Ethereum core devs launch ‘pump the Gas’ effort to raise Gas limit

Ethereum developers have launched a new initiative in a bid to raise the blockchain network’s long-static gas limit, arguing that the change can be used to help scale Ethereum.

On March 20, core Ethereum developer Eric Connor and former head of smart contracts at MakerDAO Mariano Conti unveiled a new website called ‘pump the gas’ to raise the Ethereum gas limit from 30 million to 40 million, which they say will reduce transaction fees on layer 1.

“This can result in a 15% to 33% reduction in layer-1 transaction fees,” said Connor in a March 19 post on X before adding, “We are calling on solo stakers, client teams, pools, and community members to help.”

The #pumpthegas hashtag has already started to gain some support from Ethereum users, stakers and DeFi investors on X. Conti also observed that a Rocket Pool validator had proposed a block with a 40 million gas limit on March 20.

Source: Eric Connor

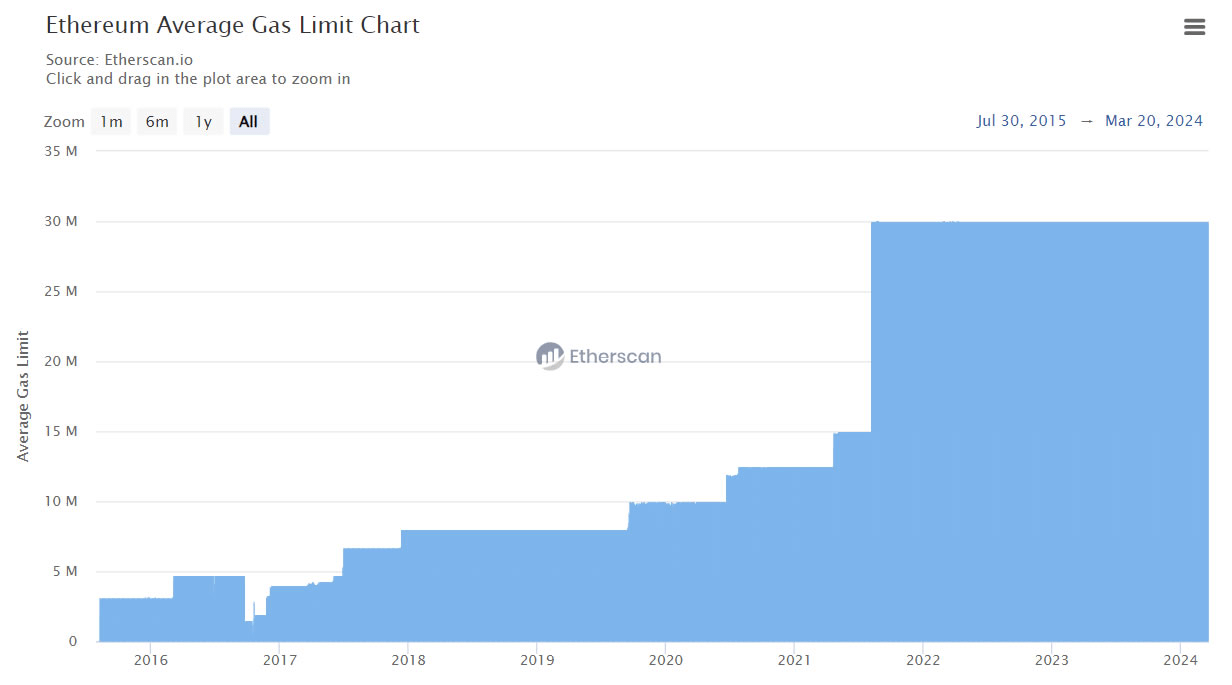

The call to increase the Ethereum gas limit has gained momentum over the last few months. In January, Ethereum co-founder Vitalik Buterin suggested that the gas limit be upped from 30 million, where it has been since August 2021, to 40 million.

Base contributor Jesse Pollak said in response that he was “strongly in support” of increasing the Ethereum gas limit to 40 or 45 million. “We have the network headroom and will be beneficial for all parties,” he added.

The Ethereum gas limit refers to the maximum amount of gas spent on executing transactions or smart contracts in each block. Gas is the fee in (ETH $3,527) required to conduct a transaction or execute a smart contract on the network.

Ethereum gas limit. Source: Etherscan

The website explained that each operation has a predefined gas cost, and contracts have a gas limit they cannot exceed during execution. This prevents malicious contracts from overloading the network with infinite loops or excessive resource consumption.

“Raising the gas block limit 33% gives Layer 1 Ethereum the ability to process 33% more transaction load in a day,” it stated.

It also stated that data blobs, introduced in the Dencun upgrade with EIP-4844, help greatly reduce layer-2 transaction fees, but not layer-1 fees. “A combination of blobs and gas limit increase can help scale both L1 and L2 Ethereum,” it added.

However, not all are in favor of this network adjustment. Venture investor and Ethereum advocate Evan Van Ness said, “I'm not in favor of raising mainnet gas limit *today* as EIP-4844 just raised the block size,” in a post on X.

Source: Evan Van Ness

Earlier this year, Ethereum developer Marius van der Wijden, expressed concern about the proposed raise arguing that it would increase the size of the blockchain state, which contains account balances and smart contract data.

Size is not the issue, he said at the time before stating “accessing and modifying it will become slower and slower,” before adding there are “no concrete solutions yet for state growth.”

Other downsides of increasing the gas limit include increased loads on hardware and the potential risk of network spam and attacks.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.