- Ethereum's network Q1 financial report shows that it tripled its earnings quarter-on-quarter to around $370 million.

- Bitcoiner argues about ETH's security status as Bloomberg analyst James Seyffart labels it as a commodity.

- VanEck expects Ethereum Layer 2 chains to accrue more revenue than the main Ethereum chain by 2030.

Ethereum (ETH) sustained its consolidating movement for the second day on Thursday, trading above $3,300 after crashing earlier in the week. While this may signify indecisiveness among bulls and bears, its Q1 results show steady growth across various sectors even as community members debate on its commodity status.

Read more: Ethereum drops further as Bitcoin’s decline, uncertainty over ETF weigh

Daily digest market movers: L2s, Q1 earnings, ETH commodity status

Ethereum has been one of the most trending cryptocurrencies in the past few weeks. Despite expectations that anticipation for Bitcoin's halving would be the main subject of discussion, the SEC's decision on Ethereum ETFs and the recent crackdown on Ethereum Foundation appears to have taken center stage in the crypto community. That said, here's a quick breakdown of the latest happenings surrounding the largest altcoin:

- In a report released on Wednesday, global asset manager VanEck analysts expect Ethereum Layer 2 networks to accrue more revenue than its main chain. They sighted data from crypto analysis firm Artemis XYZ, showing the increasing growth of the underlying Ethereum ecosystem against its Mainnet declining market share. L2s offer superior throughput and user experience, especially with the Dencun upgrade on March 13, which introduced Blob space – a data layer for L2 that reduces data overhead and gas fees – noted VanEck analysts.

- The analysts further predicted that Ethereum L2s may be worth more than $1 trillion by 2030, considering several application, sector, or function-specific Layer 2s may emerge – like an asset management L2 or rollups that host a social media sector. They noted that these L2s reinforce "the value of ETH as the true ‘oil’ powering the entire ecosystem of connected chains.”

- Ethereum's Q1 financial report, released on Wednesday by Coin98 Analytics, showed significant growth in revenue and earnings. Ethereum's revenue grew nearly 84.6% quarter-on-quarter (QoQ) to reach $1.035 billion, and earnings reached $369.11 million, a 198.8% QoQ change. Much of this increase is attributed to the spike in gas fees before the Dencun upgrade. Other metrics from the report include 107 million transactions conducted with 9.7 million new addresses in Q1.

- Following ETH Q1 results was Cory Klippsten, CEO of Bitcoin financial service firm Swan.com, arguing in an X post on Wednesday that Ethereum was a security when it launched. He claimed the SEC didn't want to get in the way of another agency when it allowed the CME to start trading ETH futures ETF.

However, Bloomberg analyst James Seyffart, who was tagged in the post, responded by stating that the ETH futures ETF was registered as "commodities futures, not securities futures."

If the SEC wanted to come out and call Eth a security, they should not have approved the listing of #Ethereum futures ETFs which rely on these contracts. To go back and change that would likely mean the delisting and closing of CME ETH futures AND the ETH futures ETFs. Thus why…

— James Seyffart (@JSeyff) April 3, 2024

- James Seyffart also said in another X post that the SEC asking for public comments on spot Ethereum ETF filings is a normal procedure and "not ‘bullish’ in any capacity for Ethereum ETFs."

Also read: Ethereum drops further as Bitcoin’s decline, uncertainty over ETF weigh

Technical analysis: Indecisiveness persists

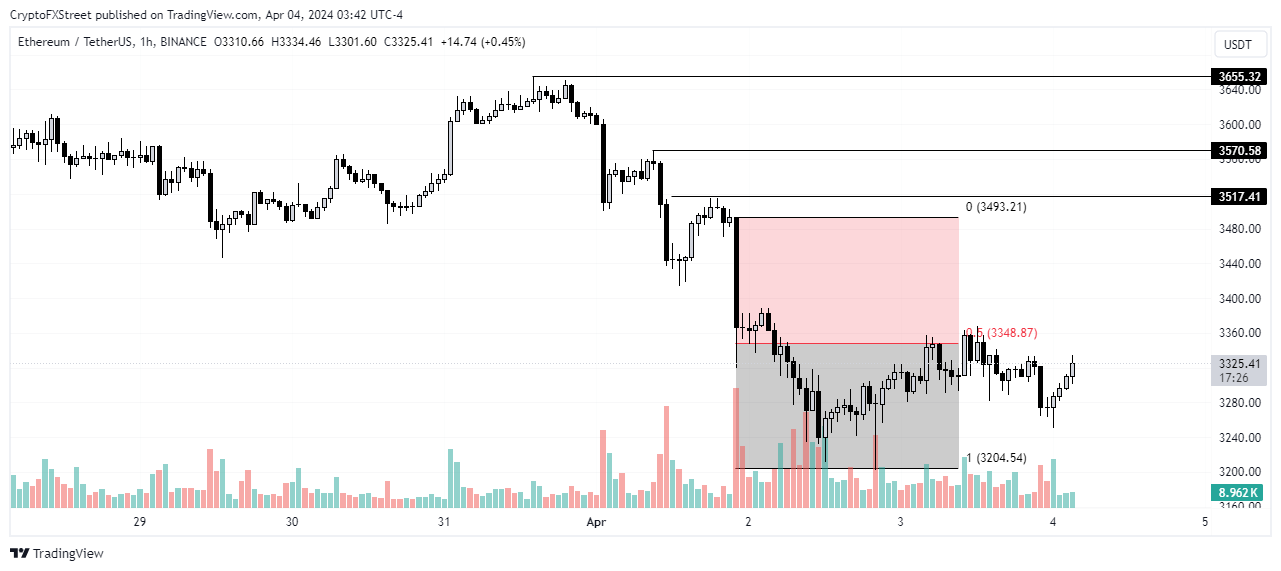

Traders are exercising more caution as Ethereum's price continues its horizontal move for a second consecutive day. This indicates reduced bullish sentiments for the largest altcoin.

ETH/USDT 1-hour chart

Read more: Ethereum consolidates above $3,500 as Bitwise CIO says ETF delay would be positive

If Bitcoin’s price shows signs of recovery, ETH could resume an upward move to break past the $3,493 level, which is the high from April 2. . Further up, next resistances are at $3,517, $3,570, and $3,655, which also align with recent swing highs seen in the past few days.

However, this thesis would be invalidated if ETH moves below the $3,204 support level, the low from April 2.

The SEC's decision on the May 23 deadline to respond to VanEck spot Ethereum ETF filings is expected to have a major effect on prices.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. Since its inception, a total of 19,445,656 BTCs have been mined, which is the circulating supply of Bitcoin. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value. For Bitcoin, the market capitalization at the beginning of August 2023 is above $570 billion, which is the result of the more than 19 million BTC in circulation multiplied by the Bitcoin price around $29,600.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Price Forecast: BTC misses Santa rally even as on-chain metrics show signs of price recovery

Bitcoin (BTC) price hovers around $97,000 on Friday, erasing most of the gains from earlier this week, as the largest cryptocurrency missed the so-called Santa Claus rally, the increase in prices prior to and immediately following Christmas Day.

$18 billion in Bitcoin and Ethereum options expire today: Market braces for big moves

A record-breaking $18 billion in Bitcoin and Ethereum options expire today, sparking anticipation of sharp market moves and potential volatility.

Crypto.com launches US trust company for digital asset custody

Crypto.com launches a US trust company to offer digital asset custody services, marking a major step in its North American expansion strategy.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.