Ethereum Classic’s market value drops to a two-month-low as prices fall by 25% in four days

- The bearish market conditions impacted Ethereum Classic’s consolidated recovery, resulting in a crash on September 18.

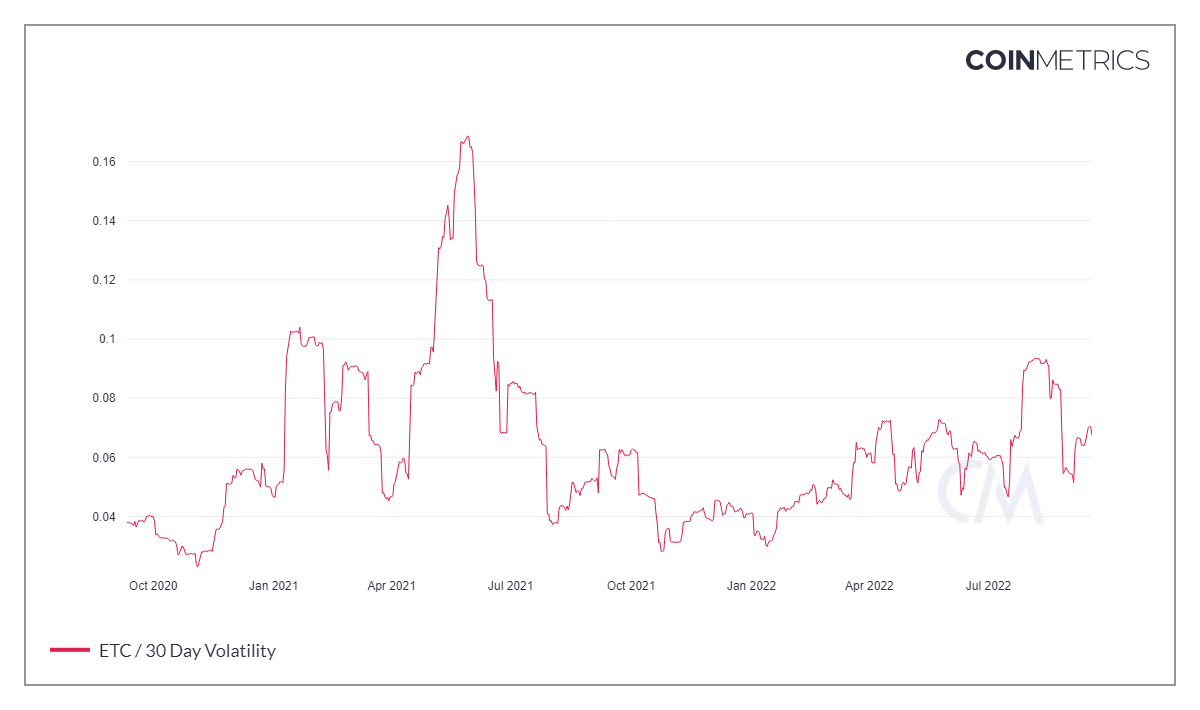

- ETC’s declining market value, along with the rising volatility, could result in steeper drawdowns.

- Ethereum Classic is still maintaining its 50-day Moving Average as support, which is crucial in restarting a recovery.

Ethereum’s namesake and a hard fork, Ethereum Classic, is one of the only few cryptocurrencies that has recovered significantly over the last couple of months. But impacted by the broader market conditions, ETC is currently looking at a short-term dip.

Ethereum Classic, back to the roots?

Trading at $29.67 at the time of writing, ETC lost about 24.74% between September 15 and September 19, which resulted in the altcoin losing critical support of the 50-day (red) Simple Moving Average (SMA). However, it is still maintaining the 100-day (blue) and the 200-day (green) SMAs as support which is critical at the moment.

Both these levels historically have been early trendsetters, and unless the recovery of July to August was a fakeout, ETC is looking at a rise above $30. However, the selling pressure needs to decline.

As visible from the downtick on the Relative Strength Index (RSI), ETC is far from noting any buying pressure at the moment, but the same is necessary for invalidating the fall in prices.

A trend reversal born out of this buying pressure will also undo the dwindling market value of ETC.

Ethereum Classic’s rising concerns

ETC’s market value had been suffering since April, but after it reached its lowest point in July, the trend reversed and shot up significantly. After ranging for the next two months, the market value slipped this week.

Ethereum Classic MVRV ratio

This brought the market value to realized value (MVRV) ratio below 1.0, indicating that the current value of ETC is below its fair value level, further highlighting losses in the market.

These conditions could persist if, over the next couple of days, the volatility of Ethereum Classic keeps going up. As the possibility of price swings increases, the predominant trend - in ETC’s case, a downtrend - would cause further damage to investors’ portfolios.

Ethereum Classic volatility

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

-637992390517208164.png&w=1536&q=95)