Ethereum classic team warns about scammers that try to capitalize on Agarata update

- ETC team reminds that Agarata fork has not produced a new coin.

- ETC/USD stays range-bound with a bearish bias, in sync with the market.

Ethereum Classic, now the 20th largest digital asset with the current market value of $632 million, reached the top at $5.82 on January 11 and retreated to $5.4 by the time of writing. ETC/USD has lost nearly 2% on a day-to-day basis and over 2.5% since the beginning of the day, moving in sync with the rest of the market.

Despite the retreat, ETC/USD remains of the fastest growing coins on a month-to-month basis (+40%).

Scammers alert

A major network upgrades known as Agarata was successfully activated on Ethereeum Classic mainnet on Sunday. According to https://etcnodes.org/agharta, about 59% of clients have updated their software for Agarata; however, according to Bob Summerwill, Executive Director, ETC Cooperative, the vast majority of nodes are run by operators that moved to new nodes but still had Classic Geth nodes running until after the hard-fork. THose nodes won't sync with the network anymore.

While Agarata was not a contentious hard-fork, which means that no new coins had been created, some fraudsters try to scam traders out of their money, offering to claim some Agarata coins. They post under "Ethereum Classic Agharta" Twitter account, which was registered only in January 2020.

The ETC Cooperative wrote on Twitter:

Needless to say, “EAgharta” is a complete scam, probably from the same people who did something very similar at Atlantis. Stay away. ETC Agharta did not result in new “Agharta coins”. They are just trying to scam you.

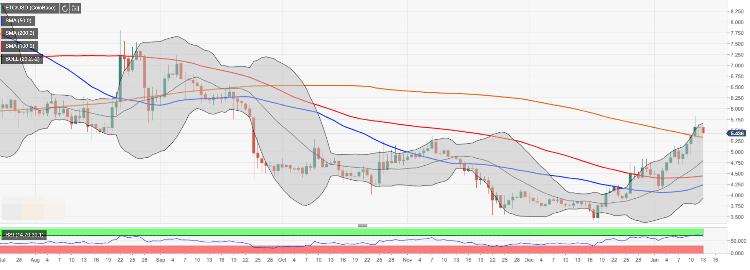

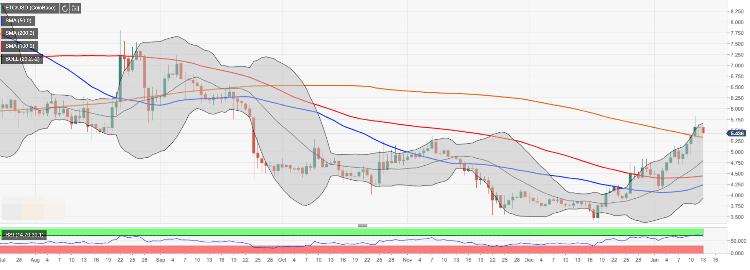

ETC/USD: technical picture

ETC/USD has retreated from the recent high of $5.82; however, the coin continues moving within the upside trend since December 18. At the time of writing, ETC/USD is changing hands at $5.42 with the upside limited by a. combination of SMA50 and the upper line of the Bollinger Band on 1-hour chart. Once this barrier out of the way, the upside is likely to gain traction with the next focus on $5.70 and $5.80.

Notably, ETC/USD stays above SMA200 daily ($5.33), which is a positive signal in the long run. If this support gives way, the sell-off may be extended towards $5.00, followed by the middle line of the daily Bollinger Band at $4.70. The RSI on a daily chart has reversed to the downside out of an overbought area, which means that the coin may be vulnerable for further losses.

ETC/USD daily chart

Author

Tanya Abrosimova

Independent Analyst