Ethereum Classic Technical Analysis: ETC/USD flirting with the 50-day SMA

- Ethereum Classic is trading in the green alongside other cryptoassets like Ripple and Cardano.

- ETC/USD is ready for the next run-up above $7.00 as supported by the up-trending RSI.

Ethereum Class is trading higher on the day in tandem with other cryptocurrencies. The entire market is in the green led by Ripple (XRP). Other digital assets performing well include Cardano, Tezos, VeChain, and Litecoin among others.

ETC/USD has added almost 3% in gains on the day to trade at $6.41 at the time of writing. The bulls are battling the resistance at the 50-day SMA but their eyes are fixated on rising above the next hurdle at $7.00.

Technically, Ethereum Classic is poised for more upward movement especially with the RSI closing in on the overbought region. The break above the key trendline resistance has supported the momentum to current price levels but there is still room for growth.

Looking at the MACD, ETC’s technical picture is likely to improve with time. The indicator’s cross into the positive territory would highlight the growing potential for more upward action. Gains above the 200-day SMA could further catapult ETH/USD past $7.00.

ETC/USD daily chart

%20(1)-637297914852372572.png&w=1536&q=95)

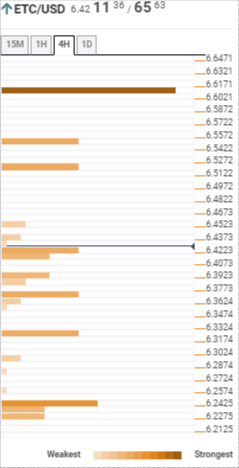

Ethereum Classic confluence levels

Resistance one: $6.52 – Highlighted by the pivot point one-day resistance two.

Resistance two: $6.61 – This is the strongest resistance zone and home to the Fibonacci 161.8% one-month.

Support one: $6.42 – Holds the SMA 50 one-day.

Support two: $6.36 – Home to the pivot point one-day resistance-one.

Support three: $6.33 – Highlighted by the previous high one-day.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren