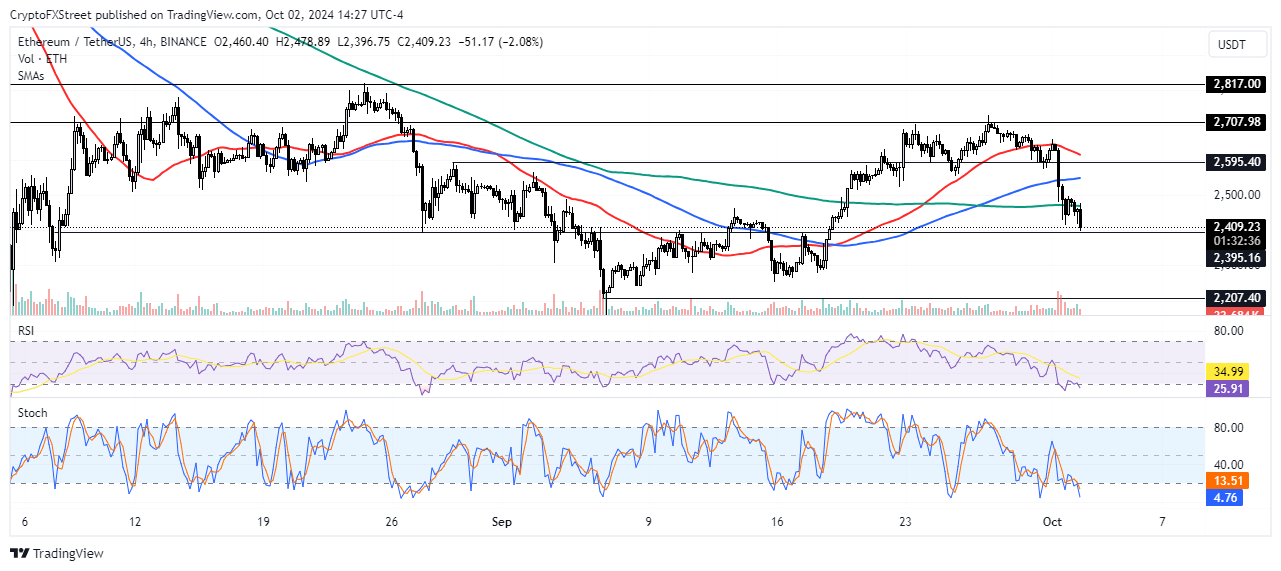

The sharp price decline following Middle East war tension on Tuesday saw ETH breaking the $2,595 key level and crossing below the 50-day, 100-day and 200-day Simple Moving Averages (SMA).

ETH/USDT 4-hour chart

However, Ethereum funding rates have remained positive despite the price decline, indicating that a larger percentage of derivatives traders are still bullish, per CryptoQuant's data.

As a result, ETH is likely to bounce off the $2,395 support level and stage a move upward. If the war tension persists, ETH will likely break this support level, but buyers could step in, considering the $2,350 level is a crucial demand zone where investors purchased over 52.53 million ETH, per IntoTheBlock's data.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) momentum indicators are in their oversold region, indicating bearish momentum.

A daily candlestick close below $2,207 will invalidate the thesis.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Its native currency Ether (ETH), is the second-largest cryptocurrency and number one altcoin by market capitalization. The Ethereum network is tailored for building crypto solutions like decentralized finance (DeFi), GameFi, non-fungible tokens (NFTs), decentralized autonomous organizations (DAOs), etc.

Ethereum is a public decentralized blockchain technology, where developers can build and deploy applications that function without the need for a central authority. To make this easier, the network leverages the Solidity programming language and Ethereum virtual machine which helps developers create and launch applications with smart contract functionality.

Smart contracts are publicly verifiable codes that automates agreements between two or more parties. Basically, these codes self-execute encoded actions when predetermined conditions are met.

Staking is a process of earning yield on your idle crypto assets by locking them in a crypto protocol for a specified duration as a means of contributing to its security. Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism on September 15, 2022, in an event christened “The Merge.” The Merge was a key part of Ethereum's roadmap to achieve high-level scalability, decentralization and security while remaining sustainable. Unlike PoW, which requires the use of expensive hardware, PoS reduces the barrier of entry for validators by leveraging the use of crypto tokens as the core foundation of its consensus process.

Gas is the unit for measuring transaction fees that users pay for conducting transactions on Ethereum. During periods of network congestion, gas can be extremely high, causing validators to prioritize transactions based on their fees.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi

%2520-%2520All%2520Exchanges%2520(6)-638634914832020134.png&w=1536&q=95)